2024 July - 2024 November / Lead Designer

Designing Scenario Builder for Investment Performance Managers

I led the end-to-end design of an enterprise platform for EverGreen Wealth (Whitelabelled company), streamlining complex financial workflows and cutting weekly operational hours by 50%.

*Client name has been white-labeled due to NDA requirements.

Project Context

Custom Reporting for Complex Scenarios is Slow and Fragmented

Performance managers analyze data across departments—such as Real Estate, Credit, and Private Equity—using various breakdowns by region, sector, currency, and benchmarks. However, due to limitations of the legacy tool and siloed workflows, they rely on manual Excel work to extract, clean, and reconcile data—leading to duplicated effort, delays, and increased risk of error.

Business Problem

1,200+ Hours Lost Weekly Due to Inefficiencies — Across a Team of 50 Performance Managers

EverGreen Wealth’s performance managers spend over 1,200 hours weekly on manual custom reporting. Each manager handles 3–5 report requests per week, with each taking 8+ hours due to complex data requirements and outdated, siloed tools.

Product Goal

Enable Performance Managers to Quickly Build Custom Reports

Design an enterprise product that enables performance managers to generate complex investment reports quickly and accurately—eliminating manual effort, reducing errors, and streamlining cross-departmental reporting workflows.

Discovery

During the discovery phase, I prioritized understanding the performance managers’ workflows and responsibilities. In the first two weeks of the project, I conducted 8 in-depth interview sessions with performance managers to learn how they currently build custom reports. This insight was critical to shaping a product that aligns with their needs and day-to-day tasks.

Understanding the Role of Performance Managers at GreenWealth

Performance managers at GreenWealth oversee and analyze the financial performance of investments and ensuring alignment with the organization’s financial goals. Their responsibilities focus on performance measurements, analysis, and reporting, which helps to inform strategic investment decisions.

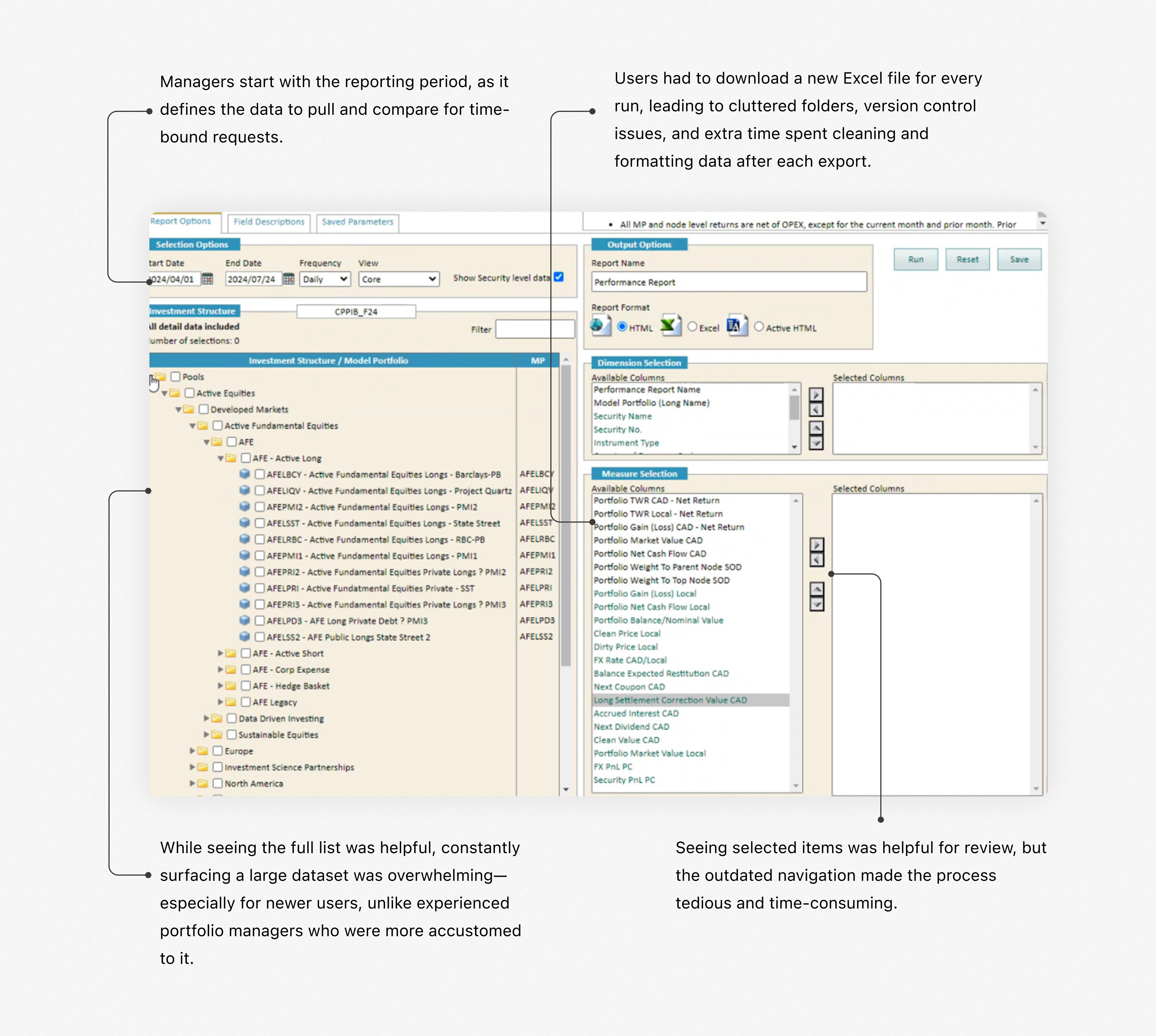

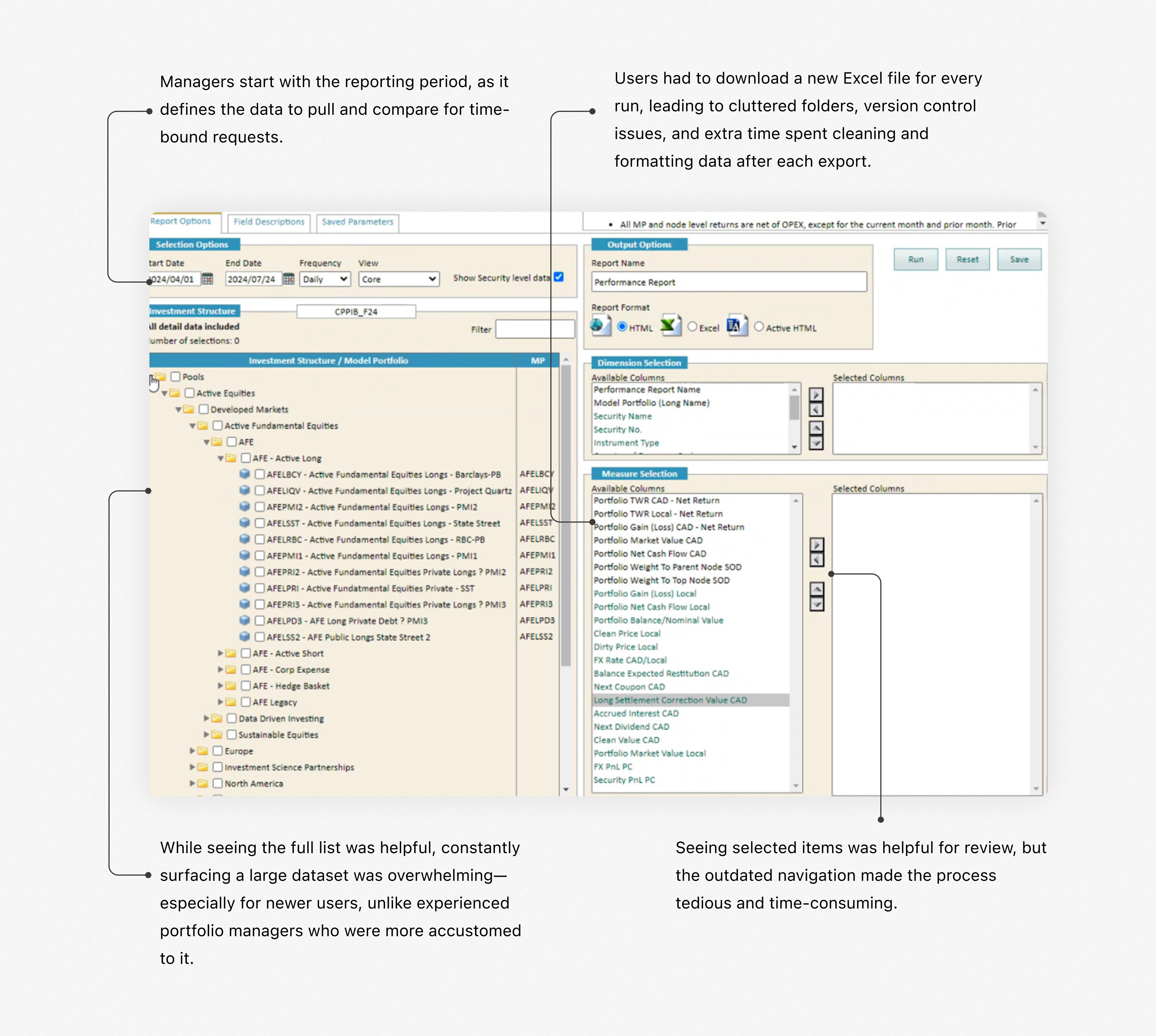

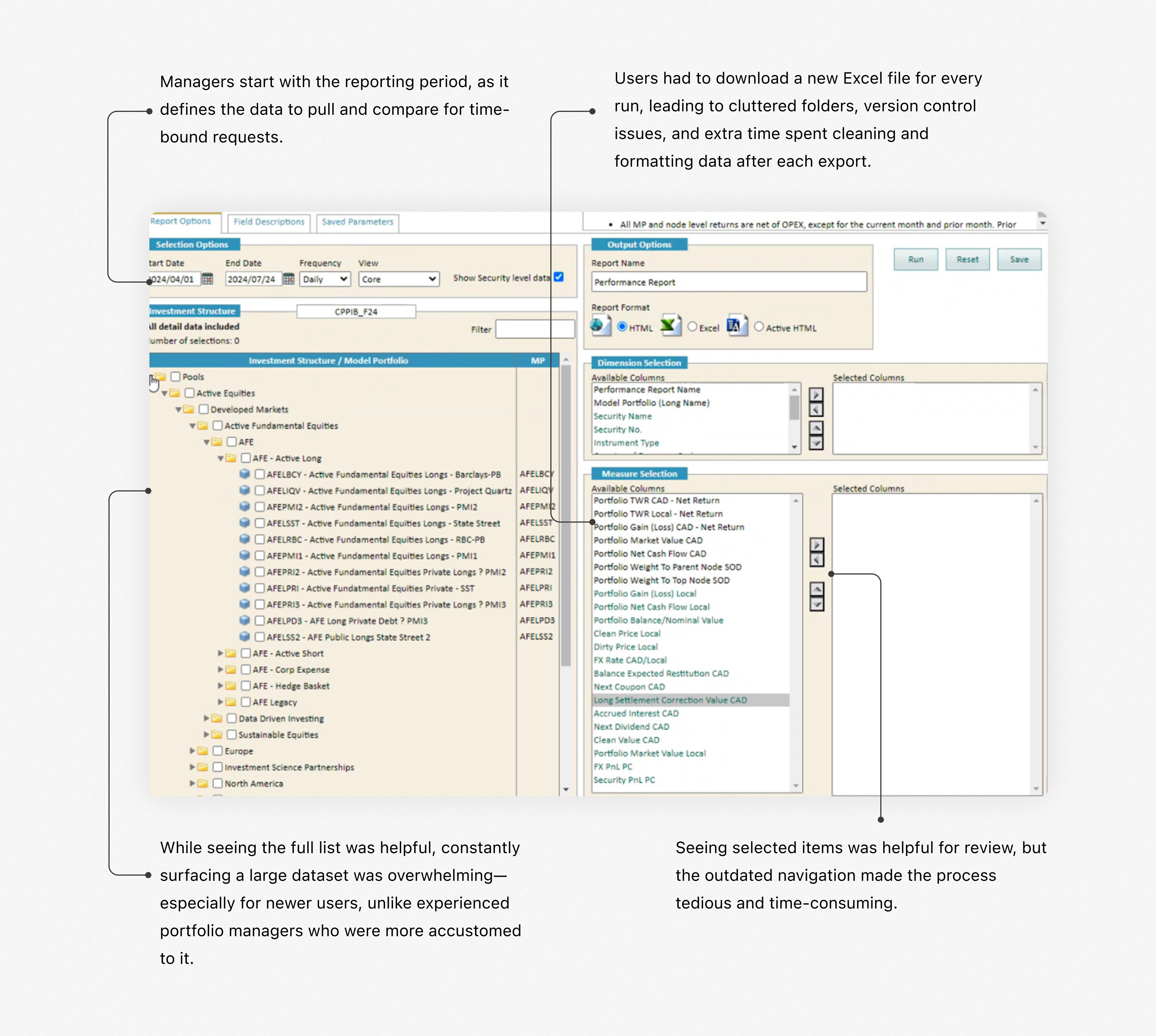

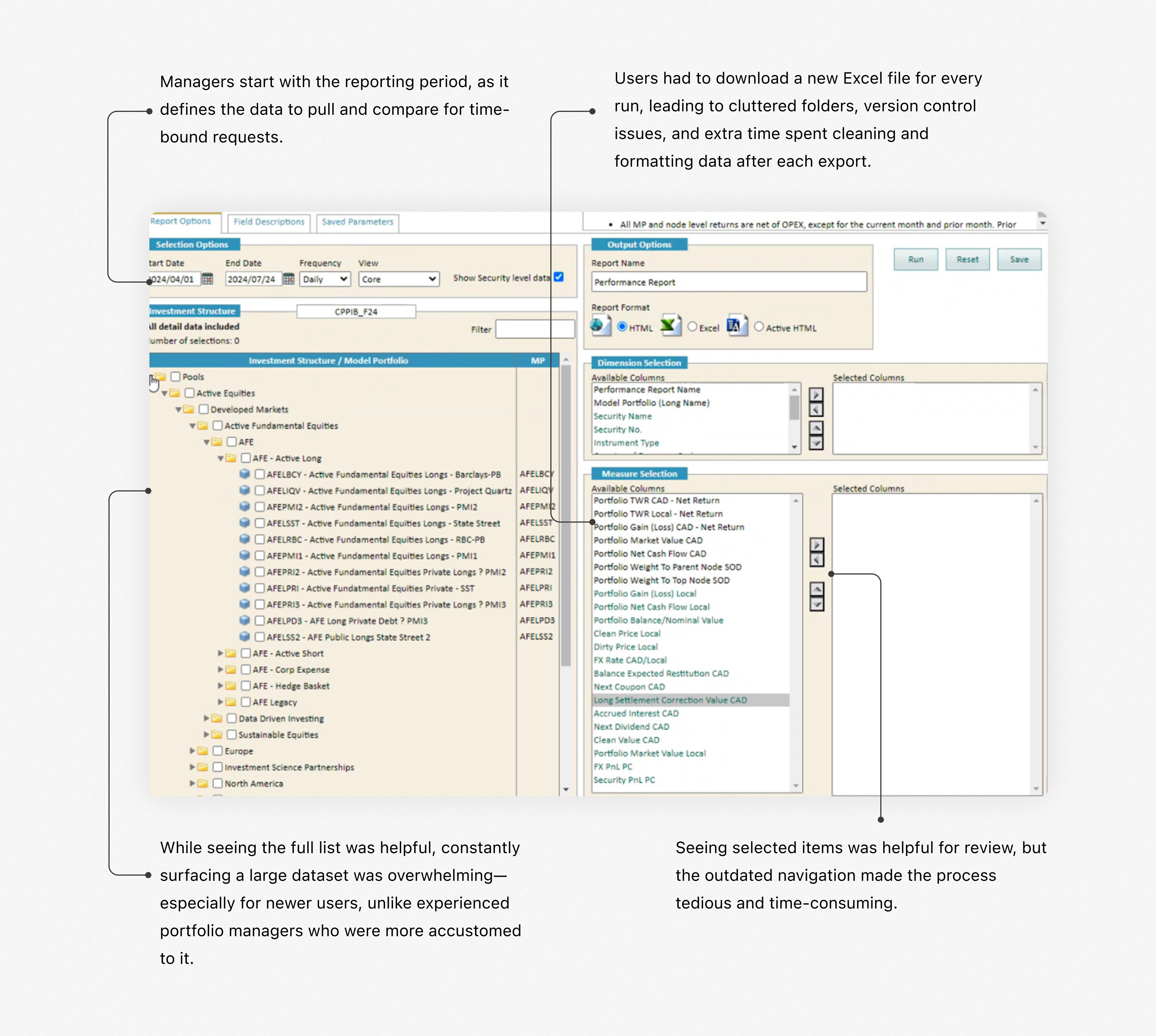

Reviewing Legacy Products to Identify What Works and What Doesn’t

During 1:1 interviews with performance managers, I asked them to walk me through their legacy products and highlight what works and what doesn’t. While the tool is outdated, understanding the elements they still rely on helped identify valuable features worth retaining in the new experience.

Insights from Performance Manager Interviews

Given the complexity and nuance of their processes, these in-depth sessions were critical for uncovering actionable insights. Below are the key findings from the Discovery phase.

Switching Between Tools Created Workflow Friction

Performance managers juggled two legacy systems and Excel, each with different logic—slowing them down and increasing error risk.

Full Data Visibility was Valued

Despite a cluttered UI in the legacy product, they valued seeing all available data fields for greater control and confidence.

Heavy Excel Use for Final Output

Despite a cluttered UI in the legacy product, they valued seeing all available data fields for greater control and confidence.

Often Duplicating Previous Reports

They often duplicated old reports and tweaked filters like date, region etc to save time.

Define

After the discovery phase, I synthesized the insights and distilled them into key problems, which helped shape the design approach and direction.

Translating Research into Design Strategy

After conducting user research and multiple in-depth knowledge transfer (KT) sessions with the product manager and performance managers, I synthesized the information to define a clear and focused design strategy.

Flexibility

Performance managers value the ability to define custom logic on their own terms. They wanted a solution that offers flexibility to create and modify logic to suit their unique needs.

Simplicity

Simplify complex processes to make them easy to understand and navigate, allowing users to perform tasks without unnecessary complications.

Familiarity

Maintain the unique workflows and replicate patterns that the users were familiar with Excel to reduce the learning curve.

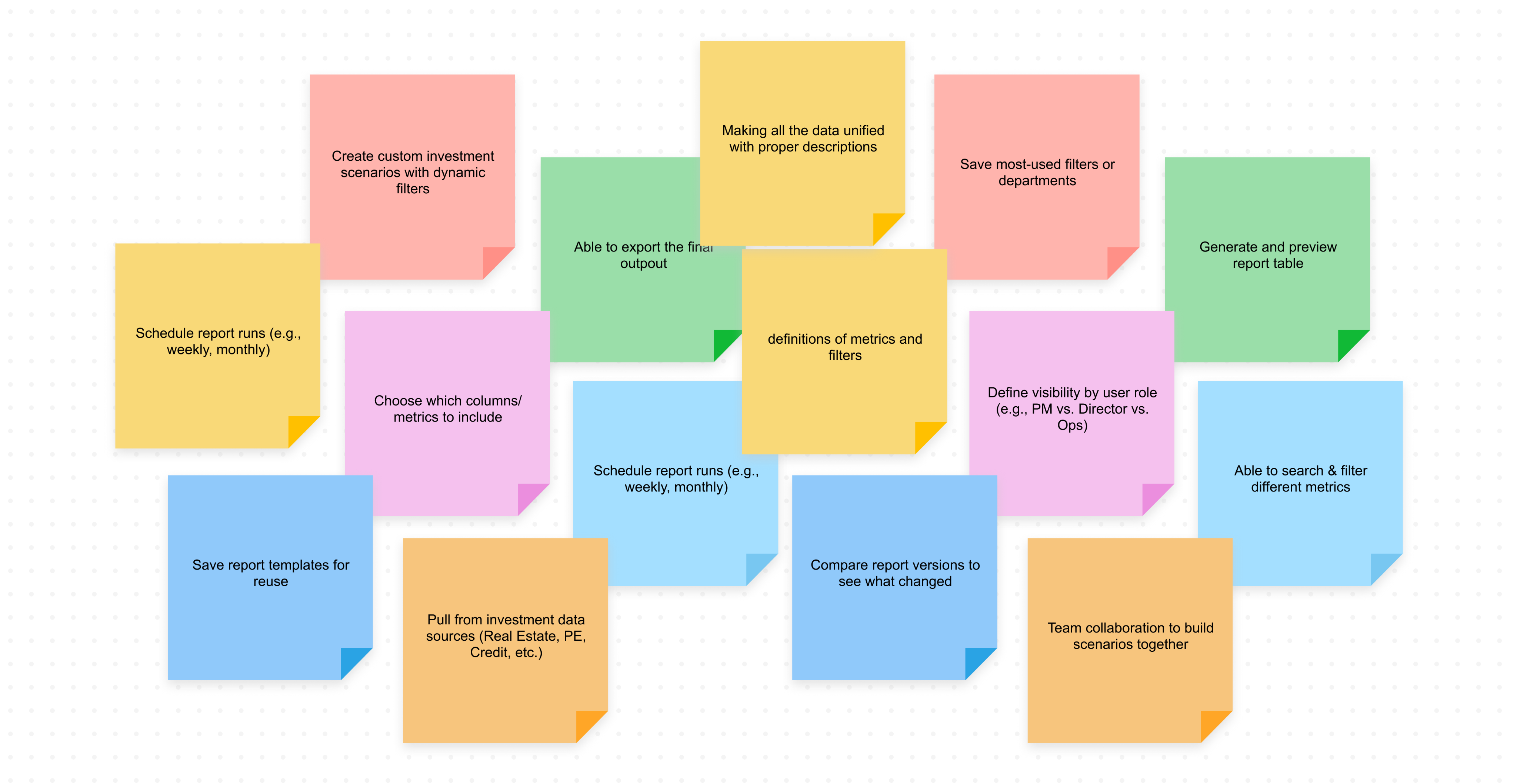

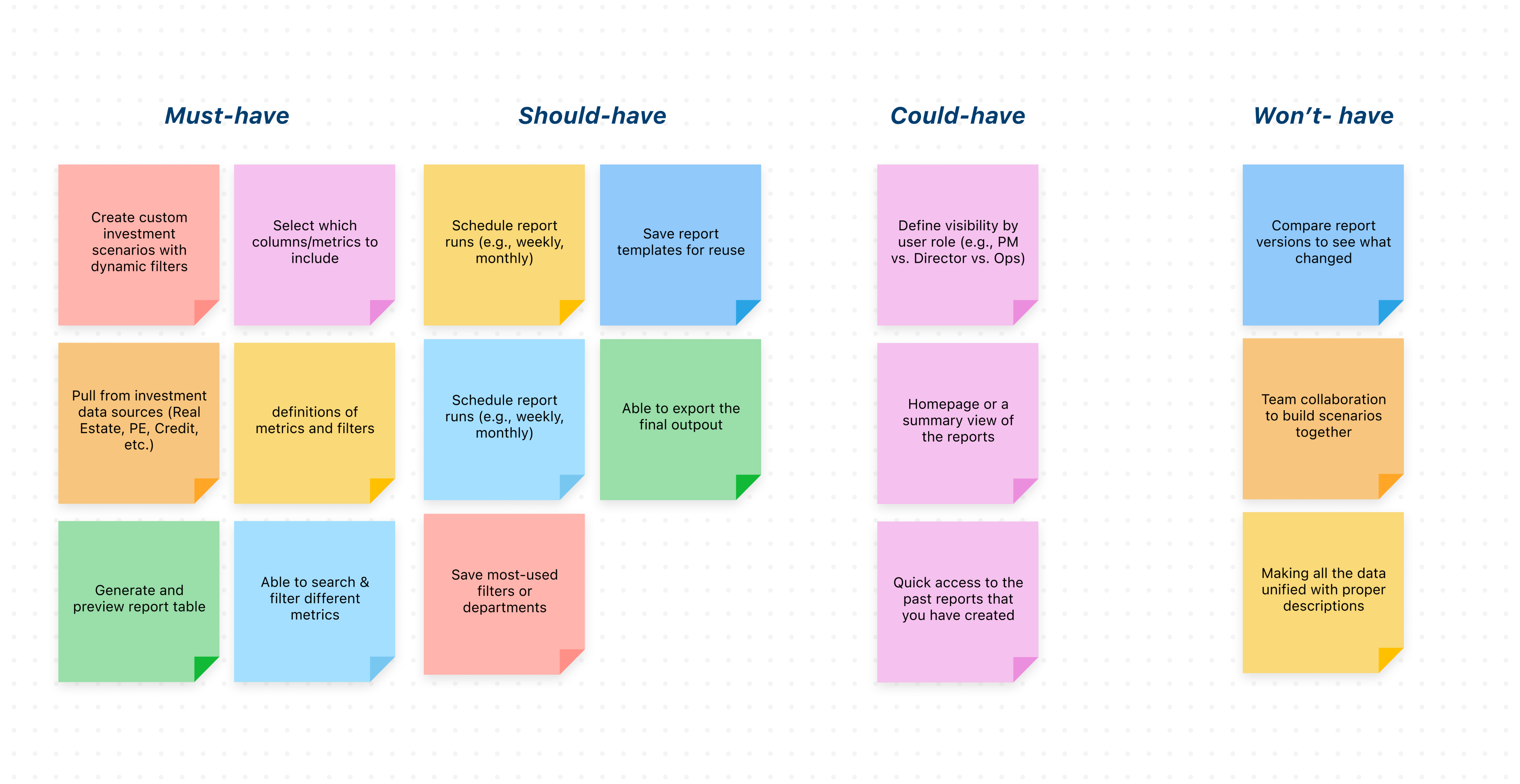

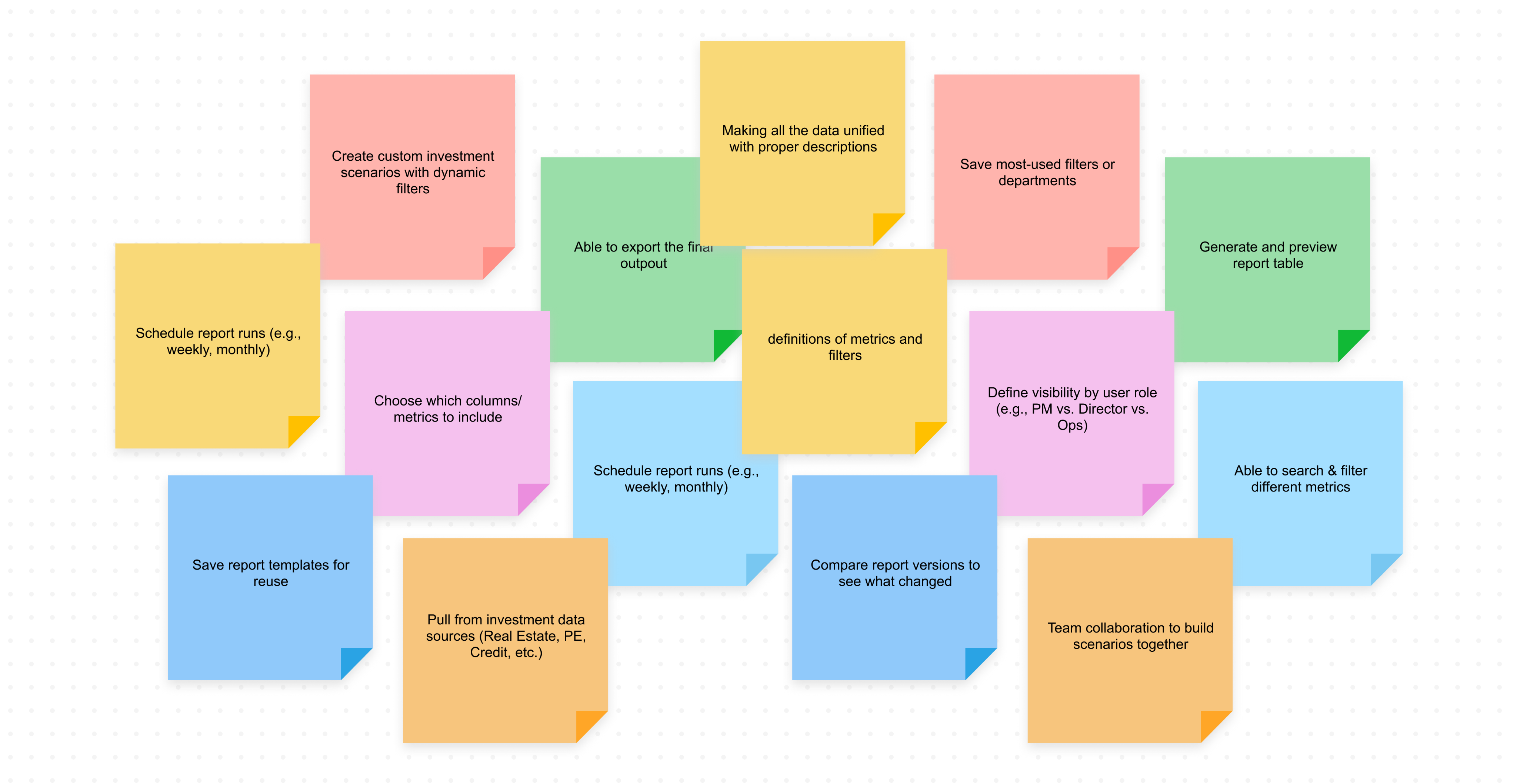

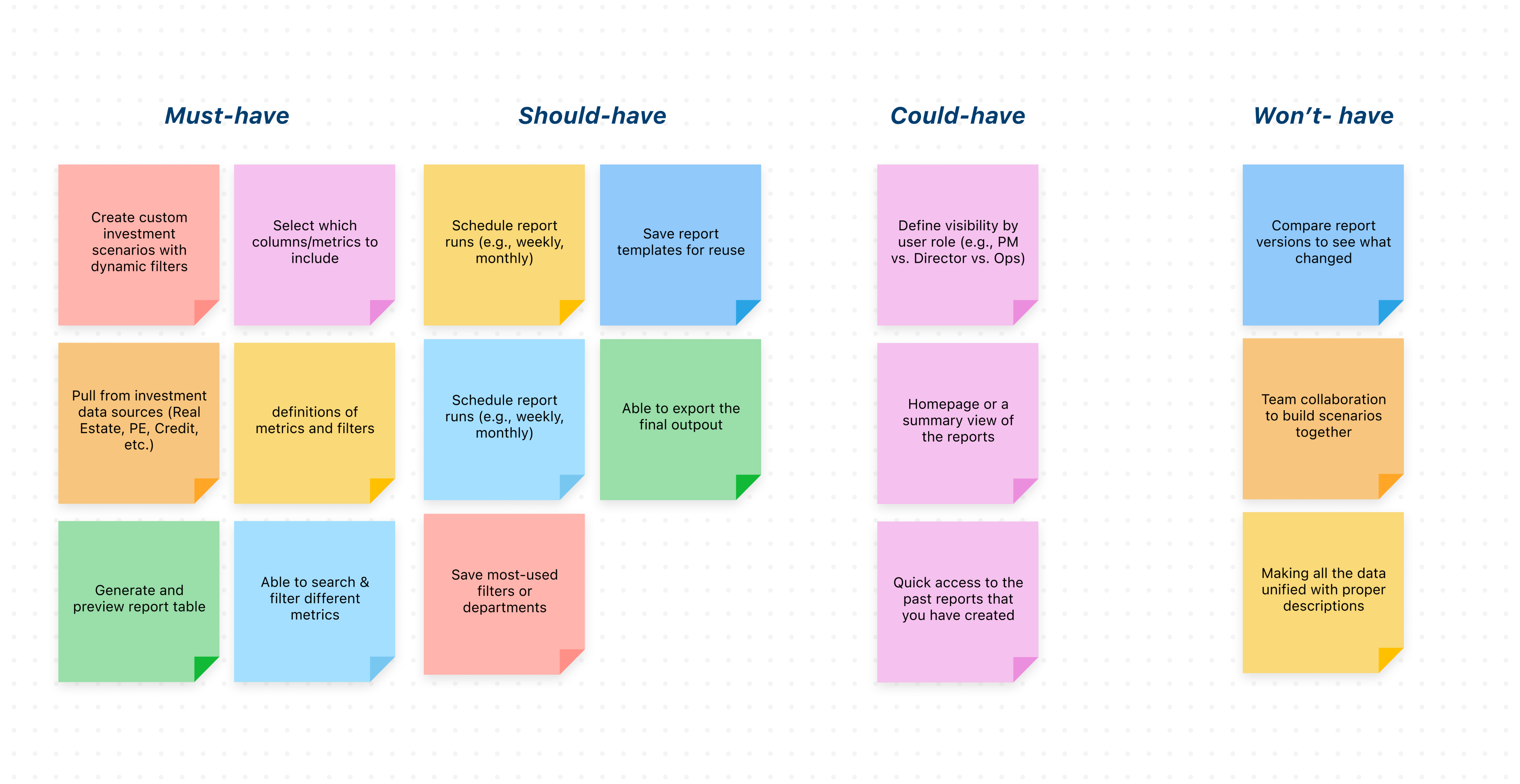

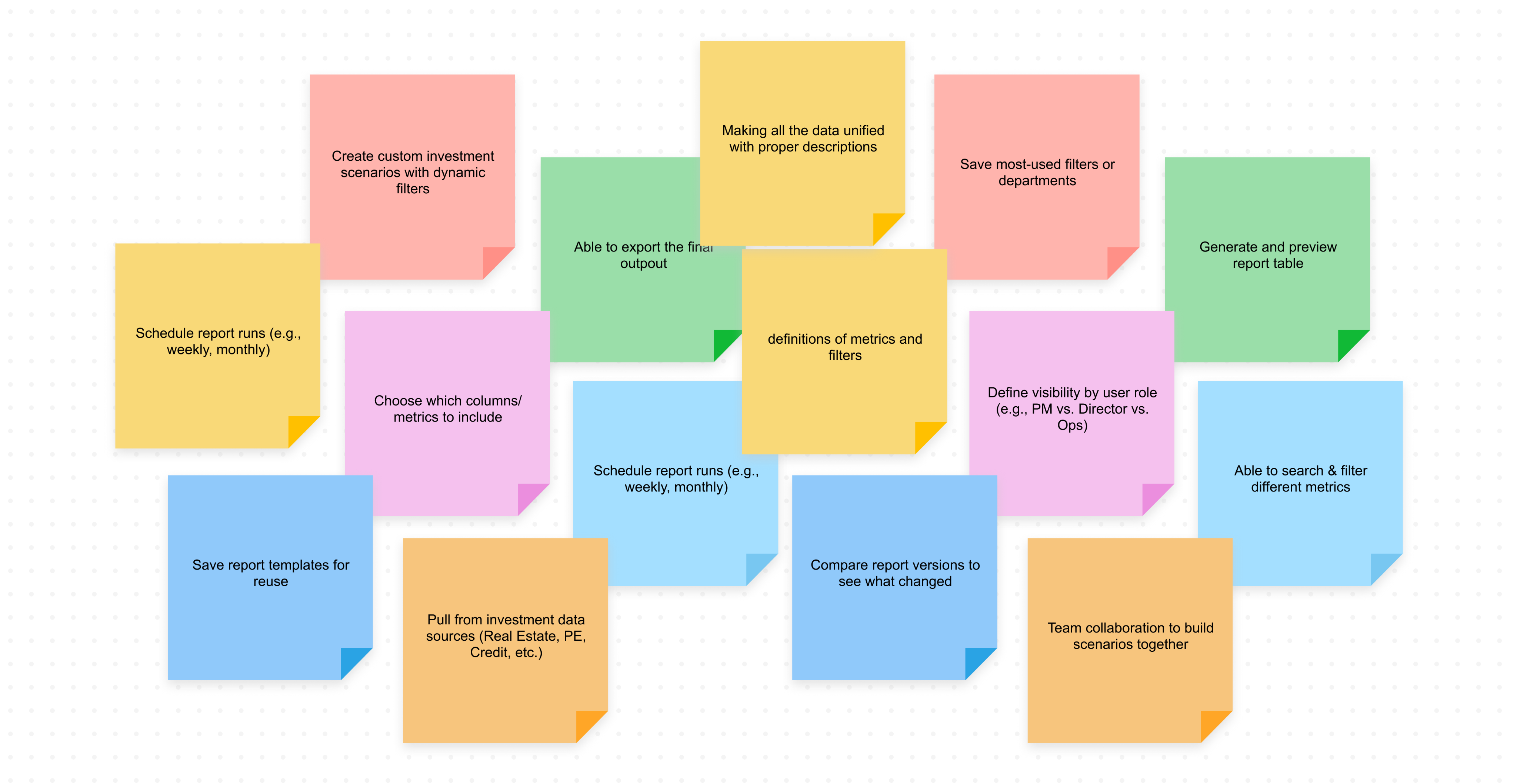

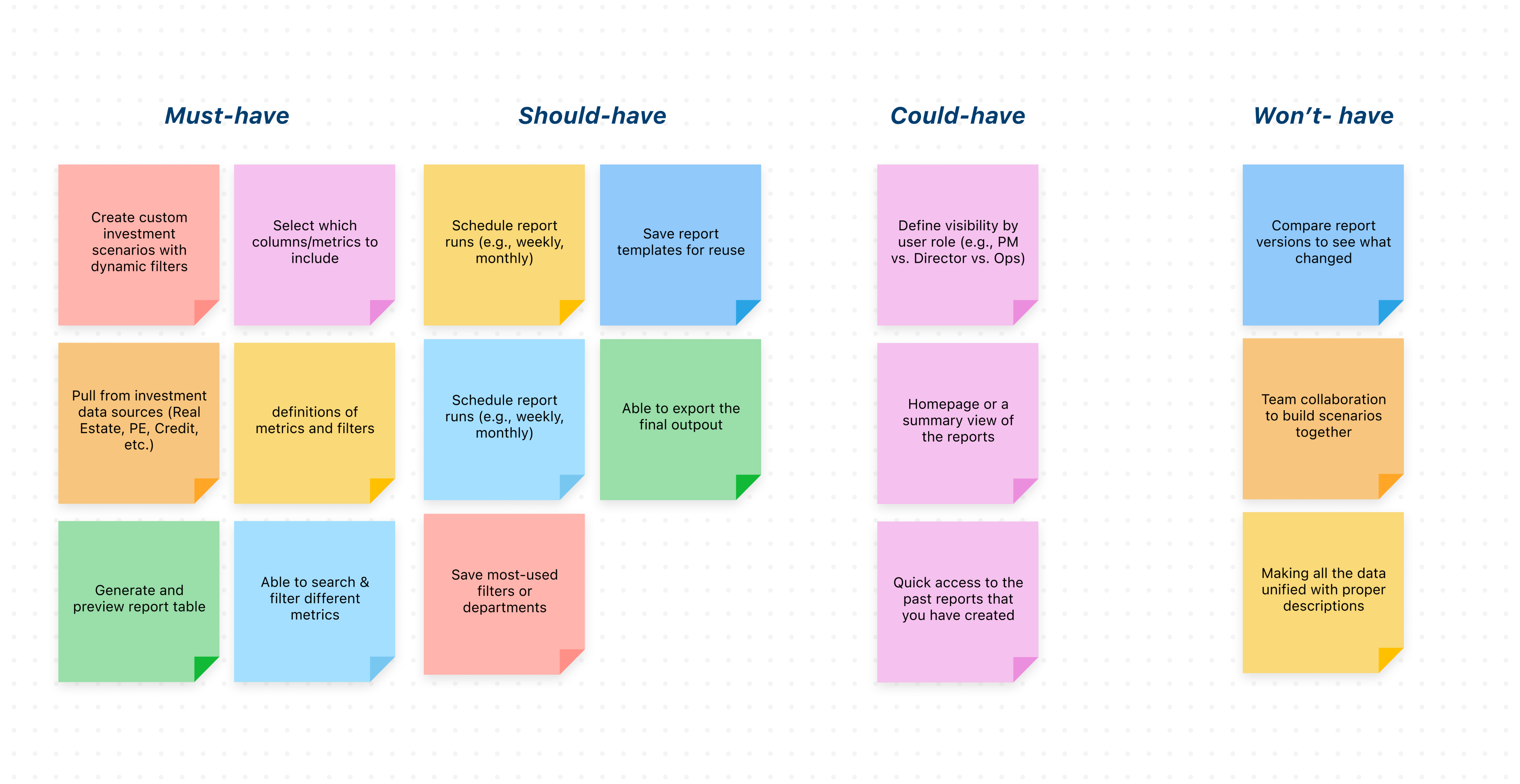

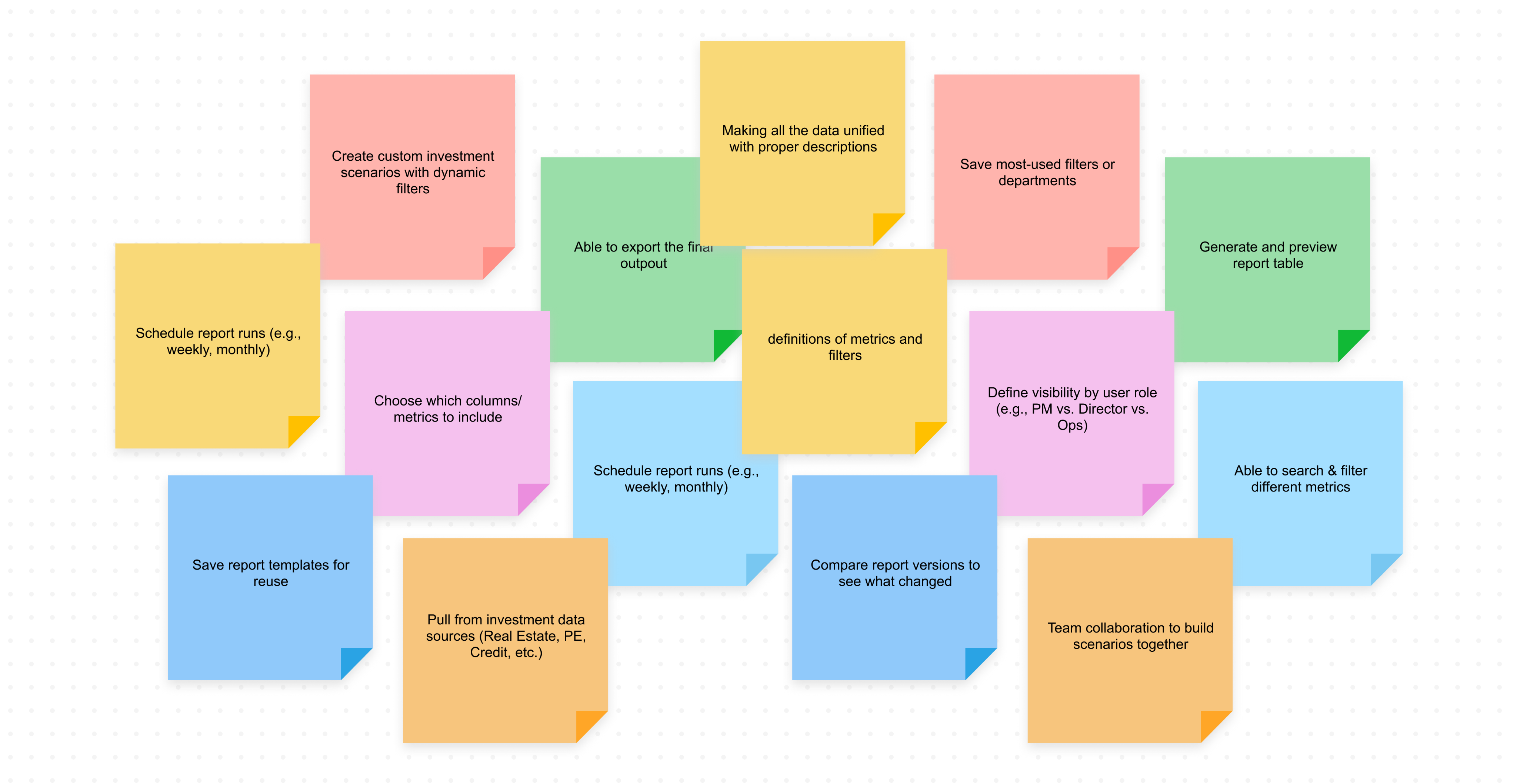

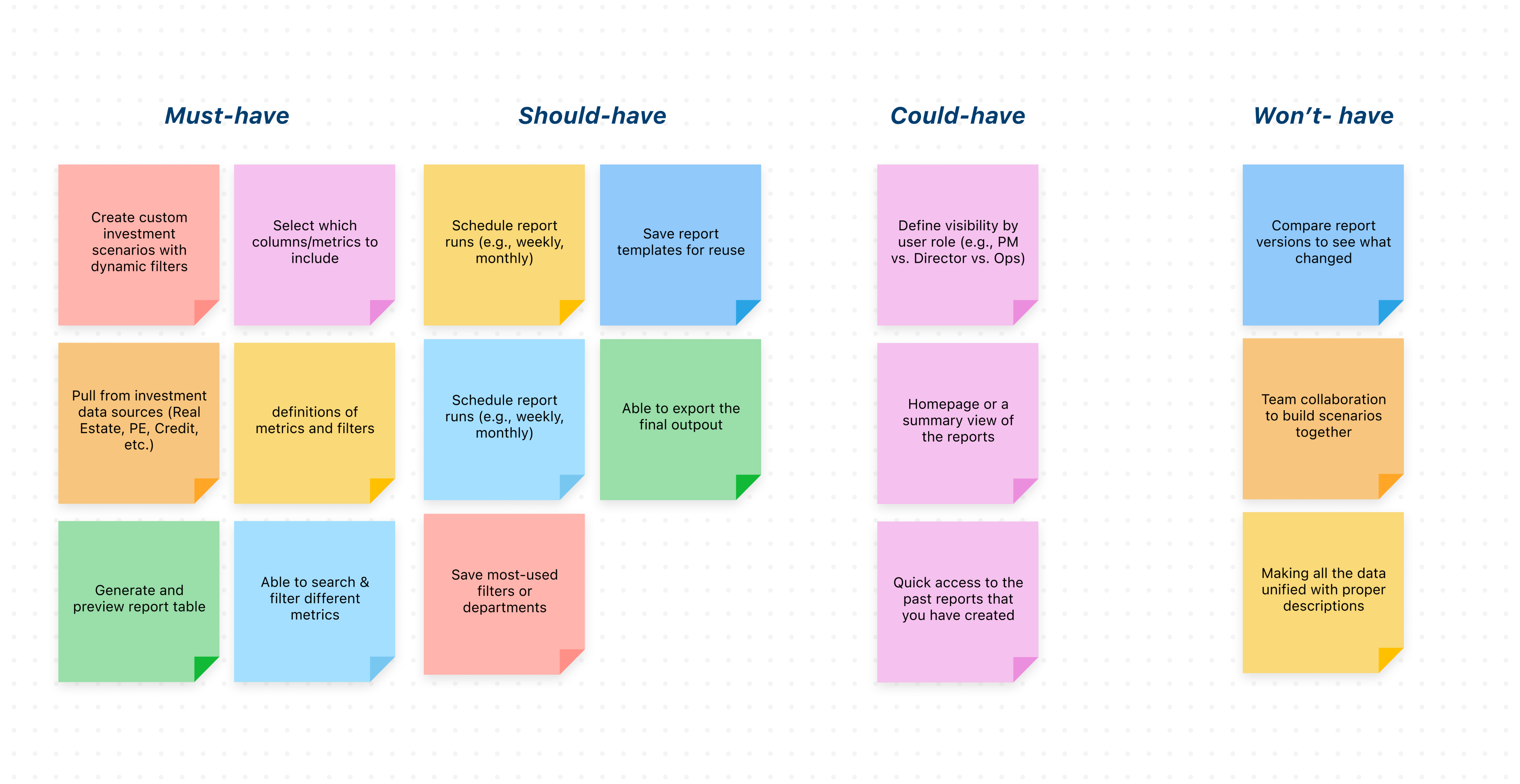

Defining the first MVP for this Product

Before diving into solutions, I led a collaborative session with the product manager, tech lead, and three business stakeholders (VP of Finance Performance, Senior Director Performance Management, Senior Performance Manager) define core features. The main challenge was aligning on the MVP, as the team often pushed for "nice-to-have" features. To address this, I facilitated a focused 1-hour workshop to prioritize and clearly define the core MVP.

Develop

To kick off the solution phase, I led a fast-paced workshop with the internal team to draft initial concepts. Given the tight six-week timeline, the process involved frequent white-boarding sessions with the core team to sketch ideas, define key use cases, and align on direction. I translated these concepts into Figma designs and maintained a tight iteration loop for rapid feedback and refinement.

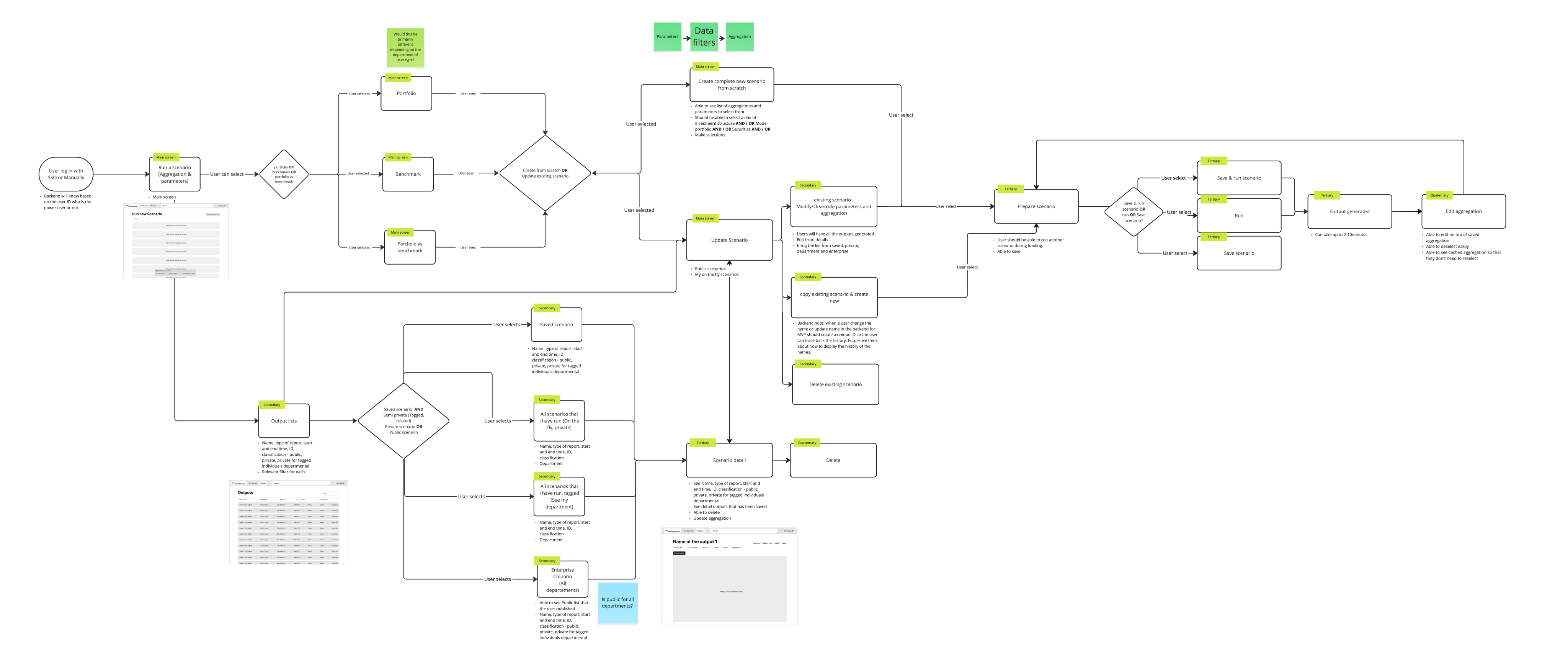

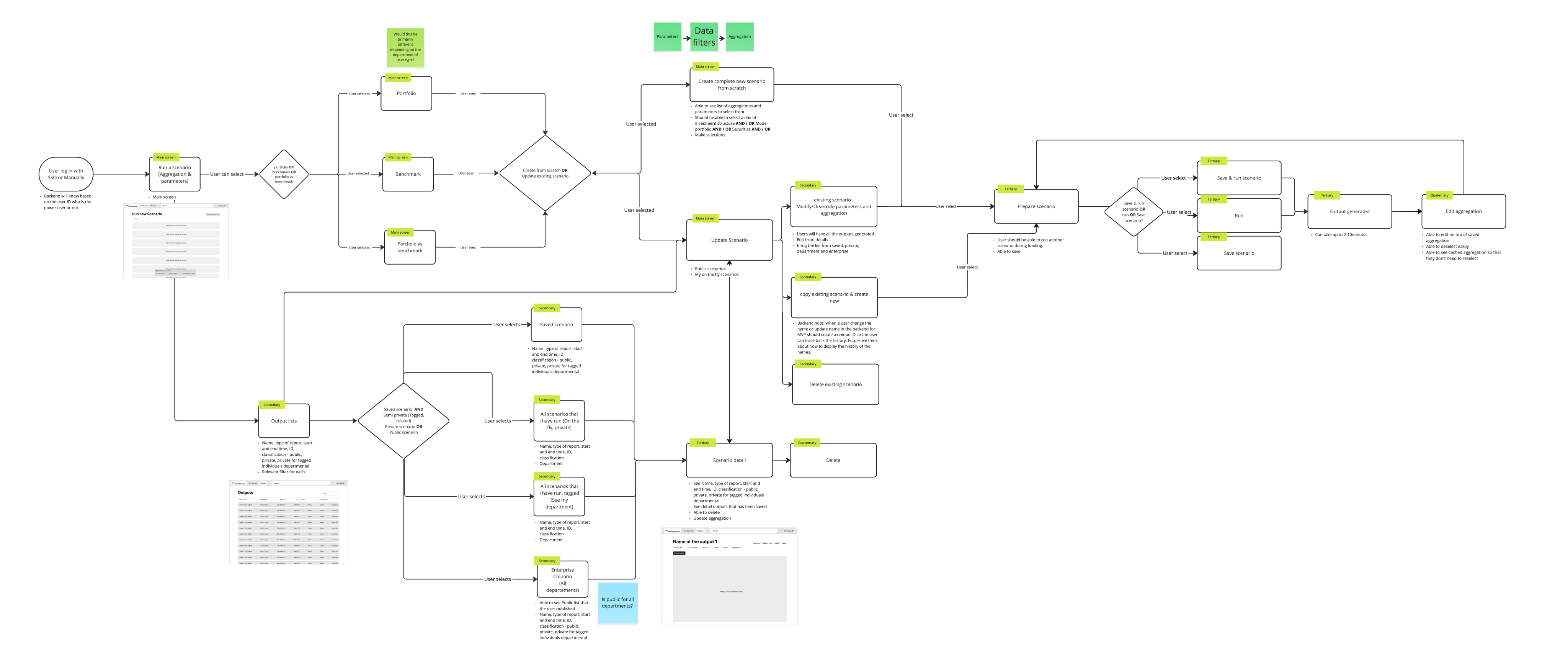

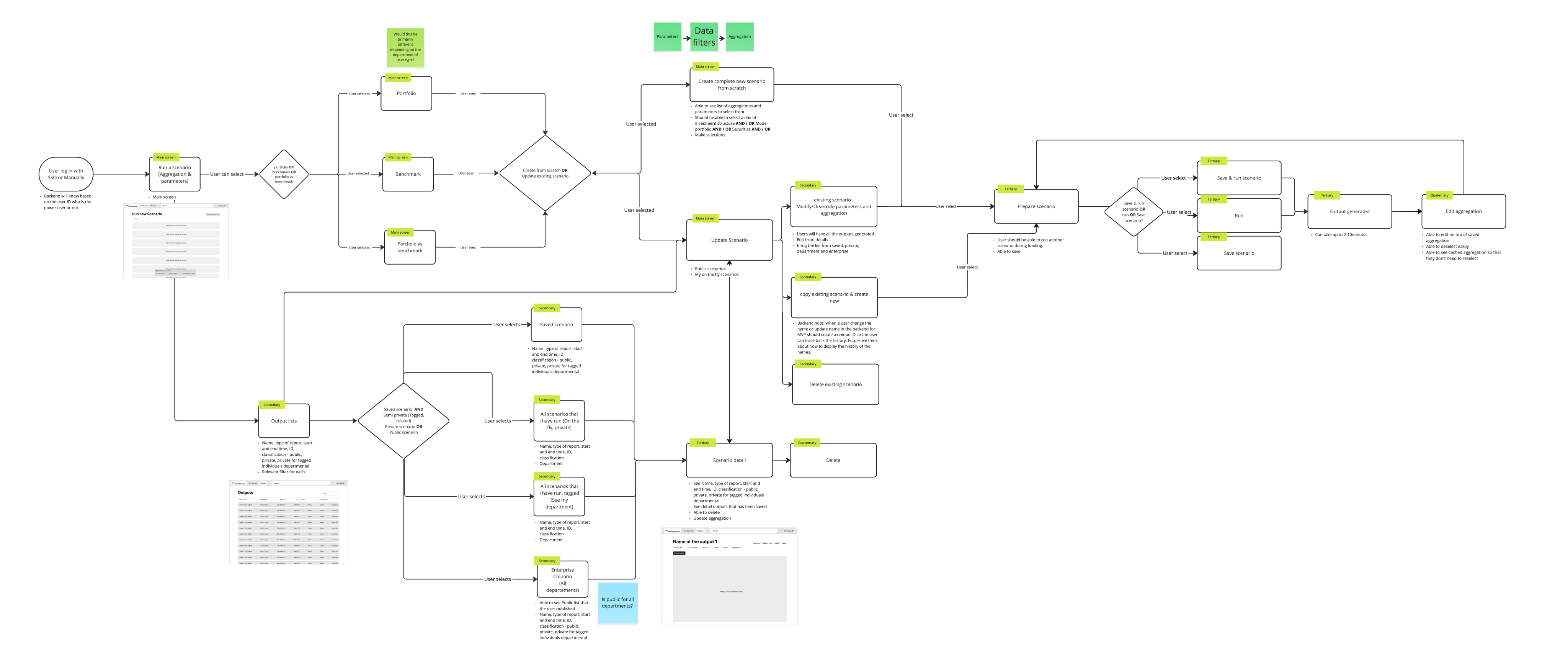

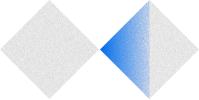

Creating Core Userflow Together

I facilitated a white-boarding session to map out the core use cases and define the main user flow. By first sketching a basic skeleton of the "happy path," I gave the team a tangible starting point, which we then refined together through live feedback and iteration. This collaborative process helped align everyone on the foundational structure before moving into detailed design.

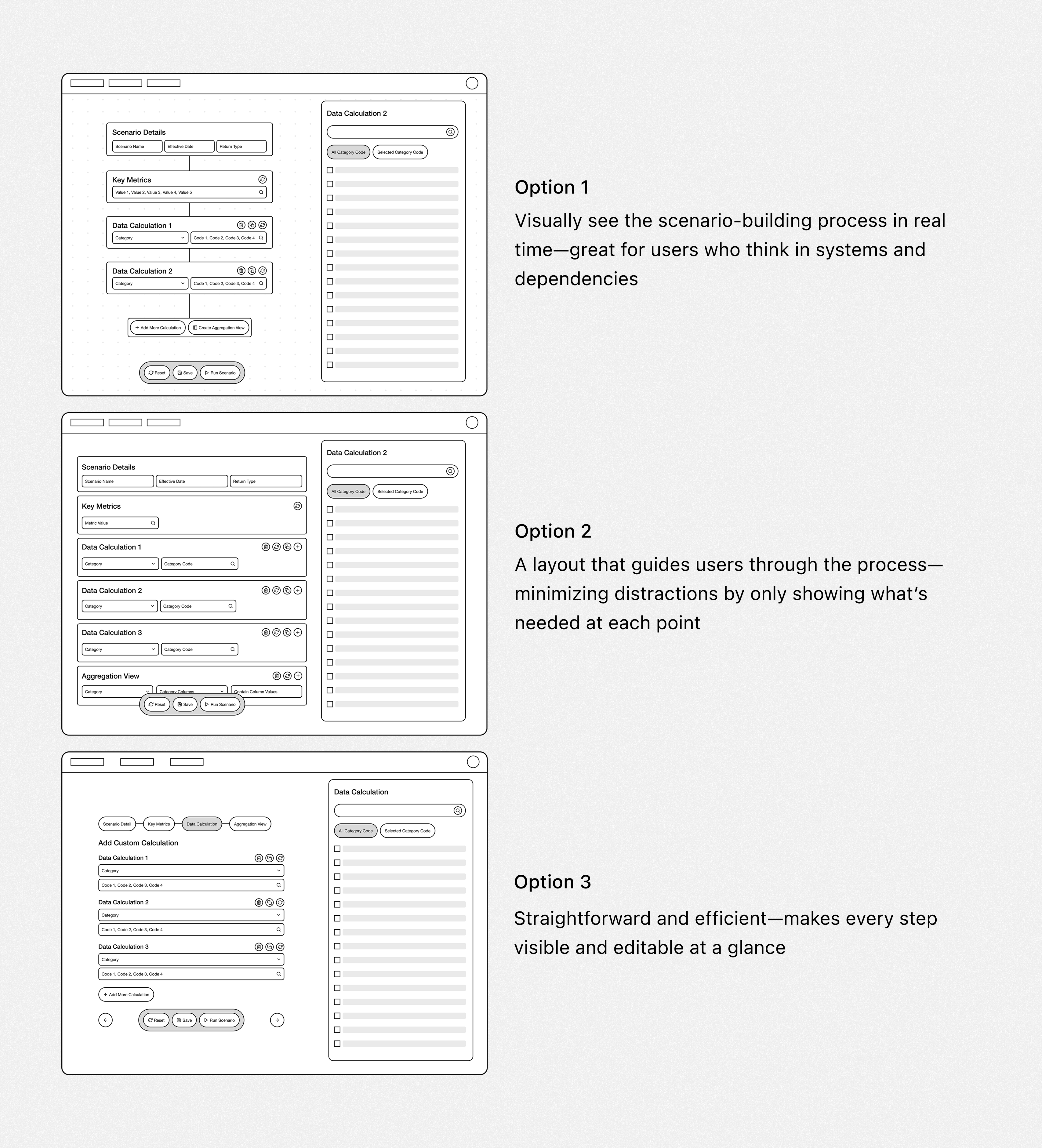

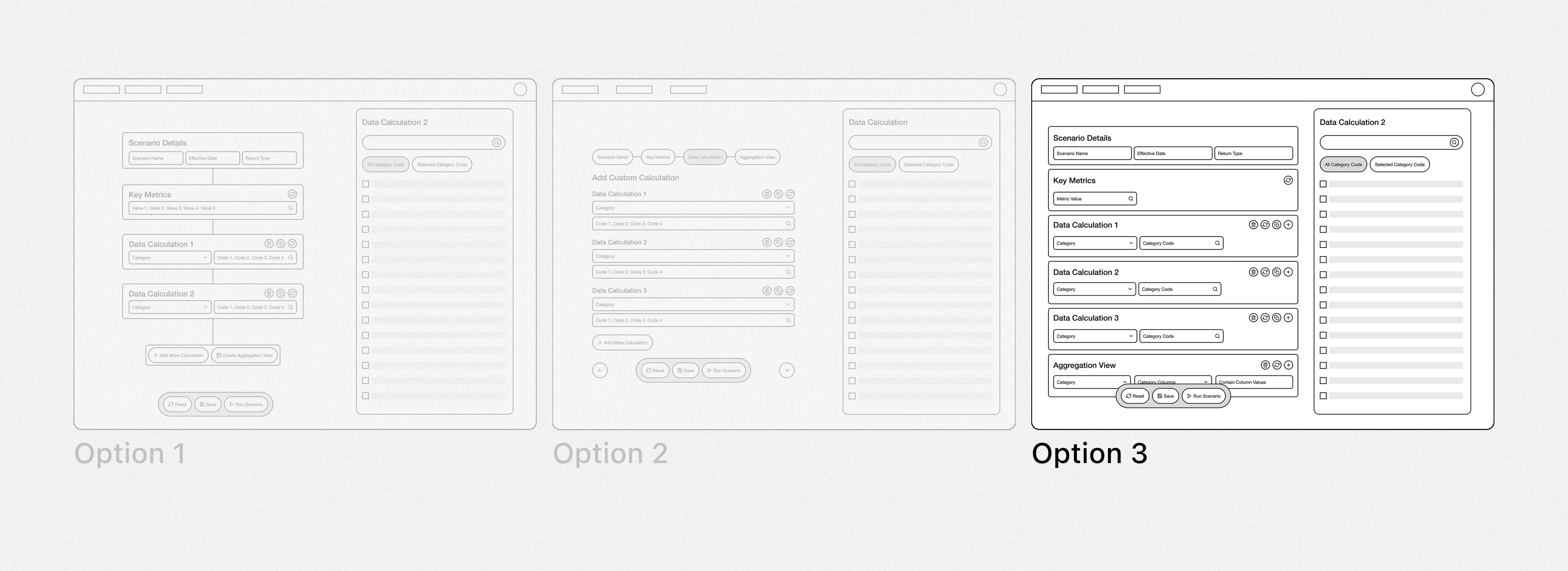

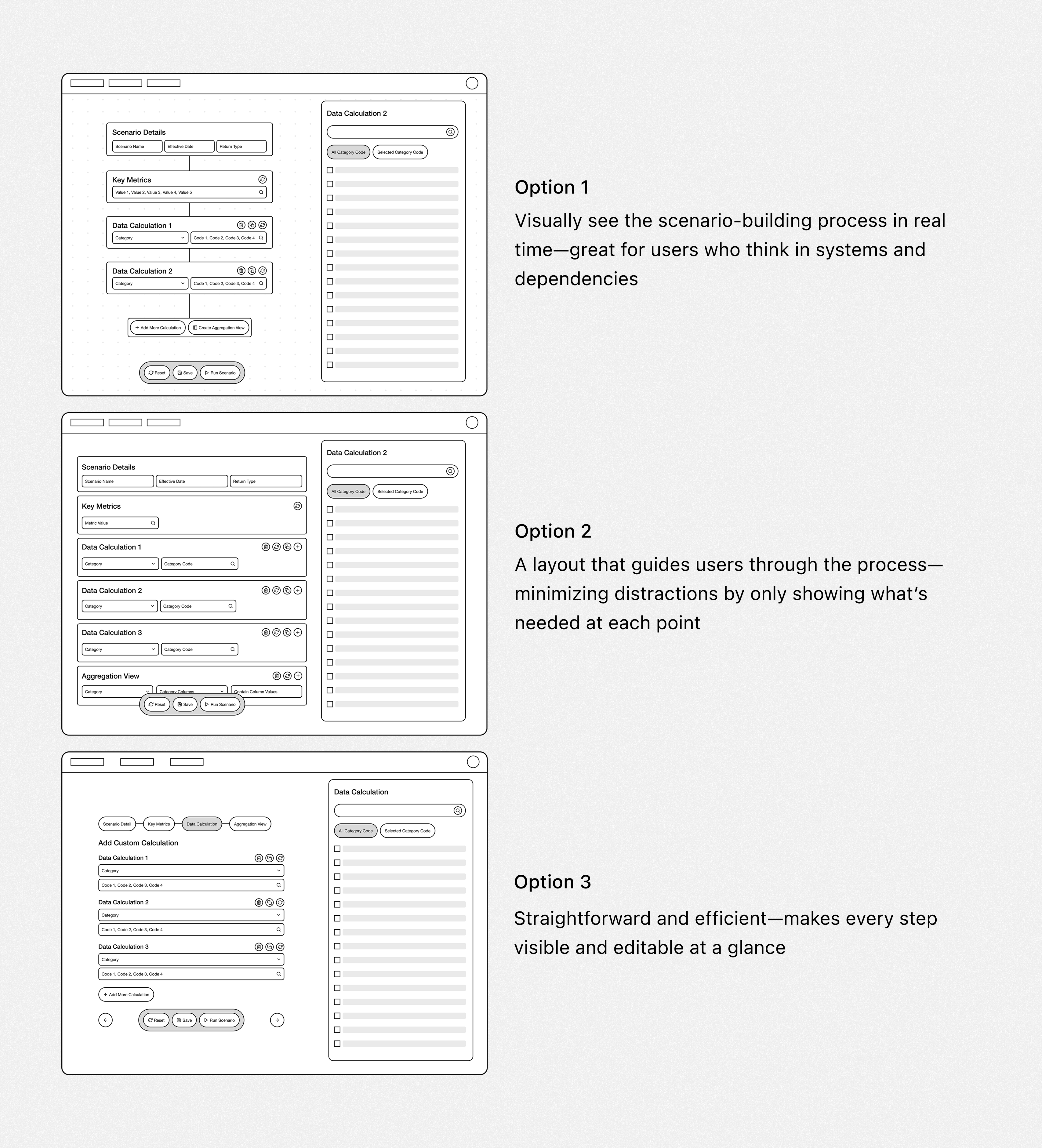

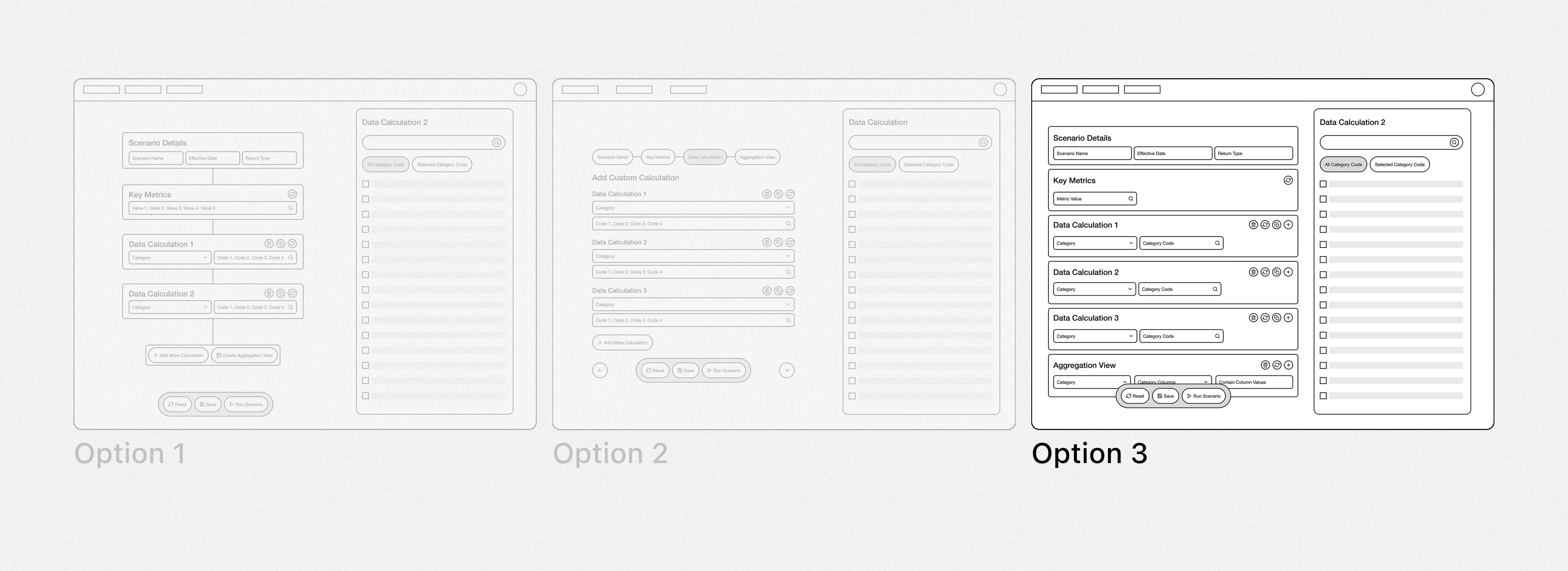

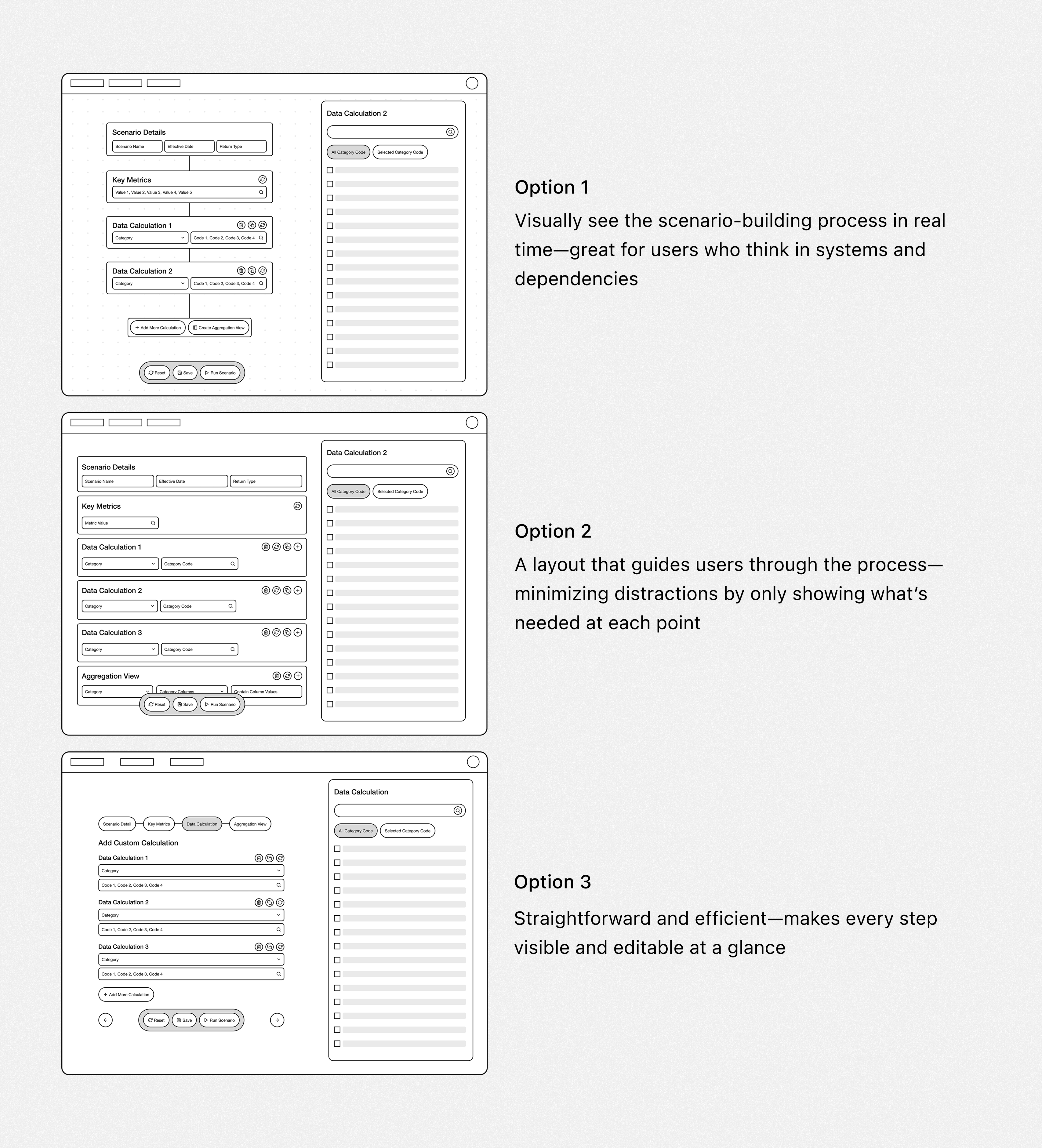

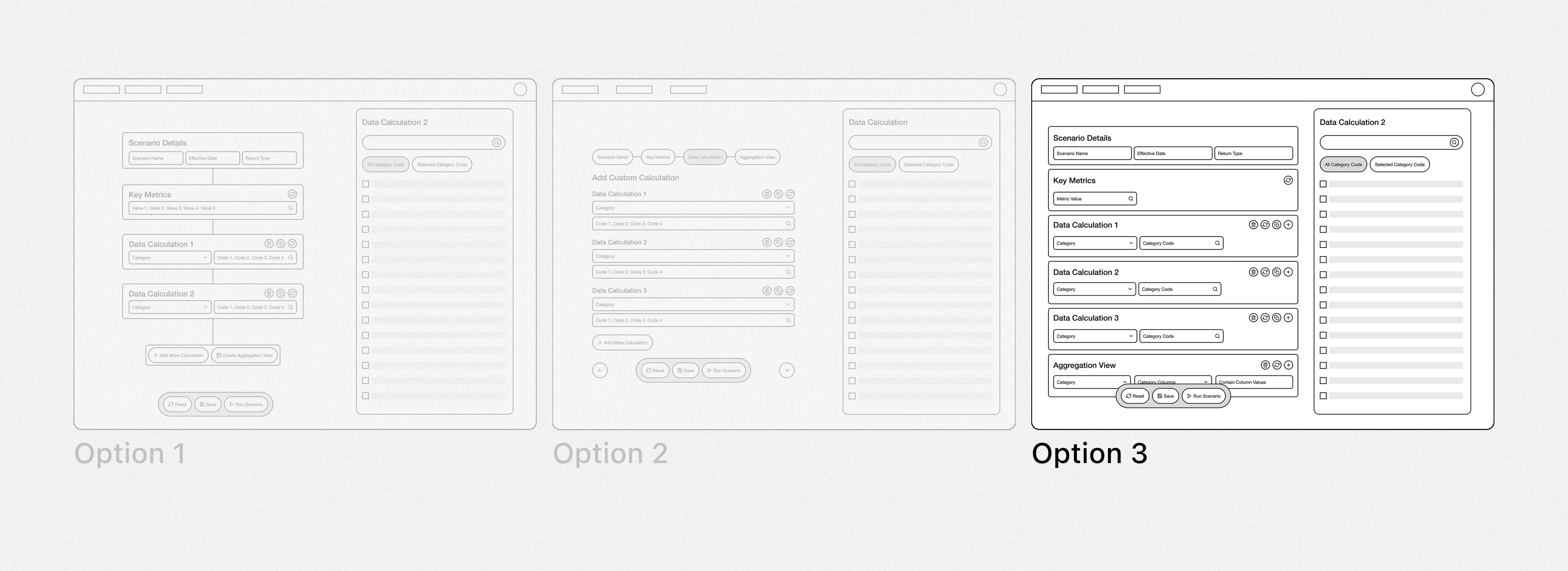

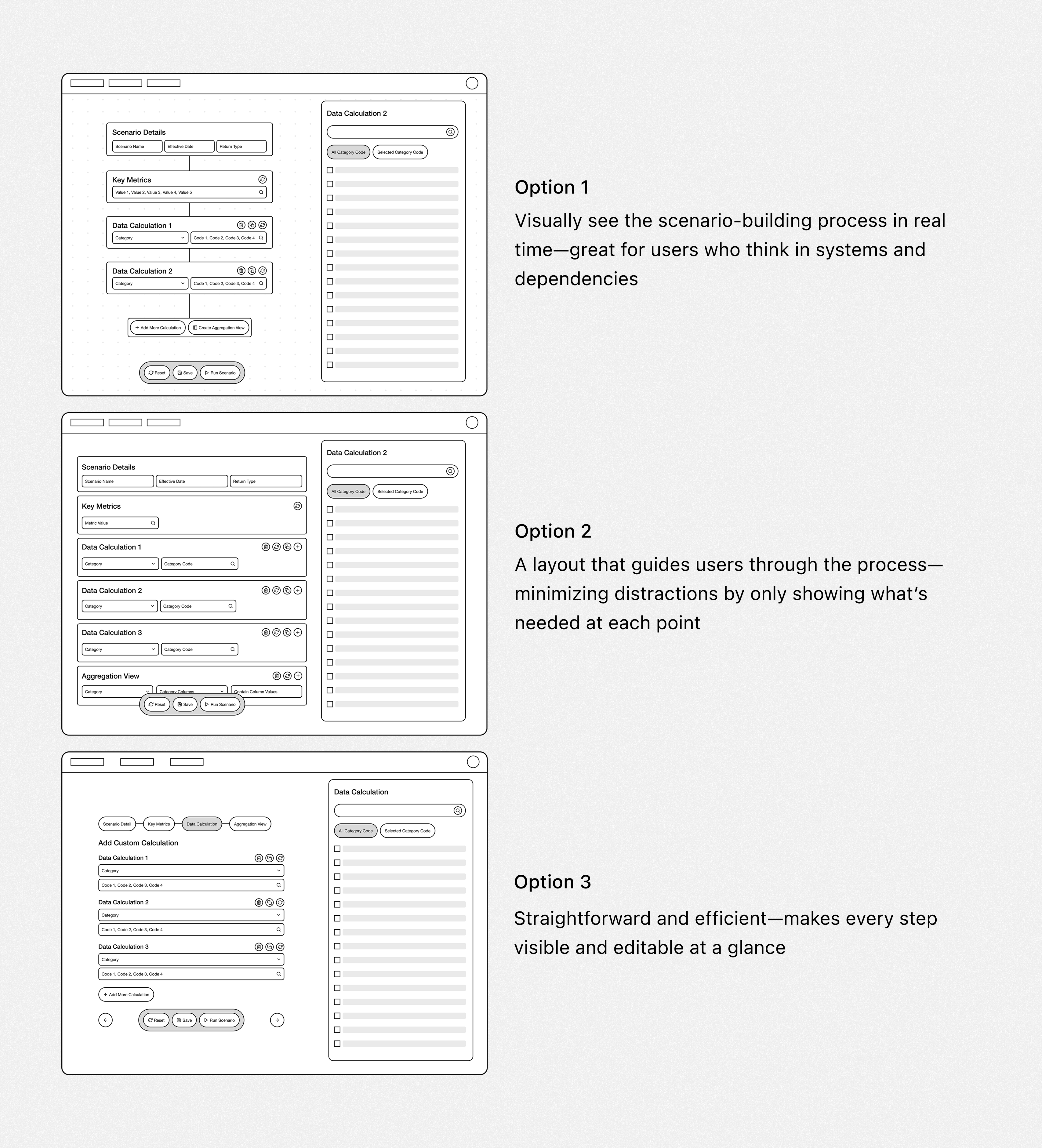

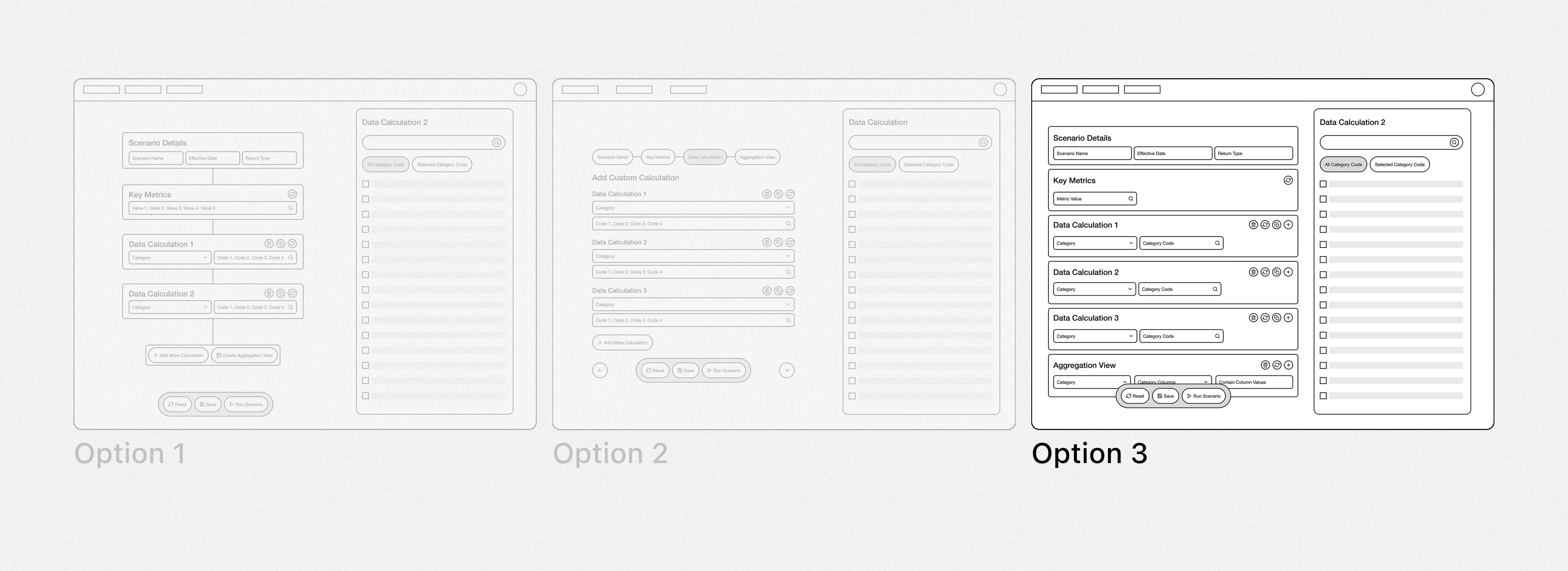

Designing the Best Layout for Performance Manager

To determine the most effective layout for scenario-building, I explored three low-fidelity options—each reflecting a different interaction model. My goal was to find the best way to support power users in building custom financial scenarios efficiently and confidently.

Evaluating Design Trade-Offs with Product and Engineering Stakeholders

I presented each low-fidelity option to stakeholders across product and engineering. We discussed trade-offs for each layout.

High Effort, Low Impact

The first option requires significant front-end engineering effort but offers limited user value, making it difficult to justify the level of custom development.

Excel-Like Experience

Across all options, stakeholders emphasized the importance of preserving familiar data behaviors—such as tabular layouts and multi-step formulas—commonly found in Excel.

Lack of Guidance and Unclear Layout

The team raised concerns about Option 1 feeling too open-ended for new users, especially without guidance or visual grouping.

Choosing the Right Design Path

Initially, I was biased toward the first design option, as I believed it clearly represented the scenario being built. However, after discussions with the team and quick feedback sessions with performance managers, it became clear that users preferred an interface more aligned with their legacy tool. The first option felt overly complex and unfamiliar to them. Additionally, it posed significant front-end limitations and scope challenges, which led us to explore the third option further.

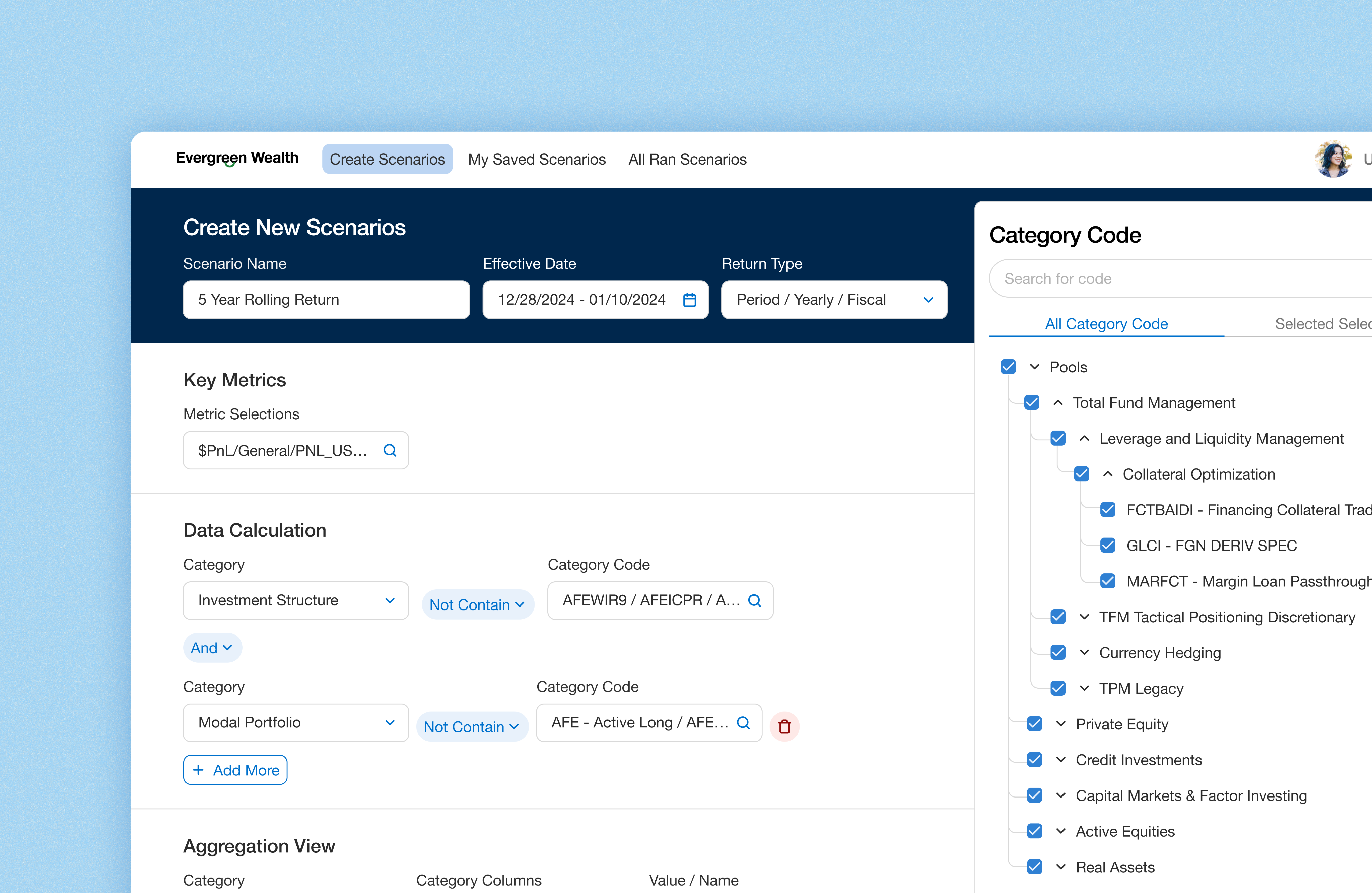

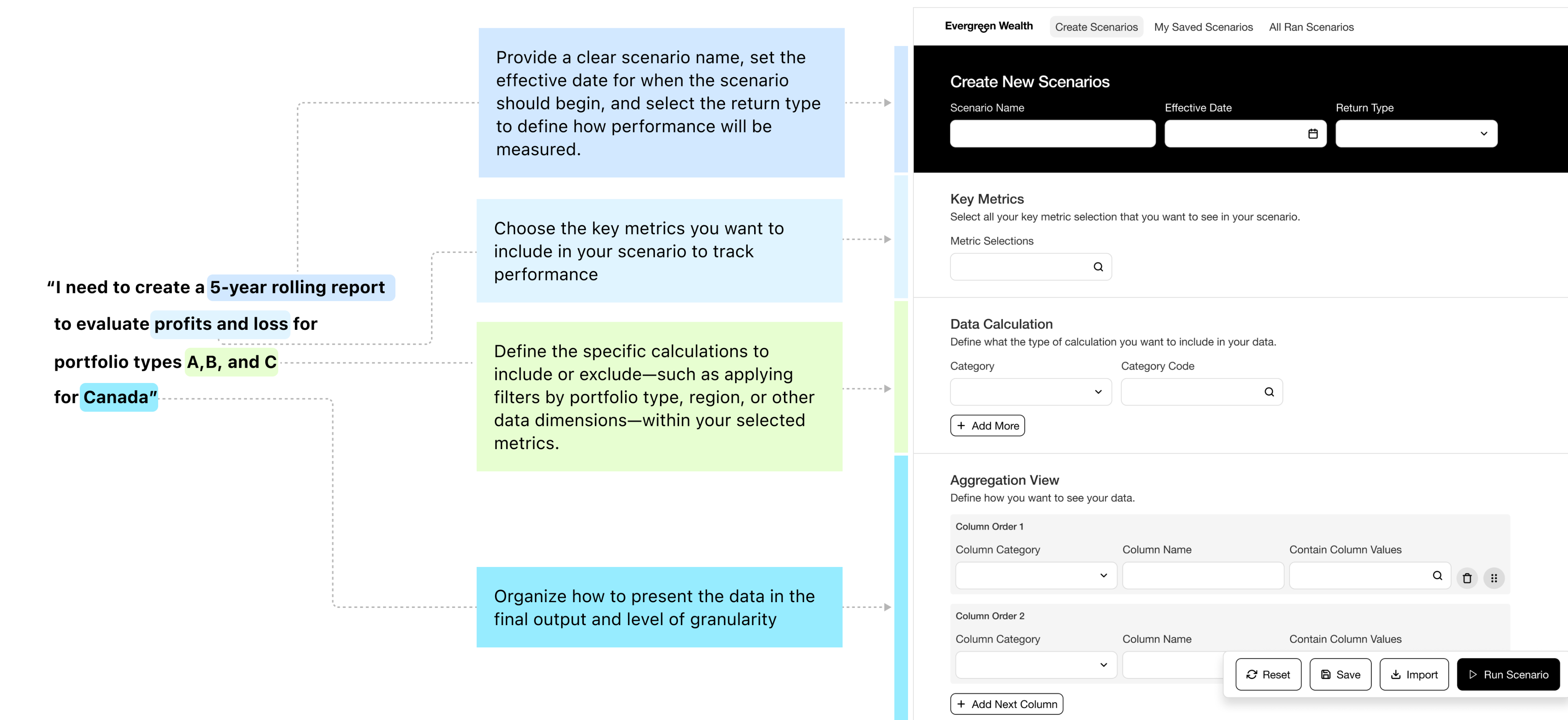

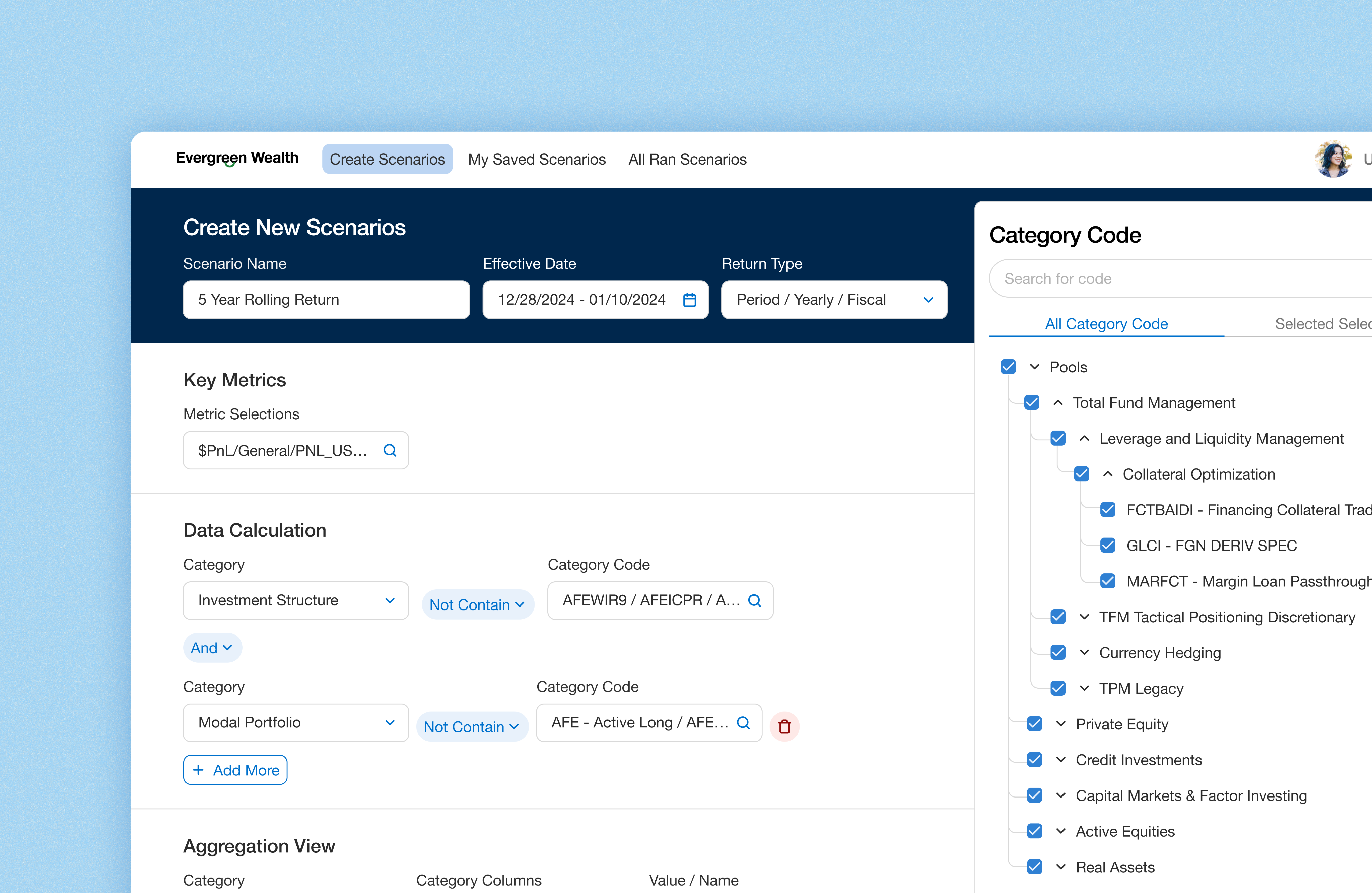

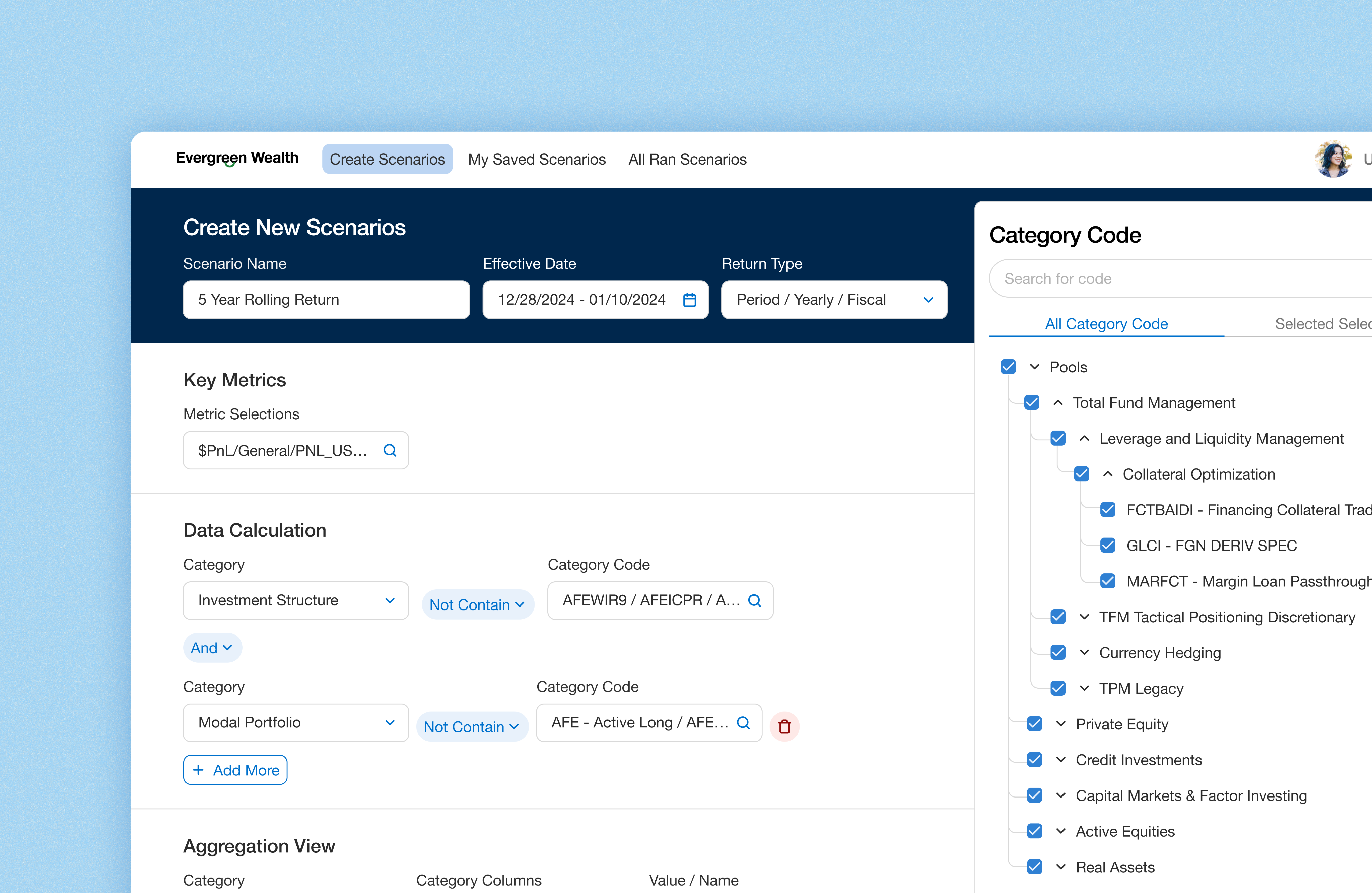

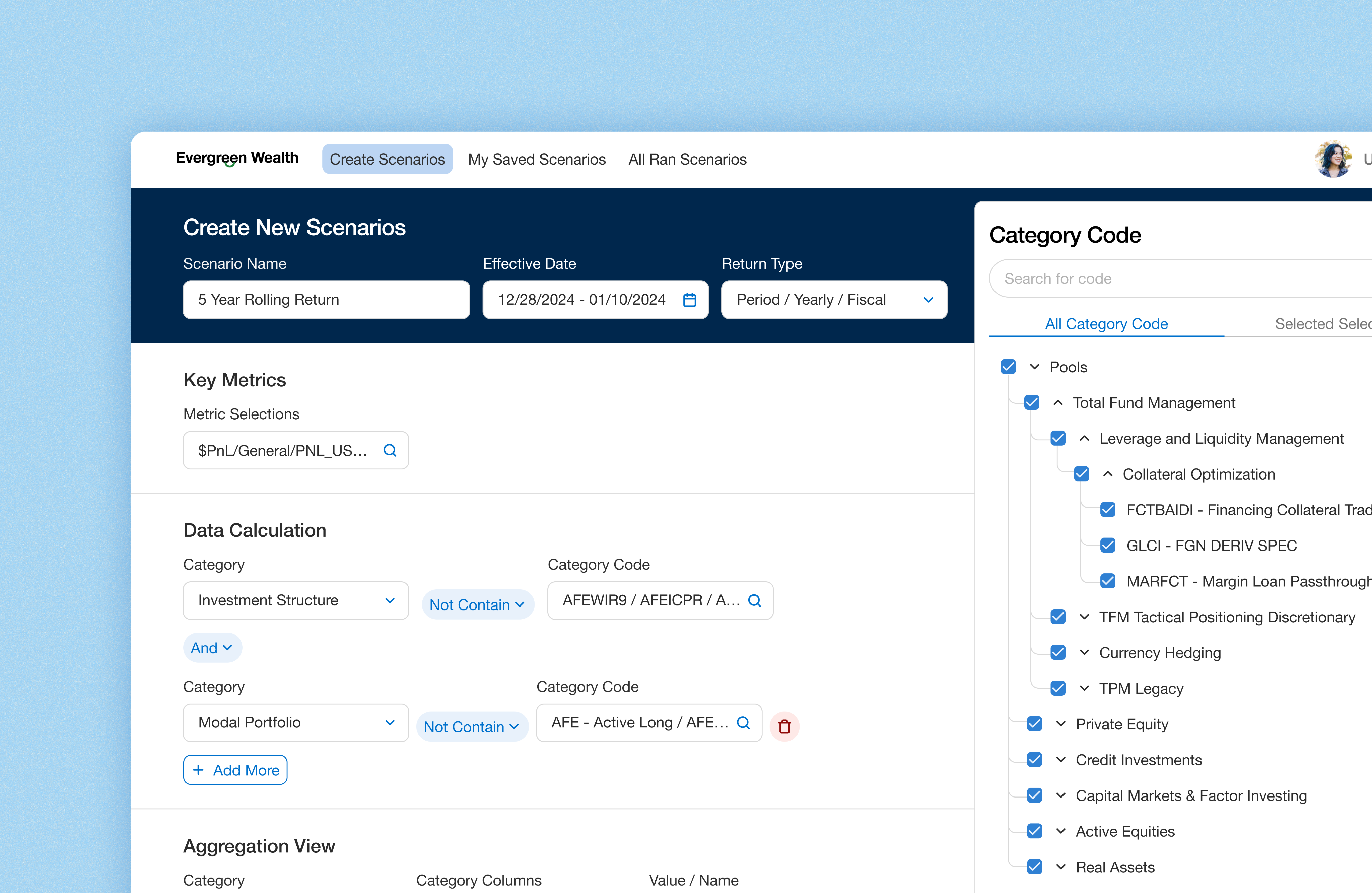

Design Solution

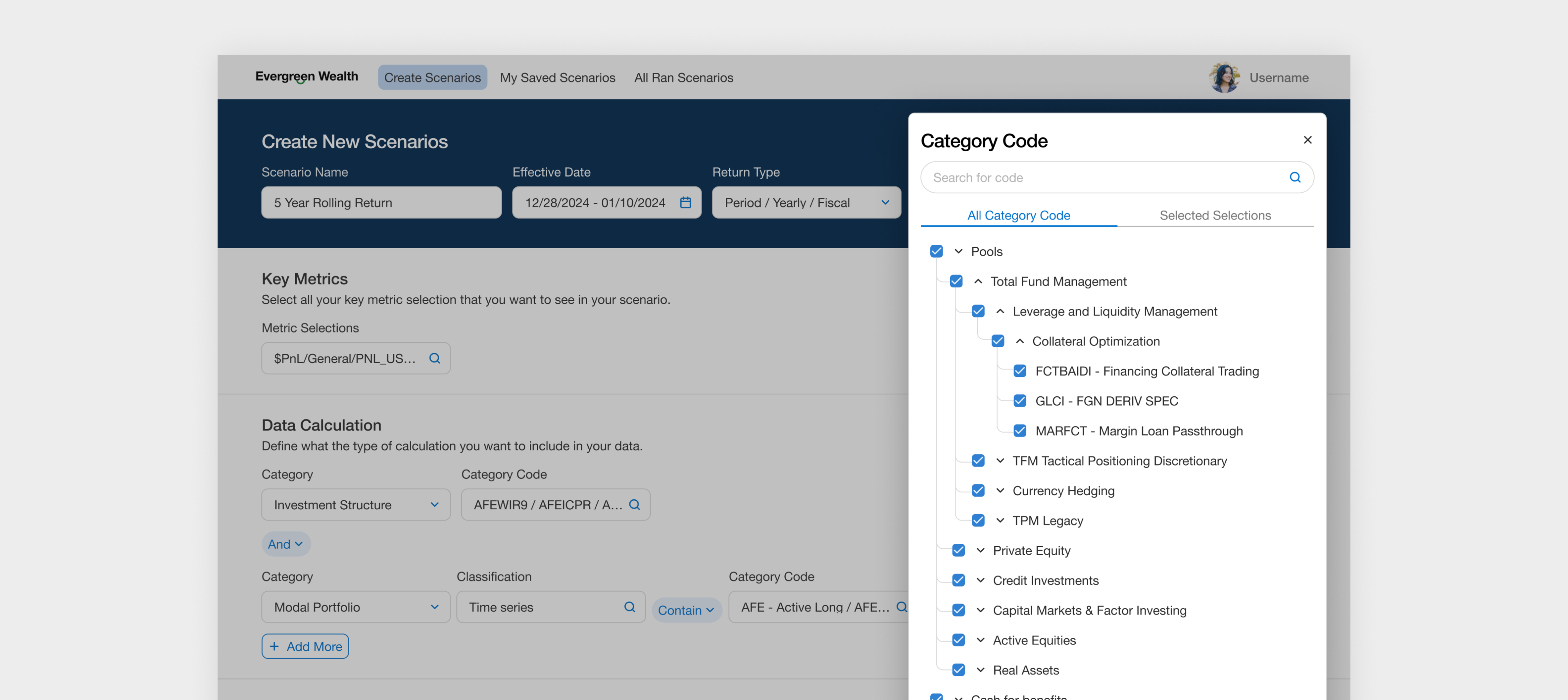

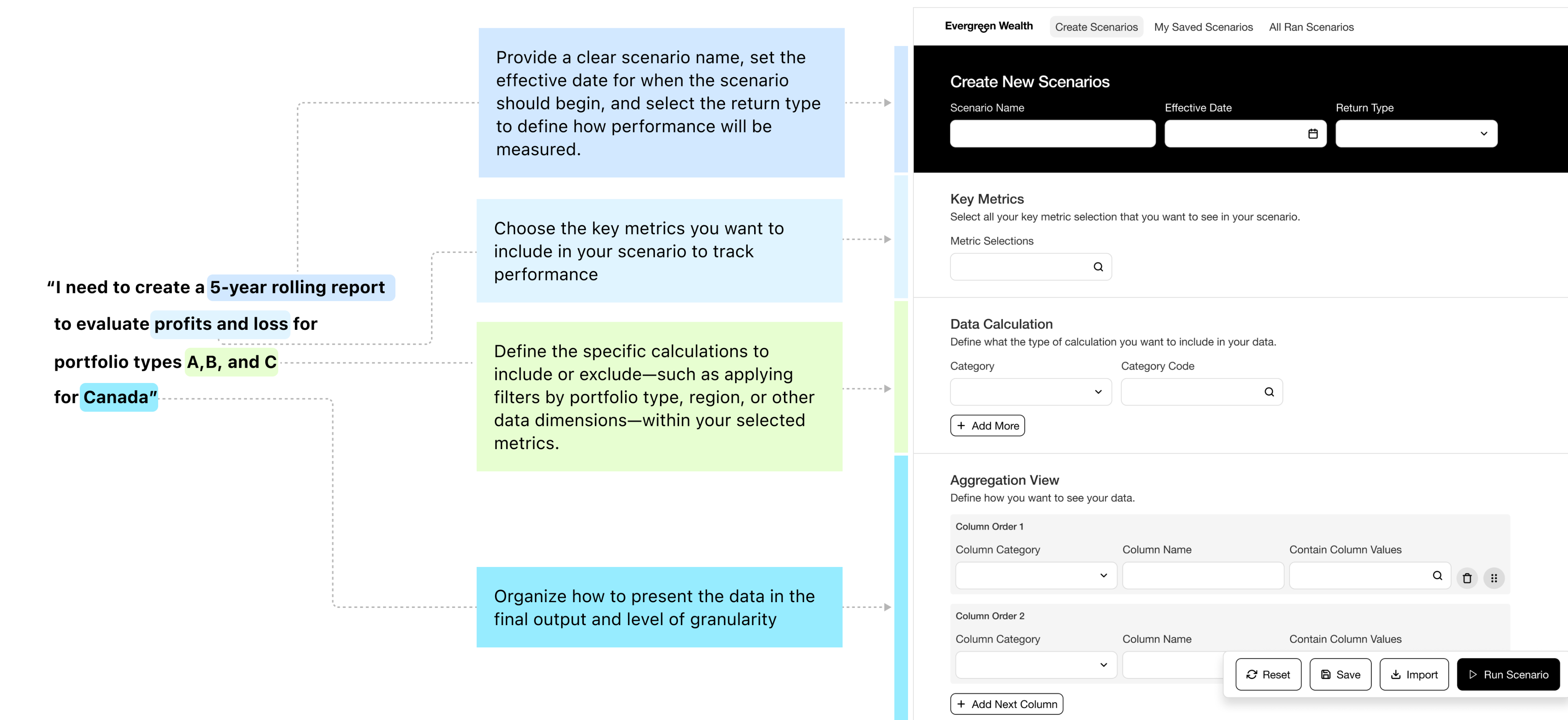

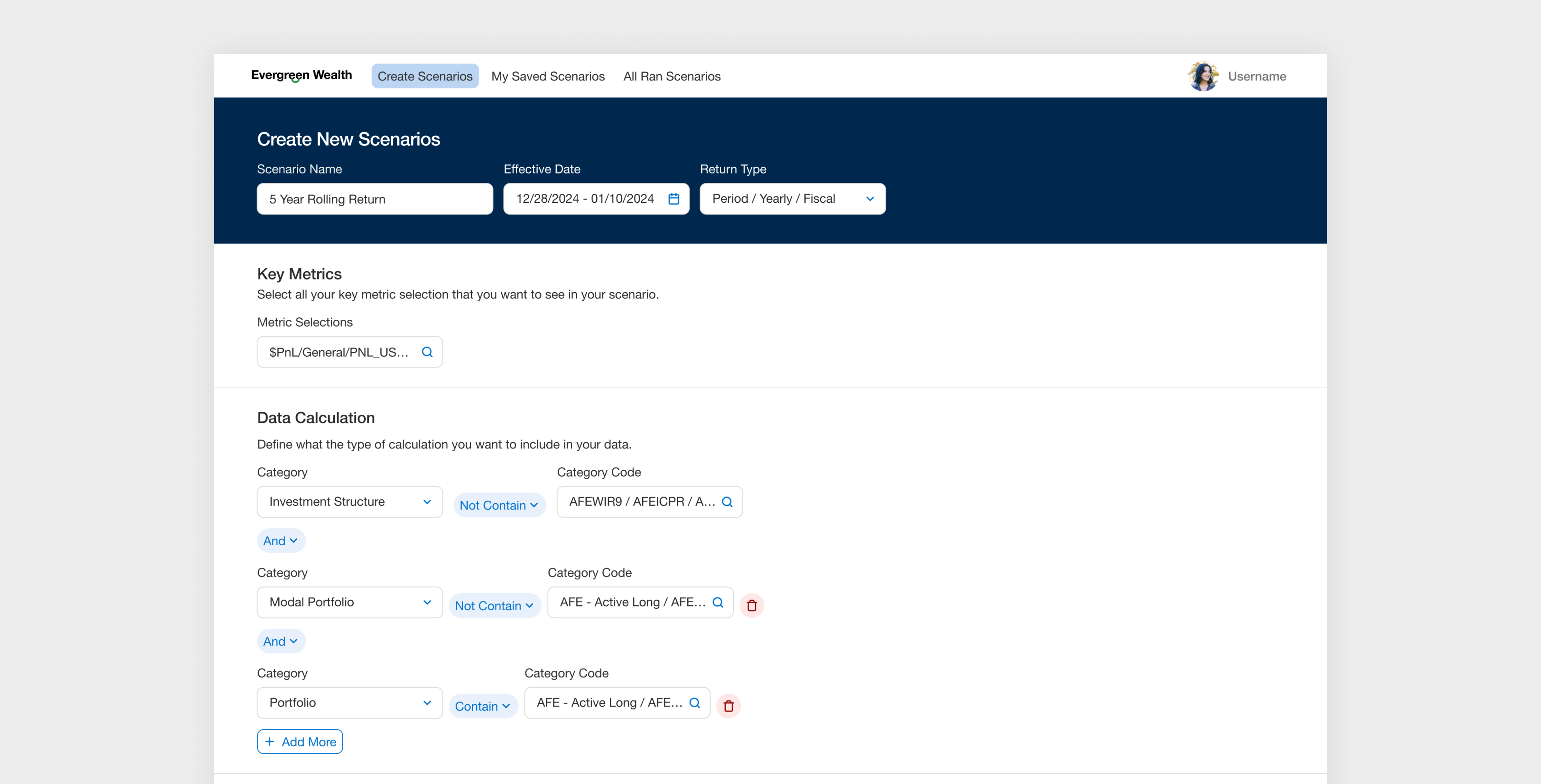

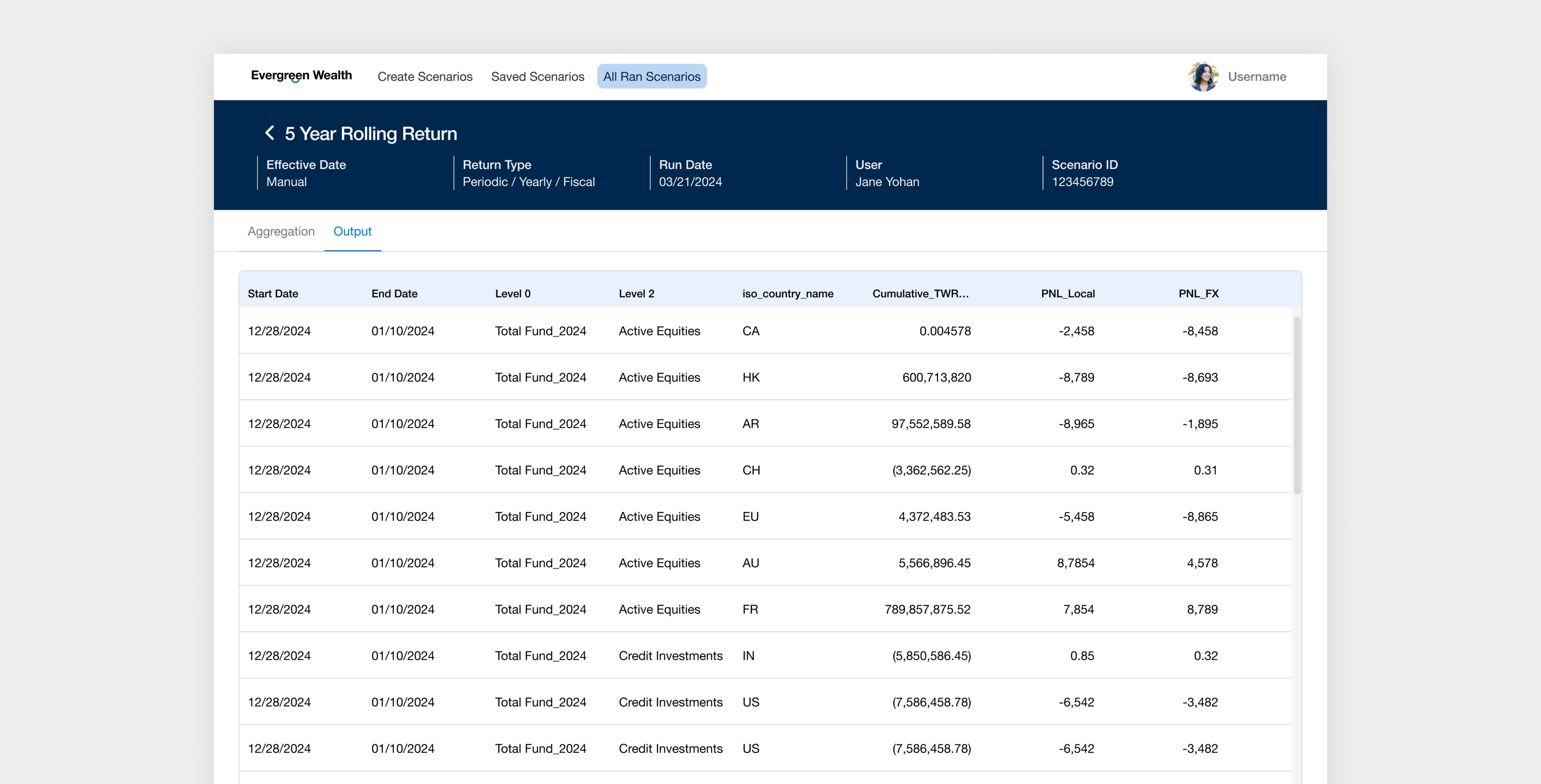

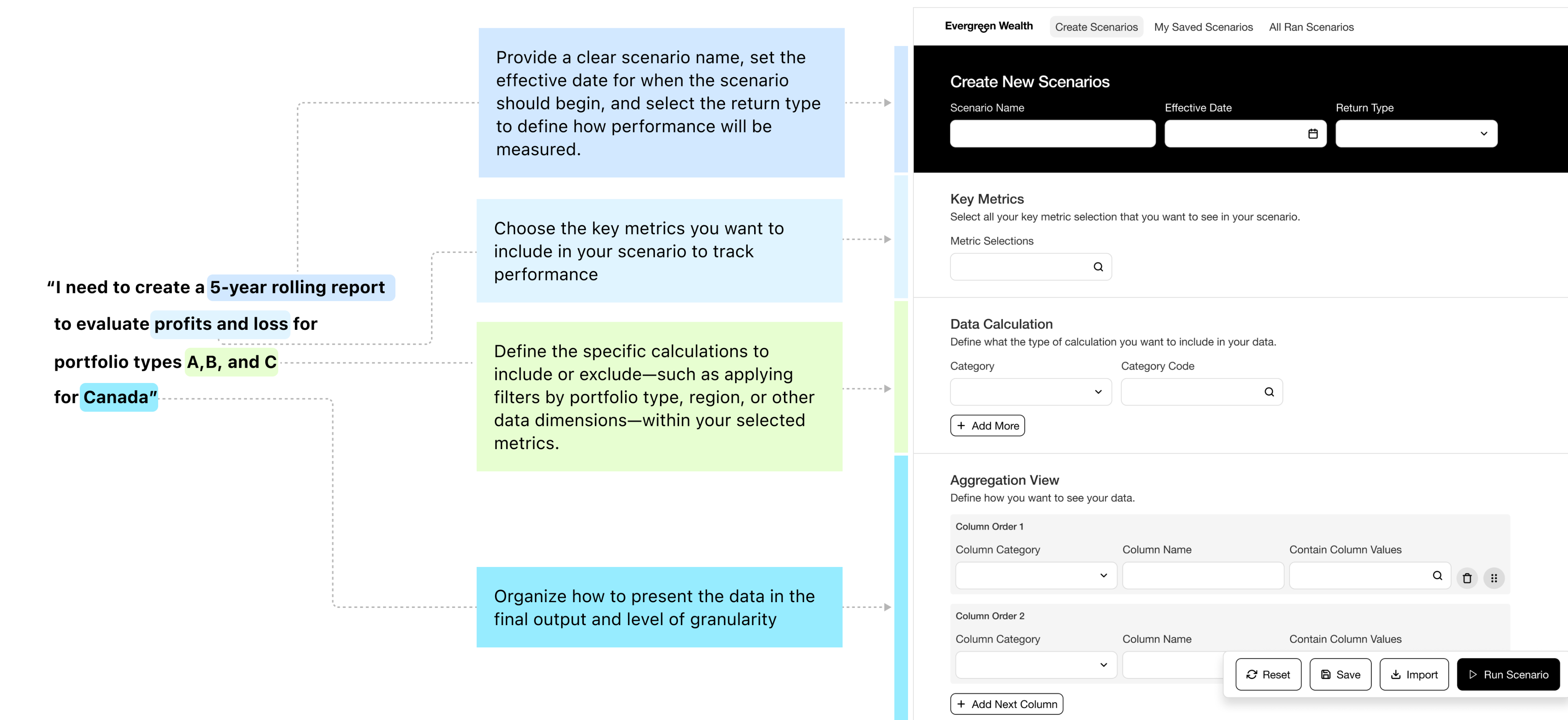

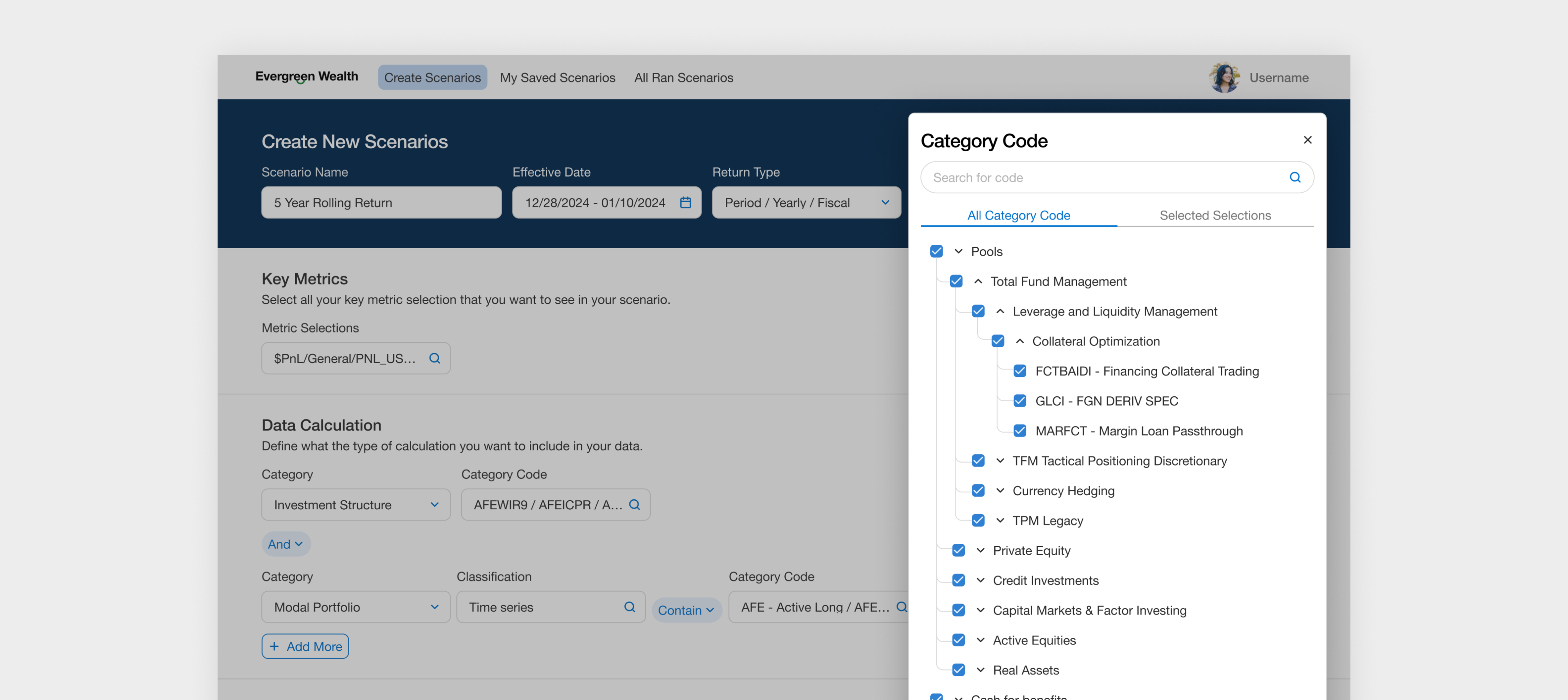

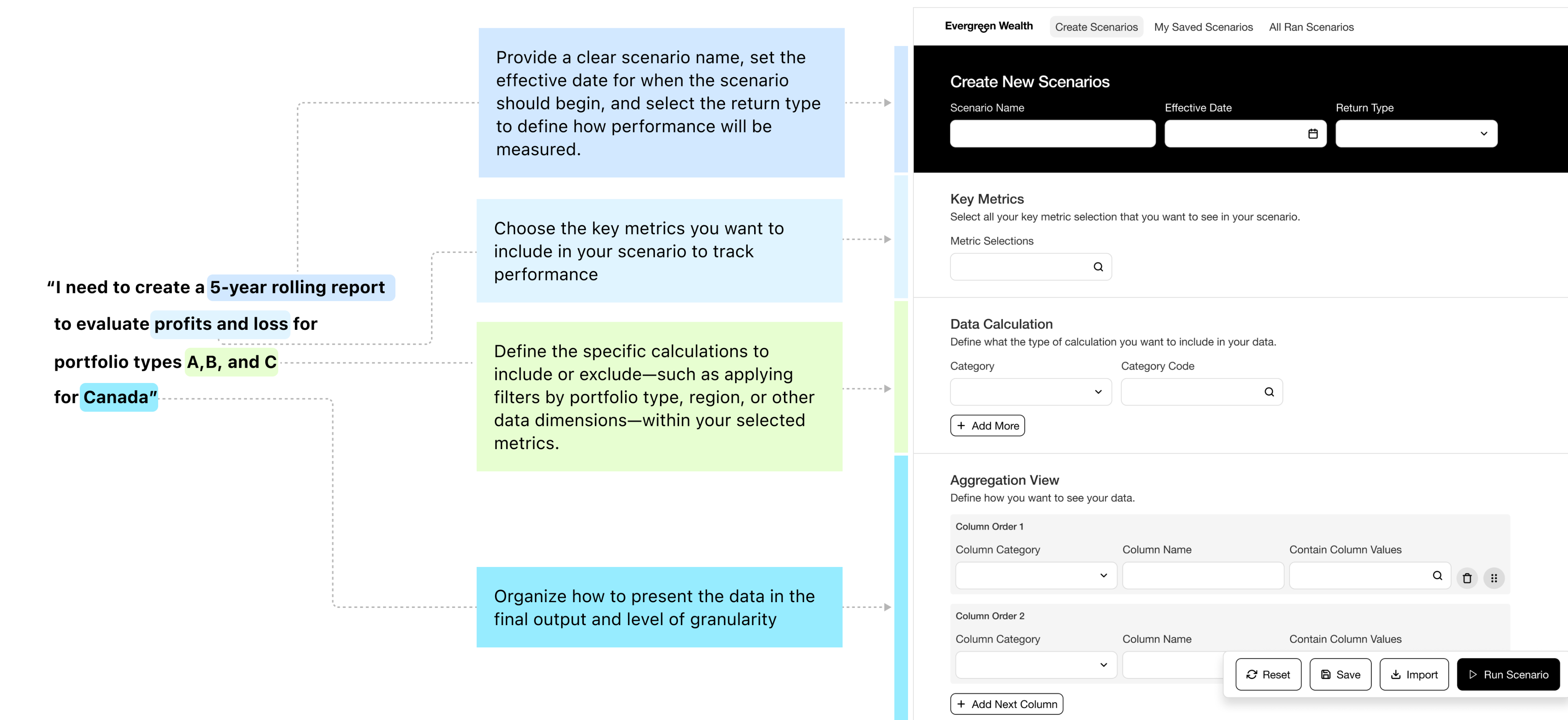

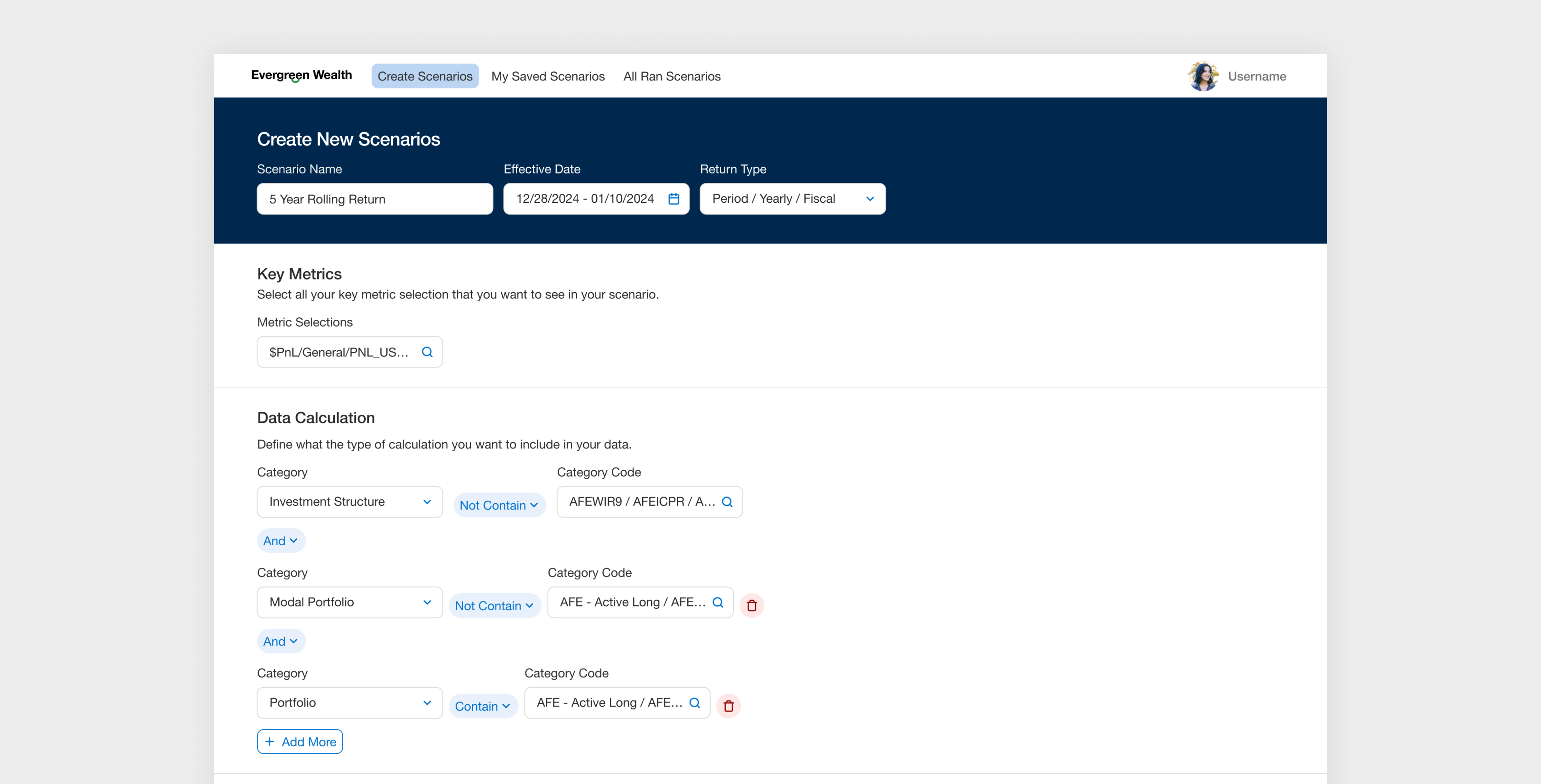

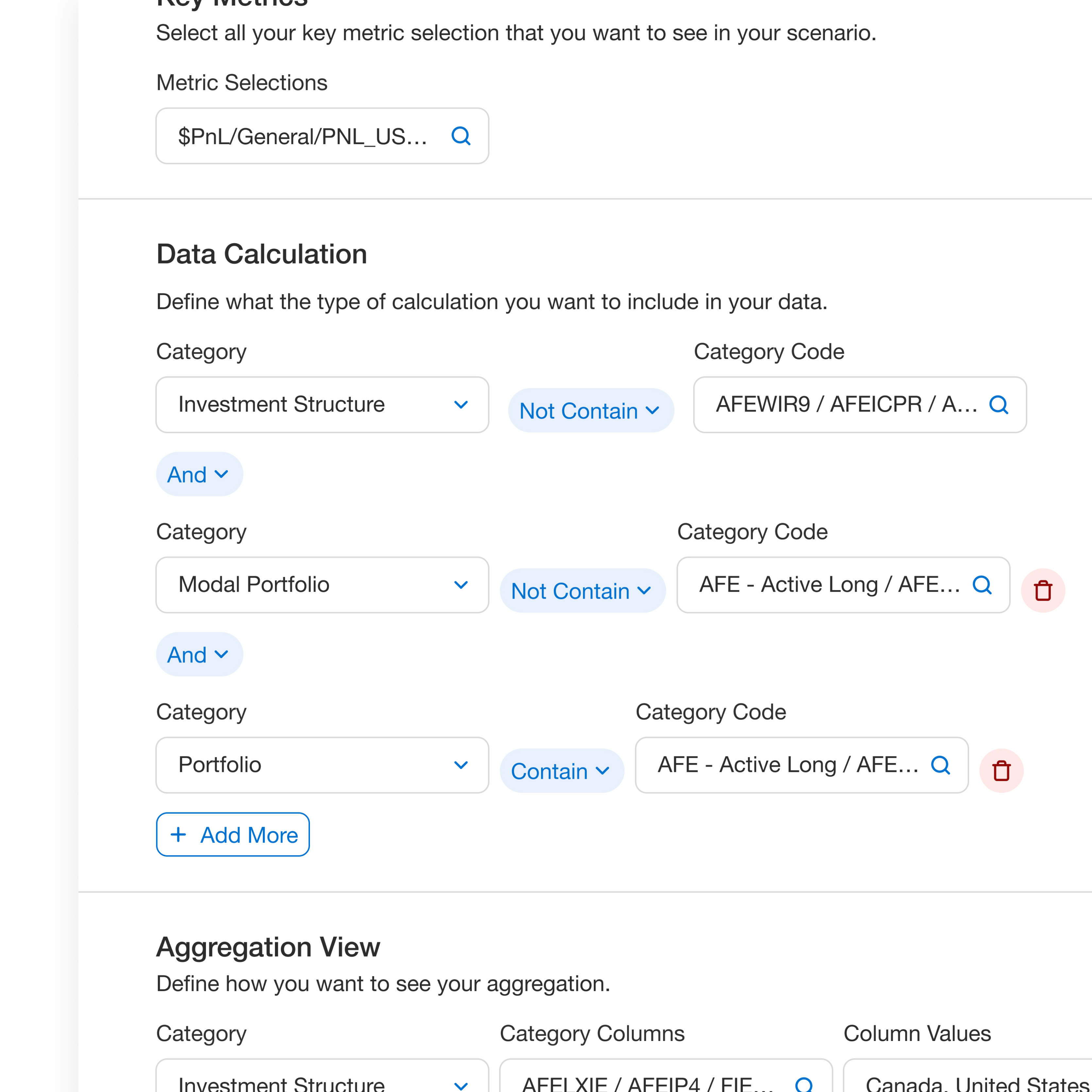

Layout Aligned with Users’ Logical Workflow

The final design approach prioritized a flow that mirrors how users naturally think through scenarios—starting with defining key parameters (e.g., dates, return type), then selecting metrics, and finally organizing the data. This structured sequence supports clarity, efficiency, and familiarity.

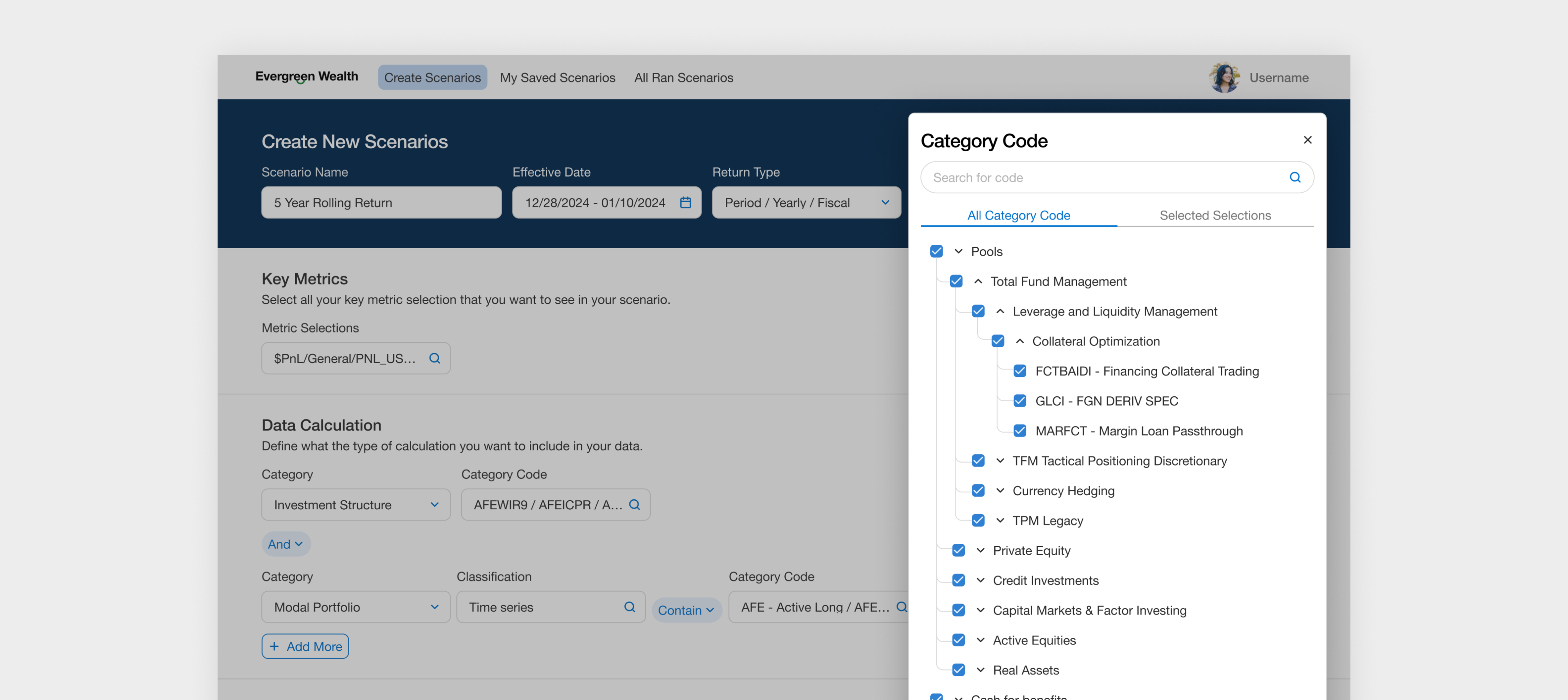

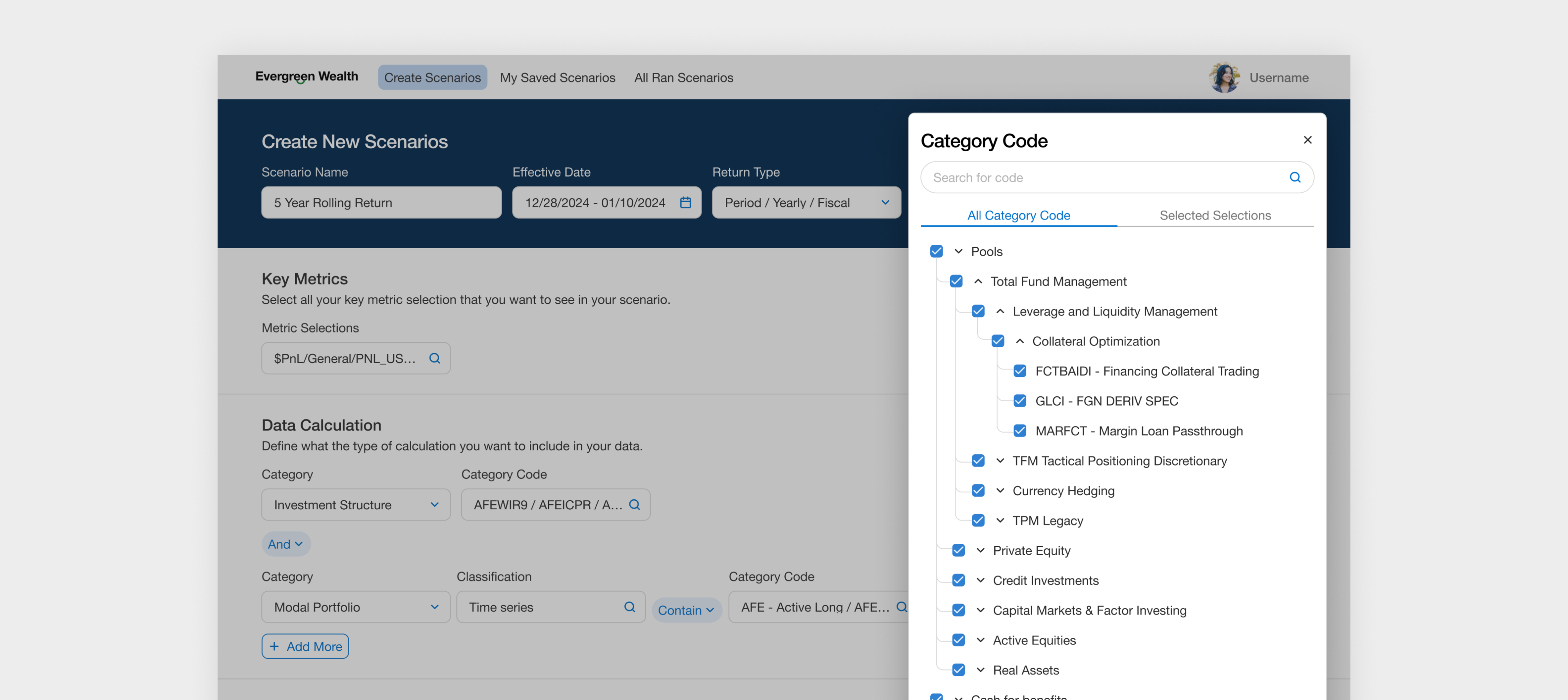

Helping Users to Sort Through the Long List of Metrics Easily

The most important aspect for users was the ability to quickly select specific key metrics and perform metric aggregation. Users needed to view all available data, but also be able to quickly filter and select the relevant metrics for their reports.

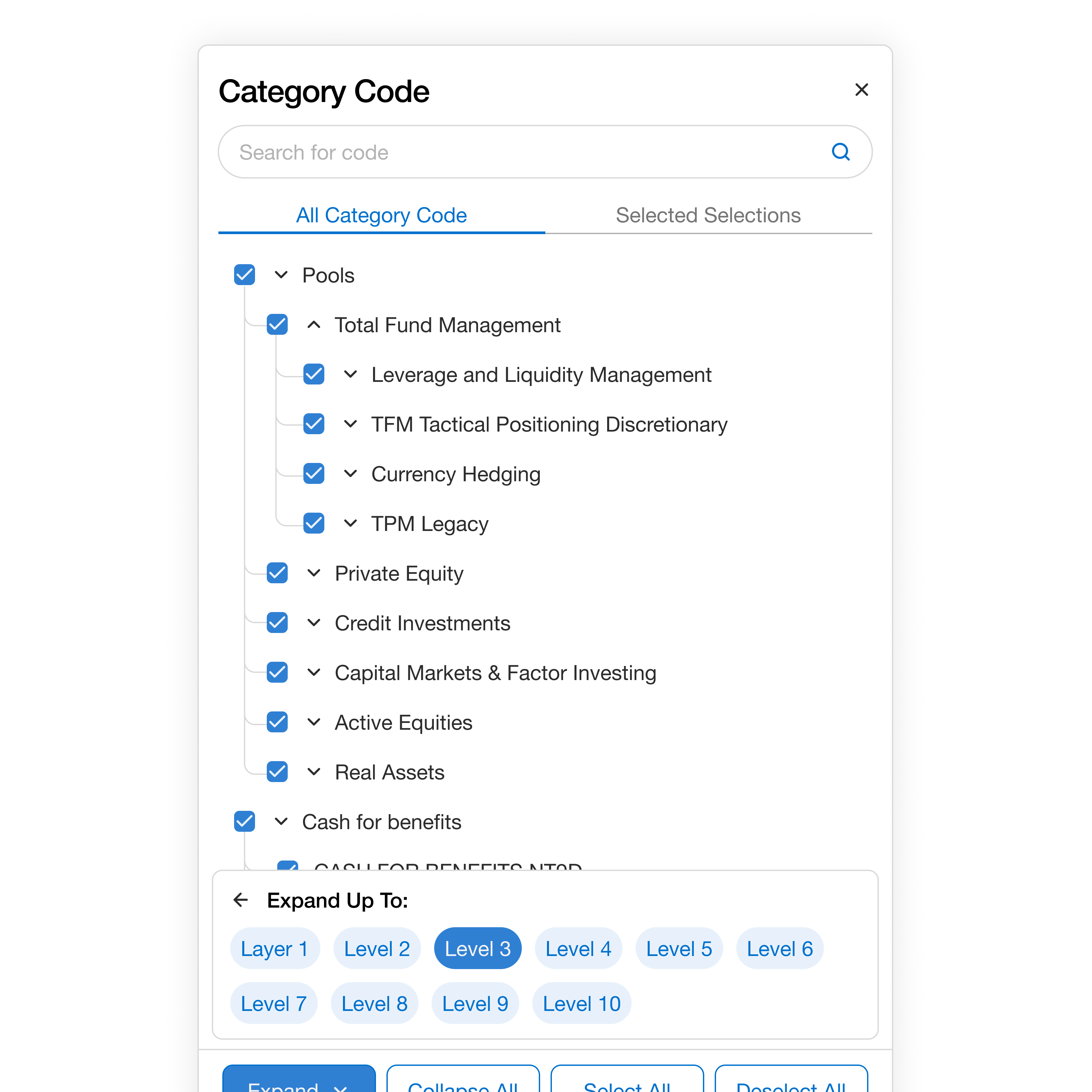

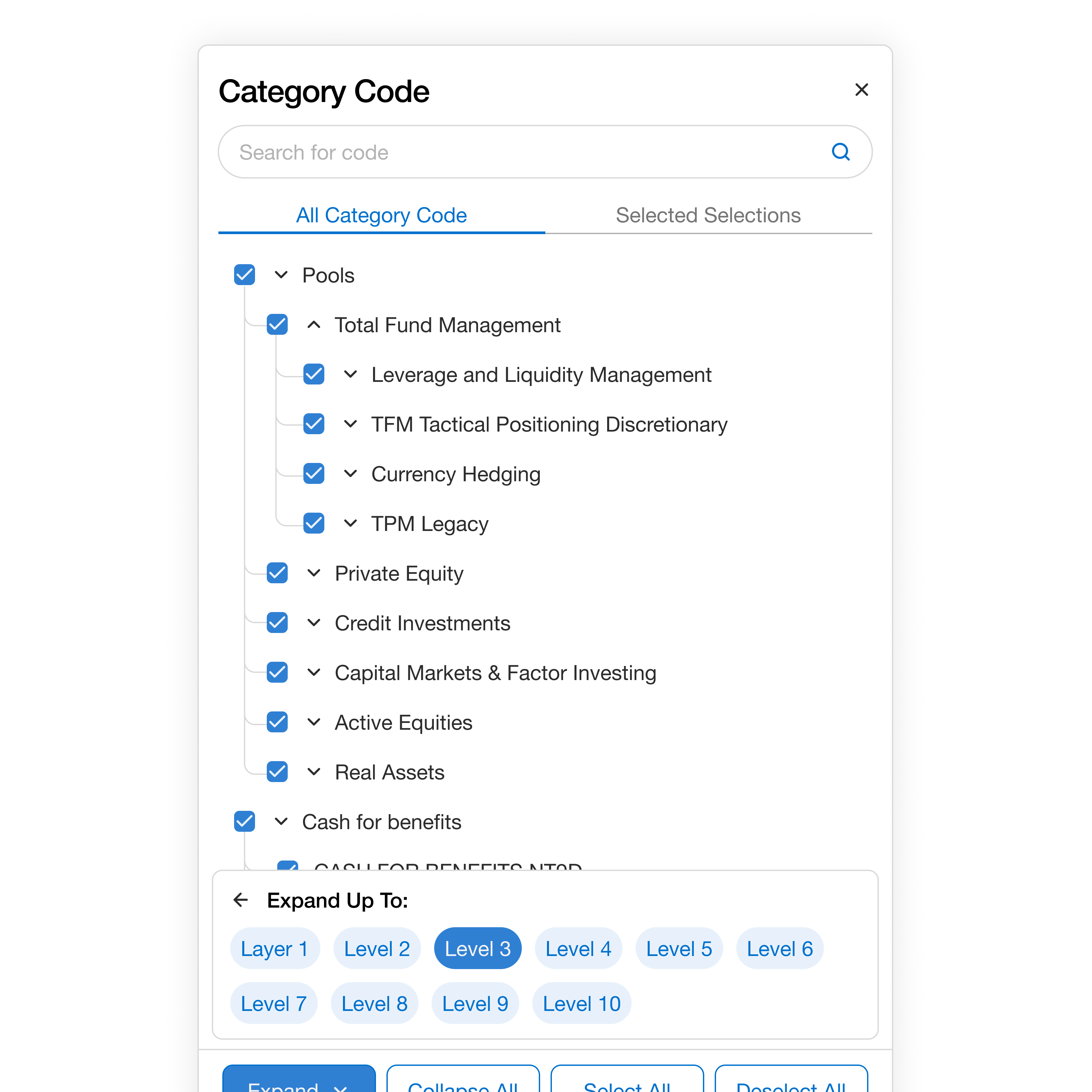

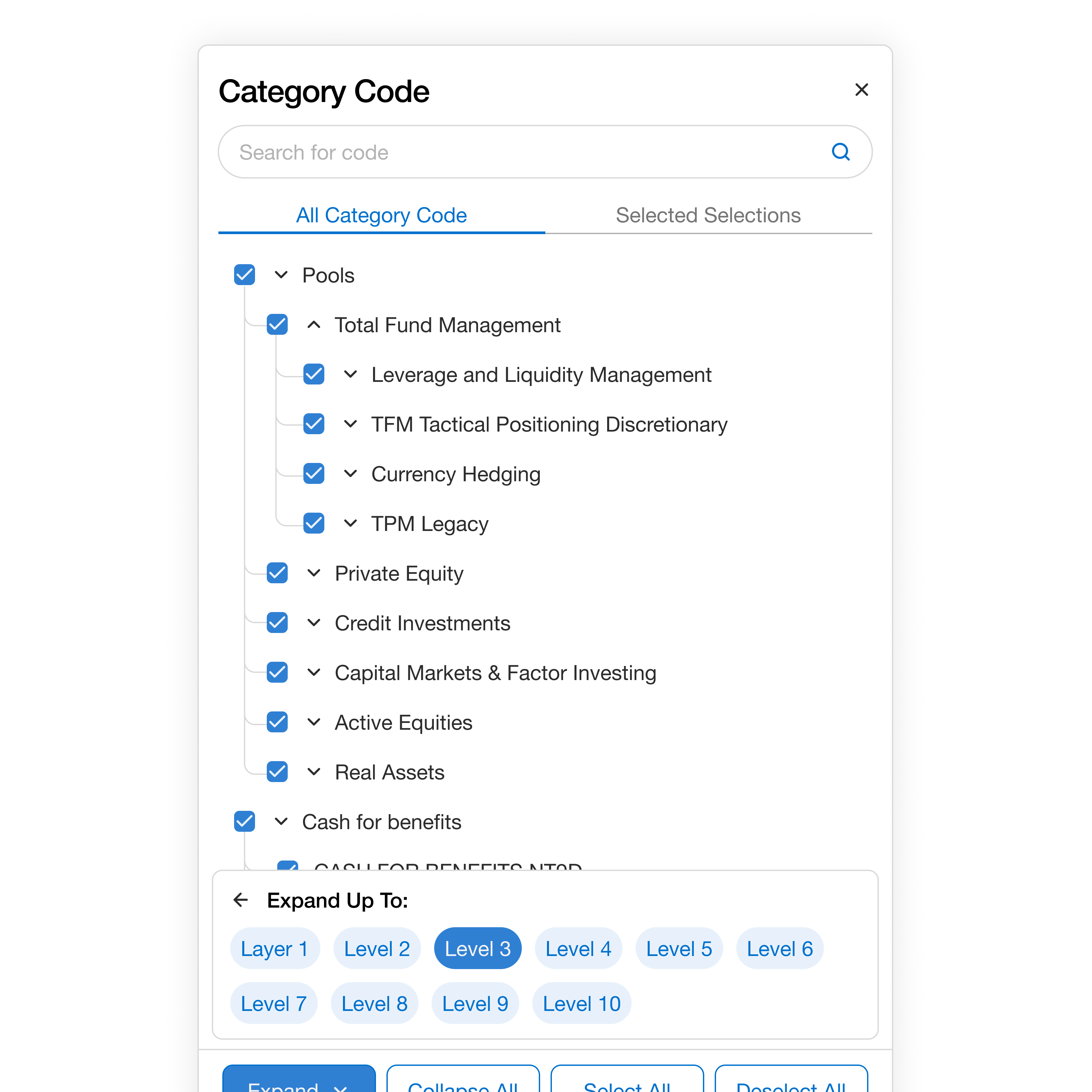

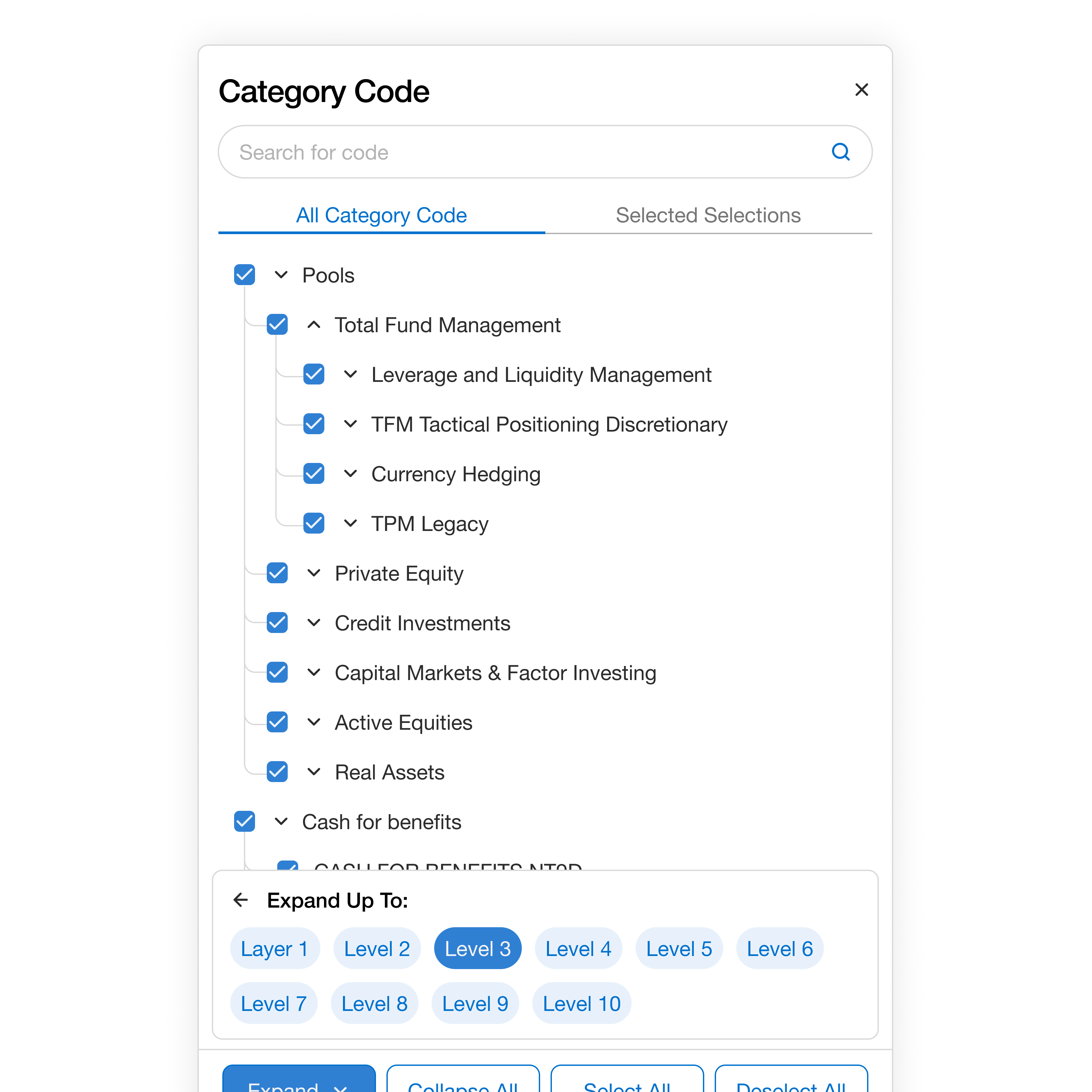

Improving Usability for Long Lists Through Group and Level Selection

Users can navigate groupings in bulk, avoiding the need to manually sift through each grouping. This makes the process faster and more manageable.

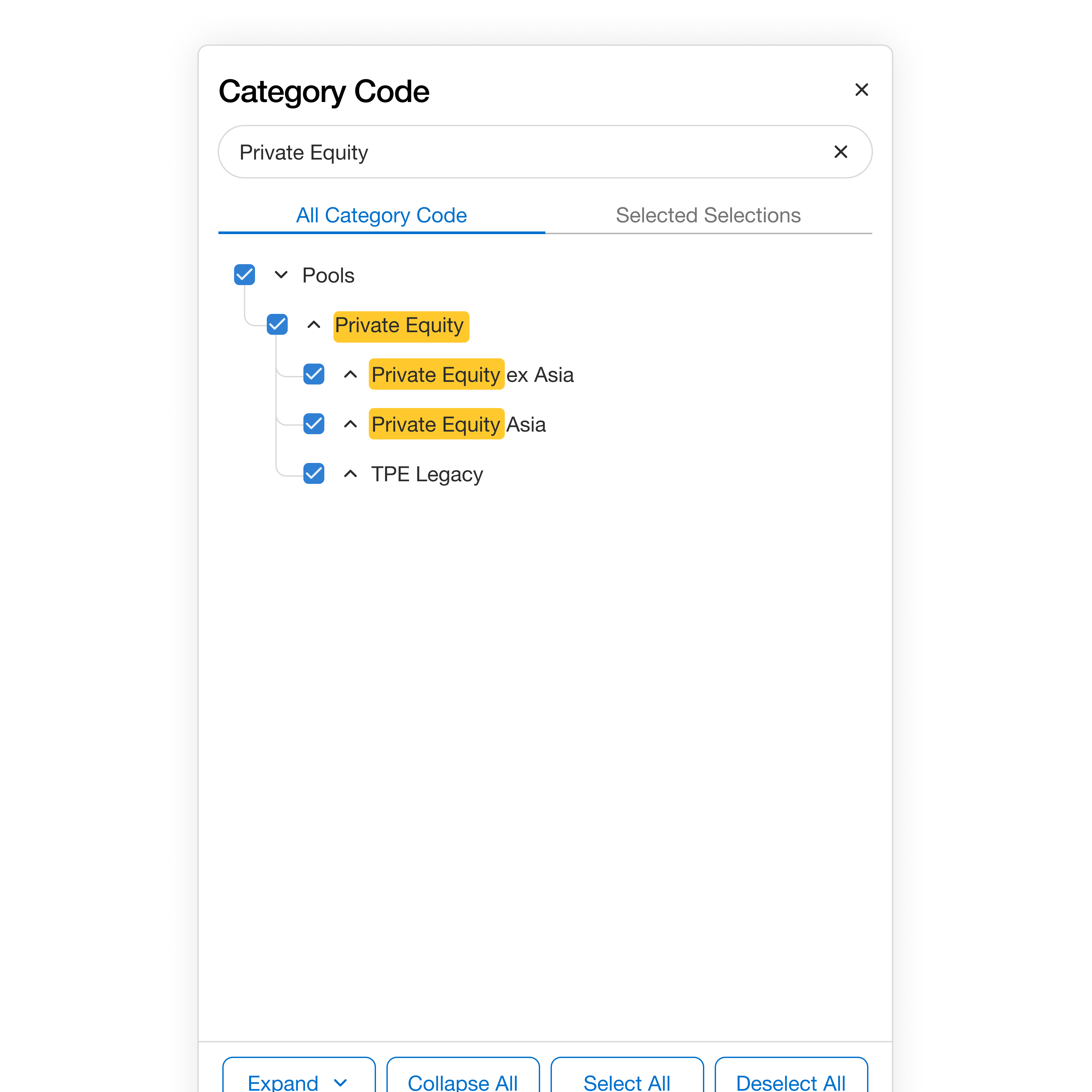

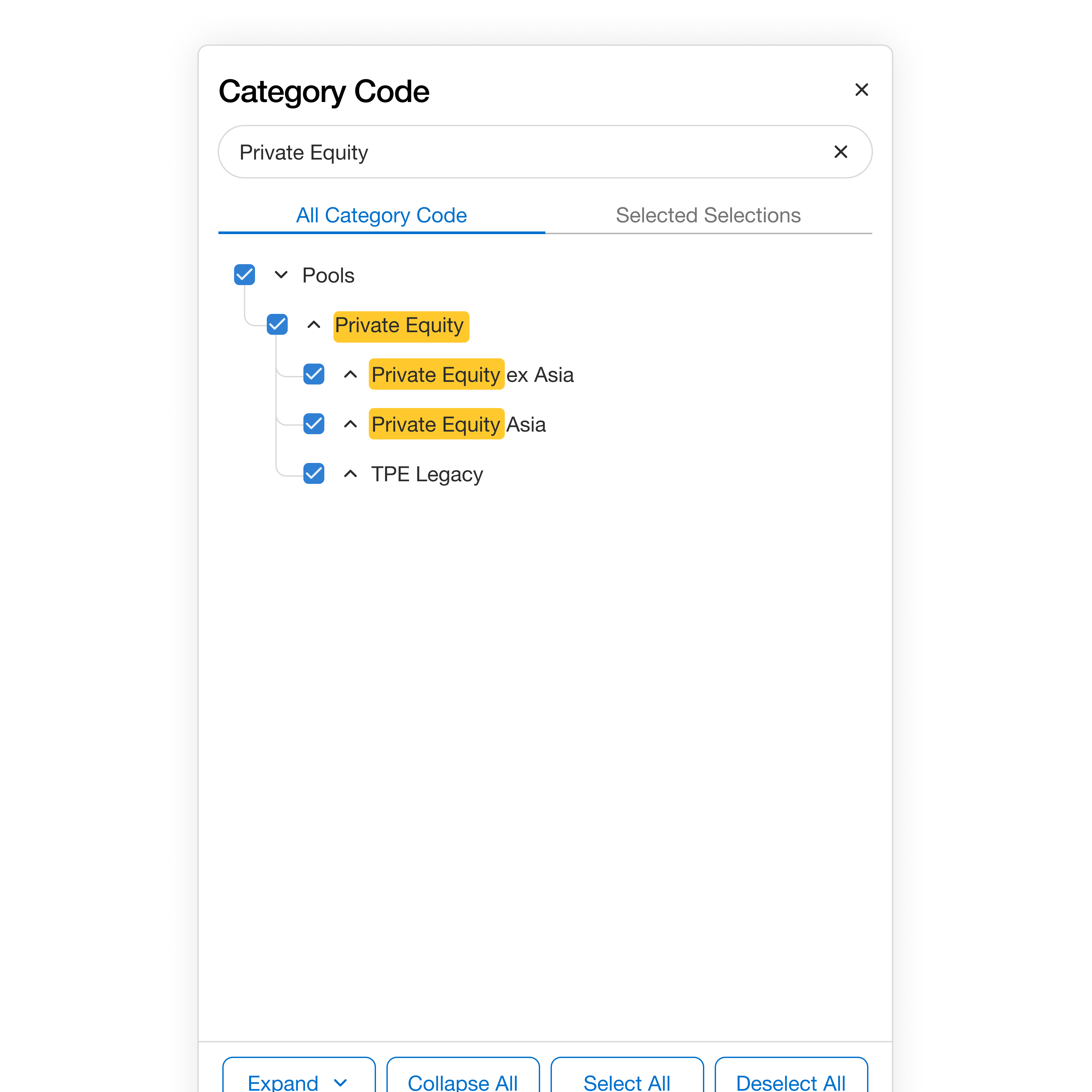

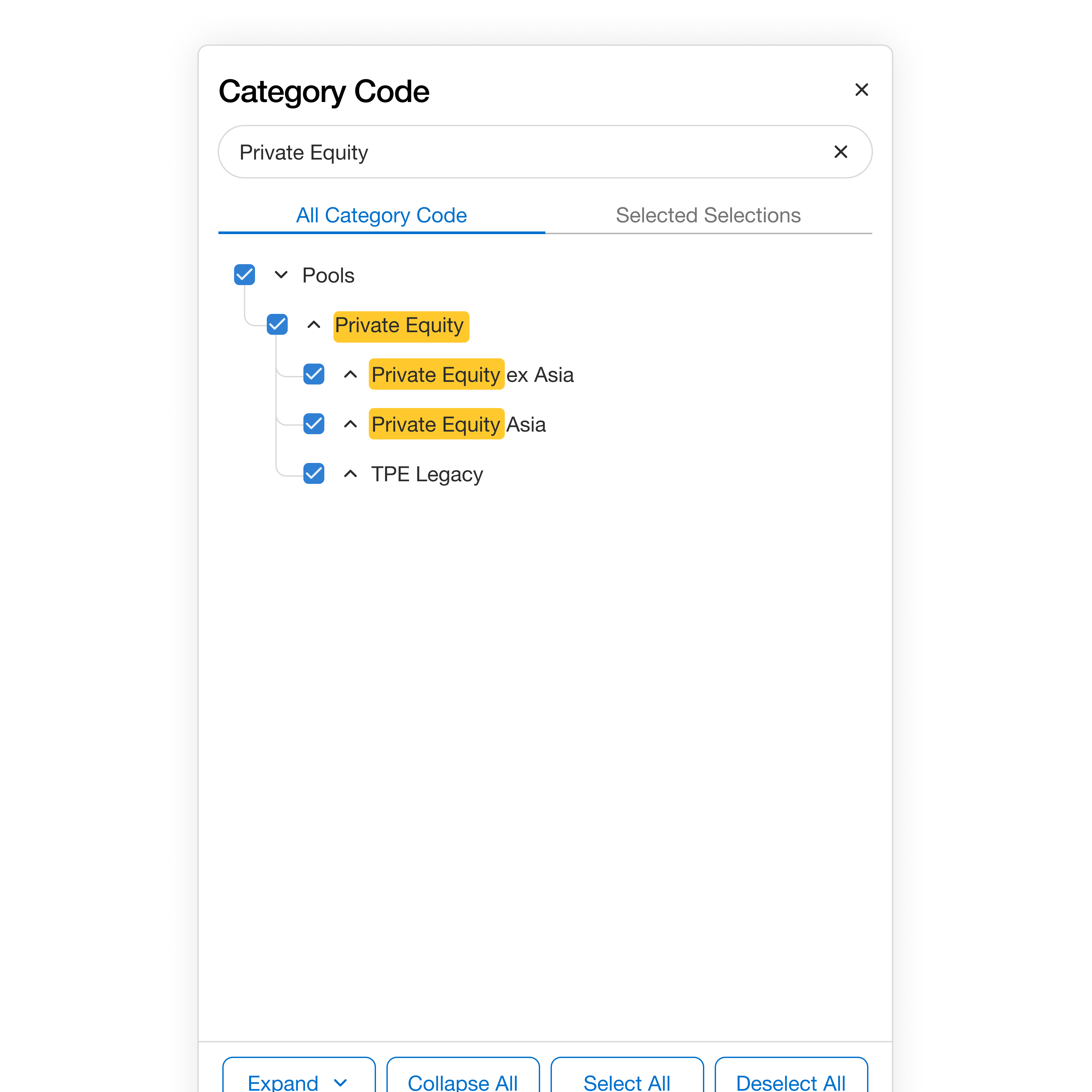

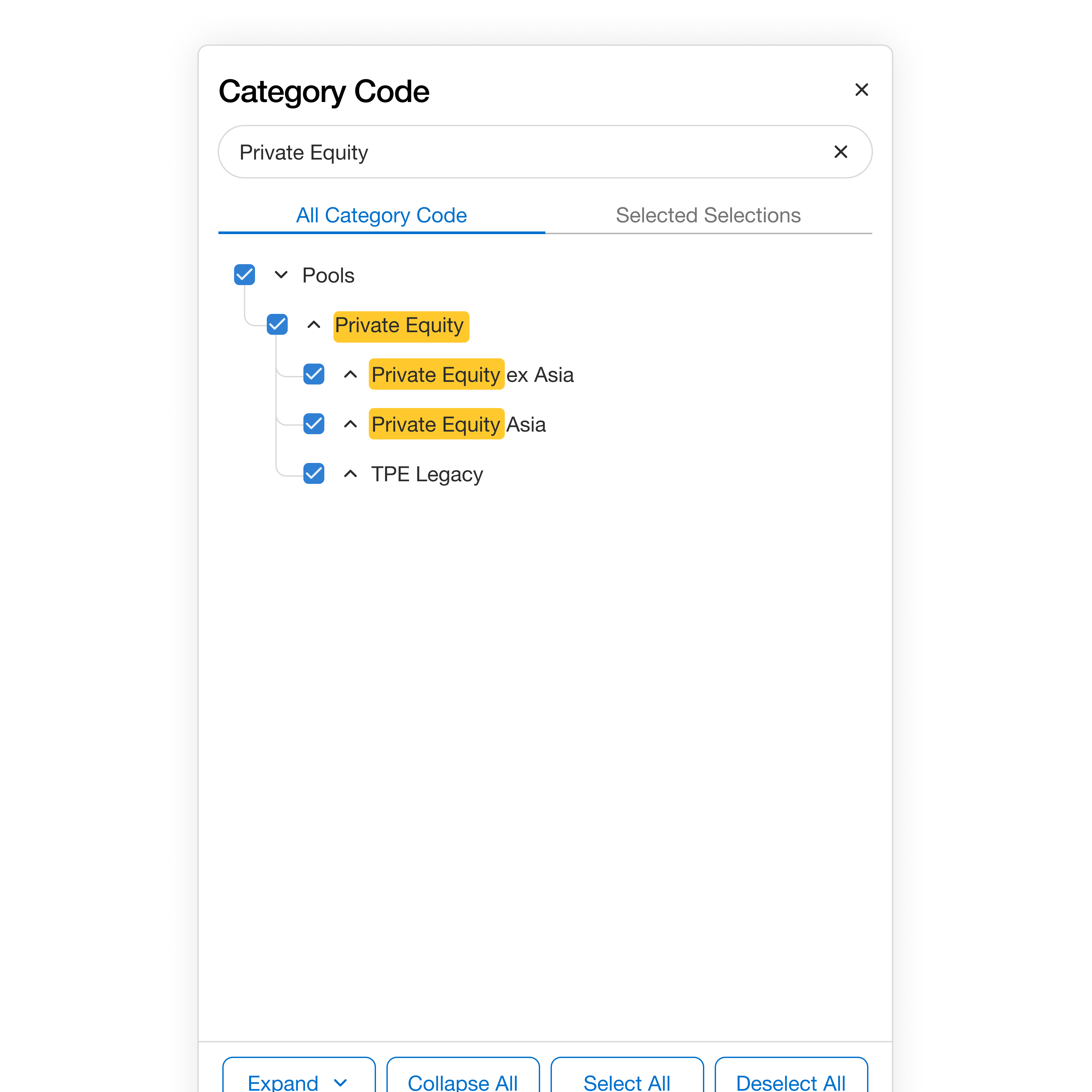

Find Fields Instantly with Quick Search

If users know the type of field they’re looking for, the quick search feature helps them find it instantly—eliminating the need to scroll through long lists.

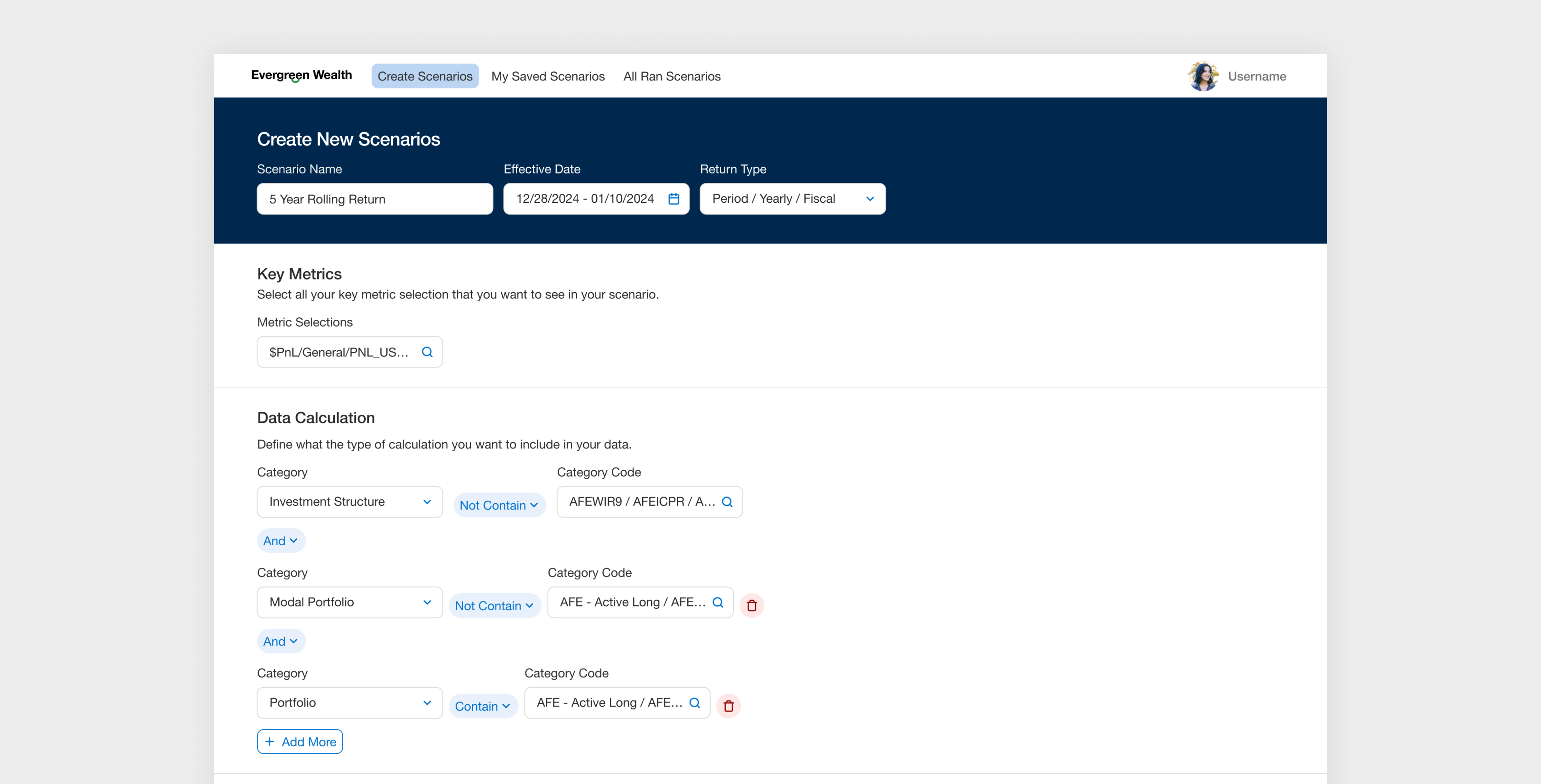

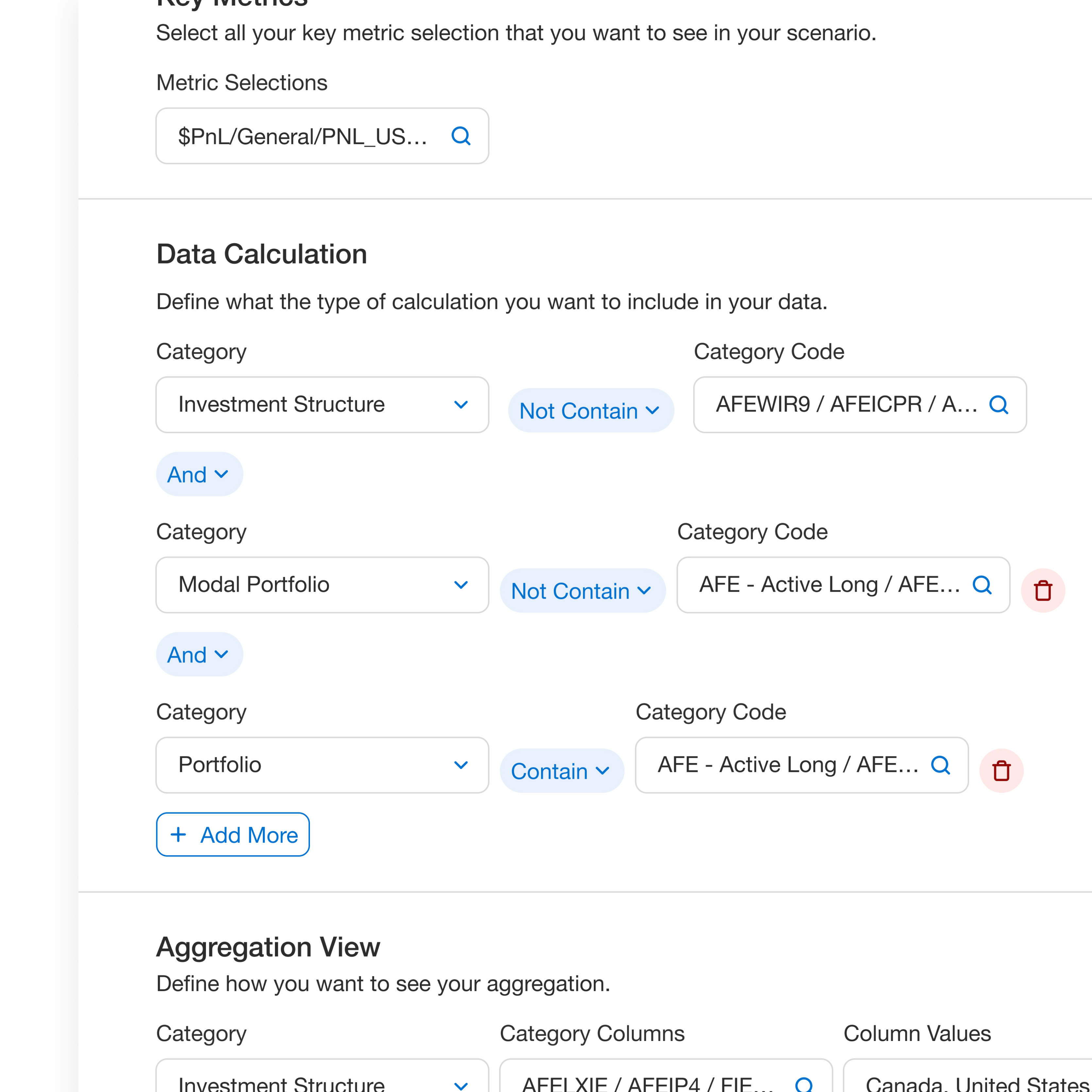

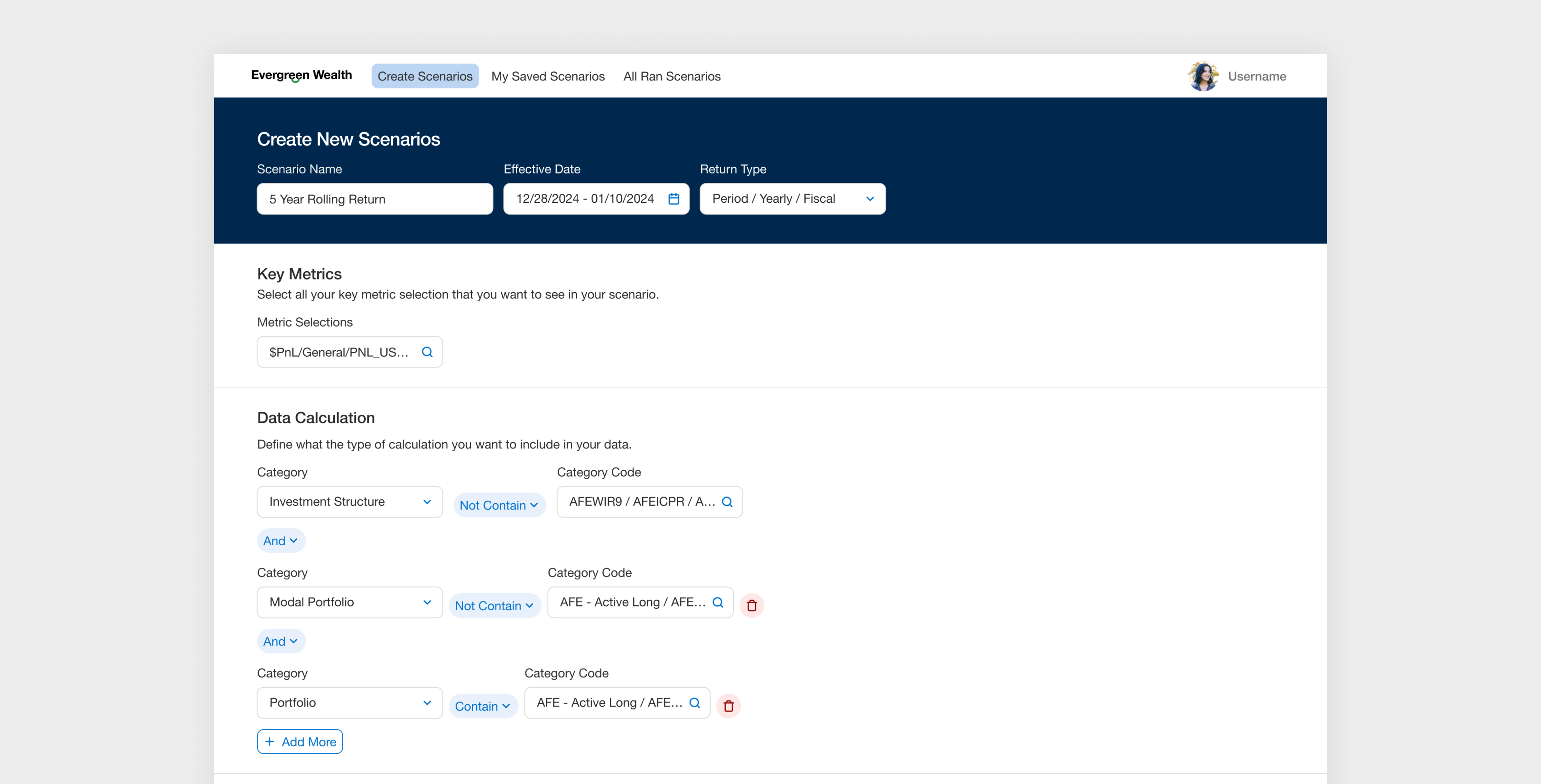

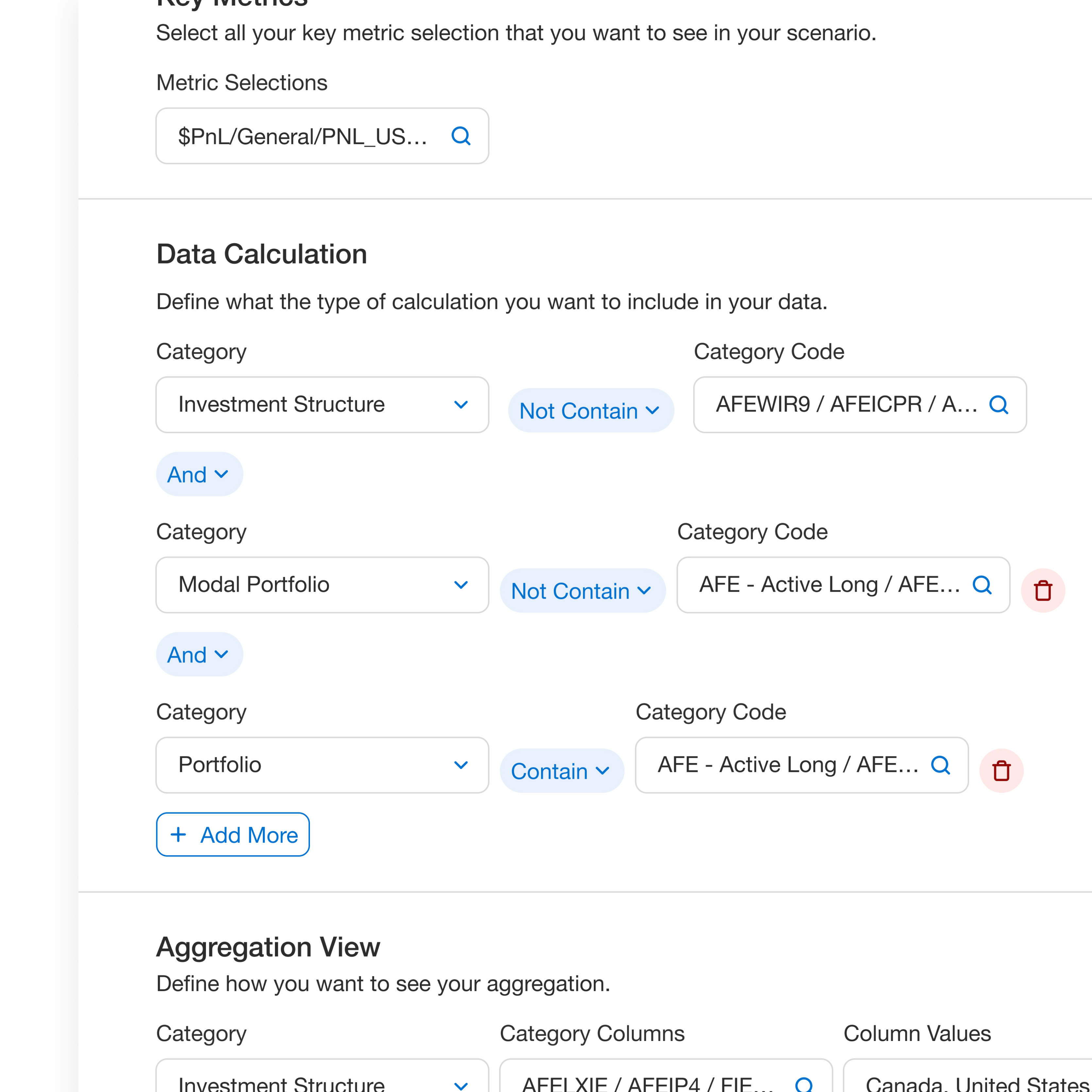

Give Flexibility to Easily Include or Exclude Specific Types Quickly

A key feature for users is the ability to define which investment strategies to include in their metric calculations. The challenge was to give users the flexibility to easily include or exclude specific investment types or categories in their calculations through an intuitive interface.

Define Custom Logic with Conditions

Users can define specific conditions to automatically filter data used in metric calculations. For example, when focusing on certain investment types, conditional logic surfaces only the relevant data—streamlining the workflow and reducing both manual effort and cognitive load.

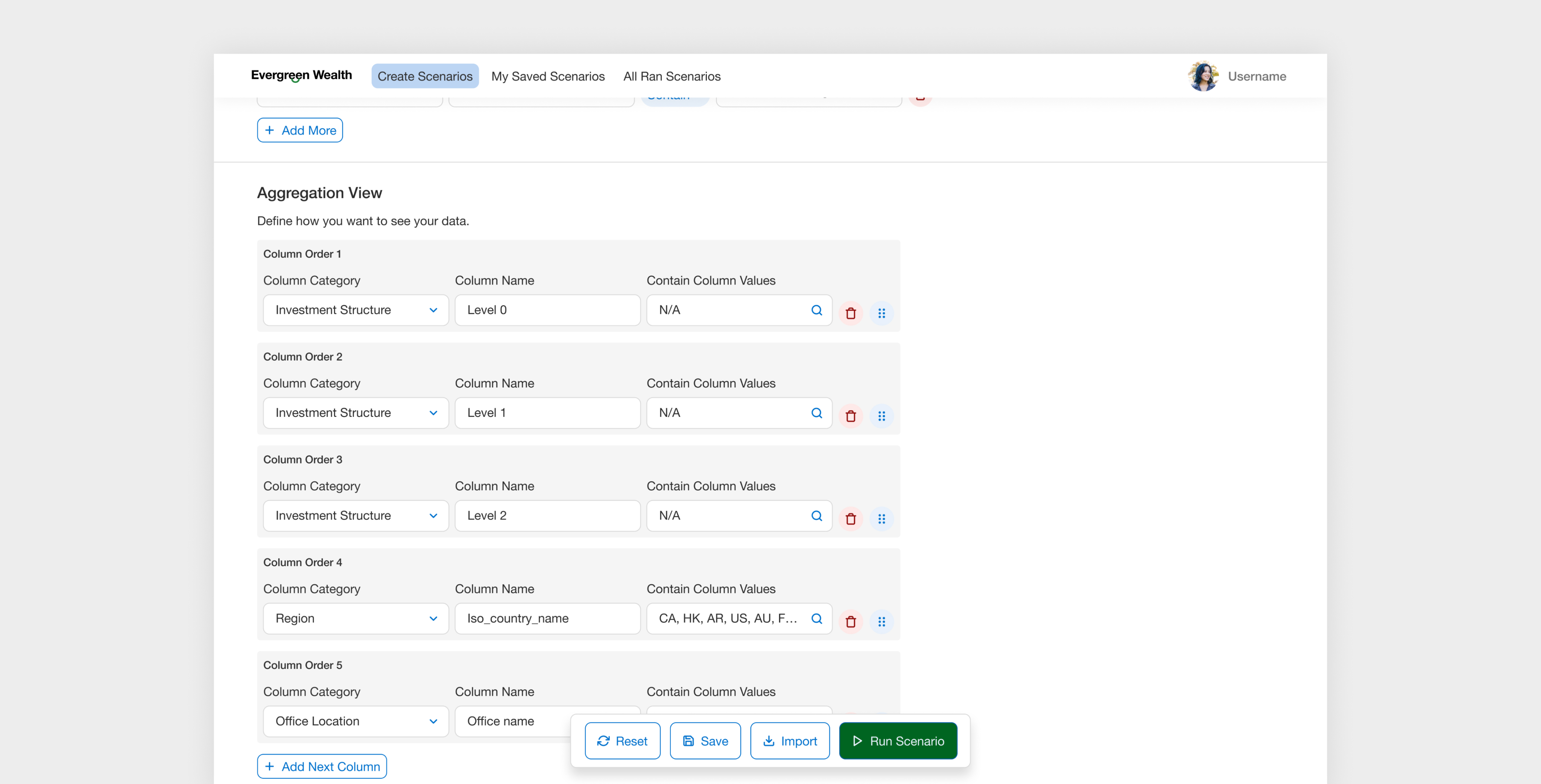

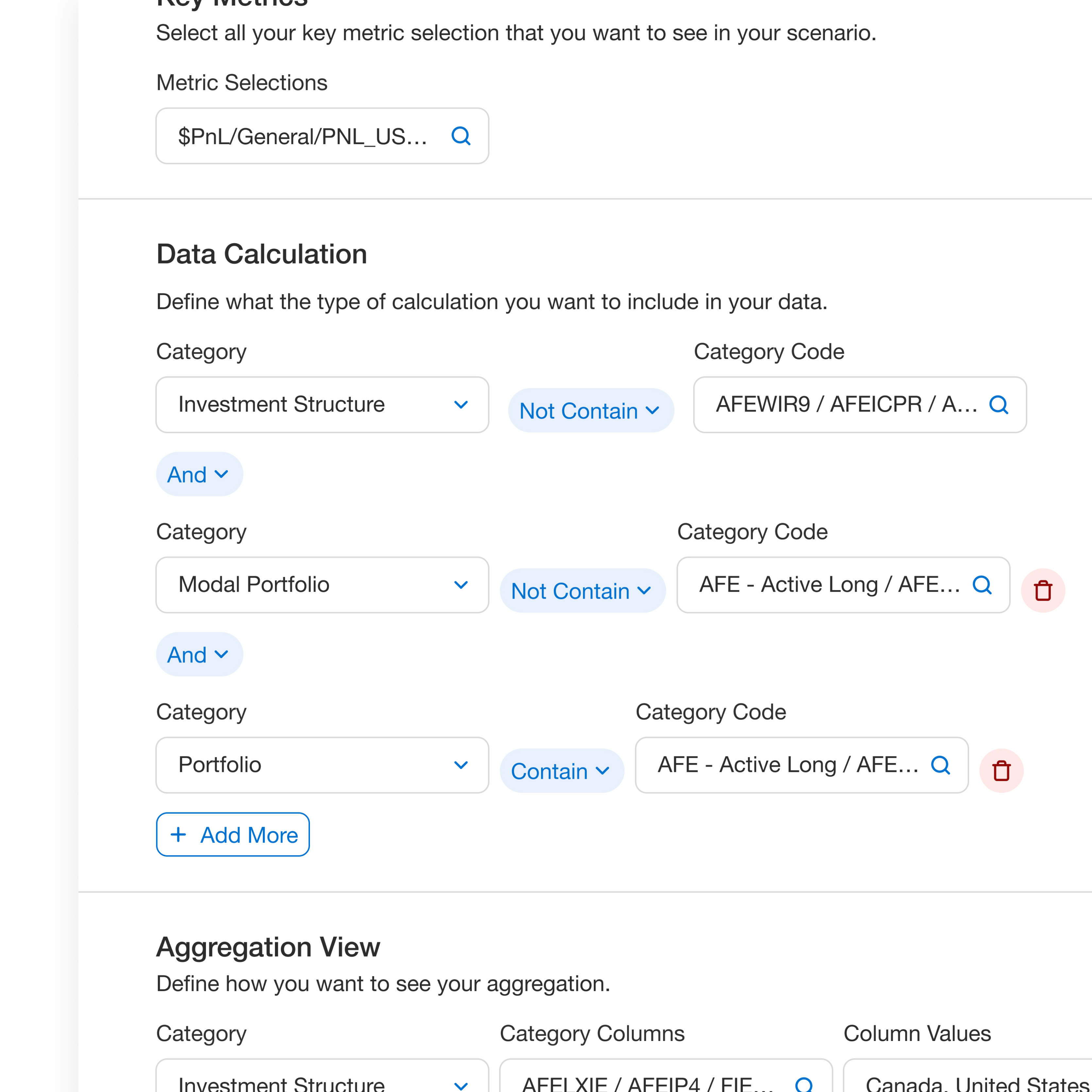

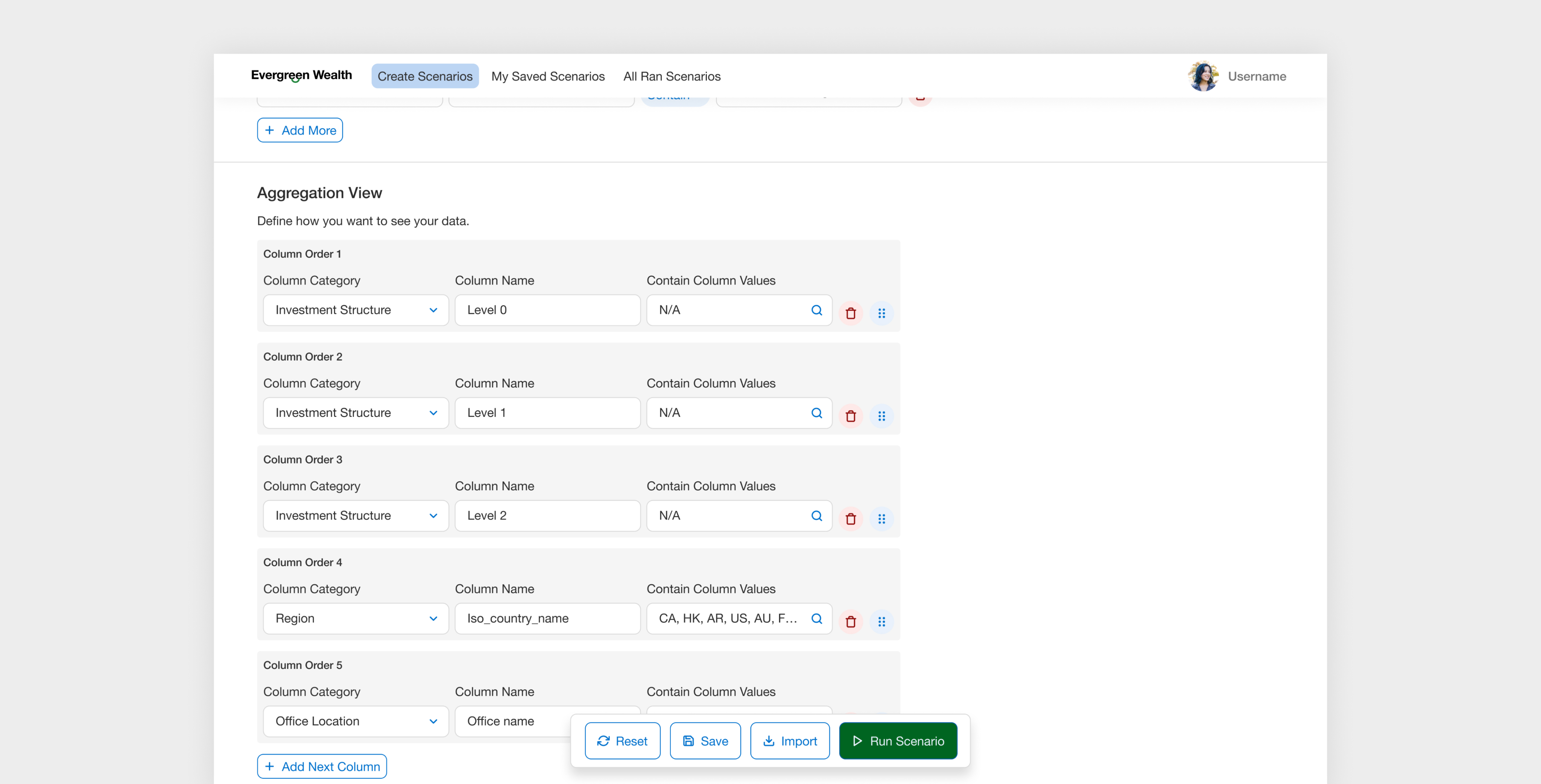

Letting Users Choose How Data is Displayed

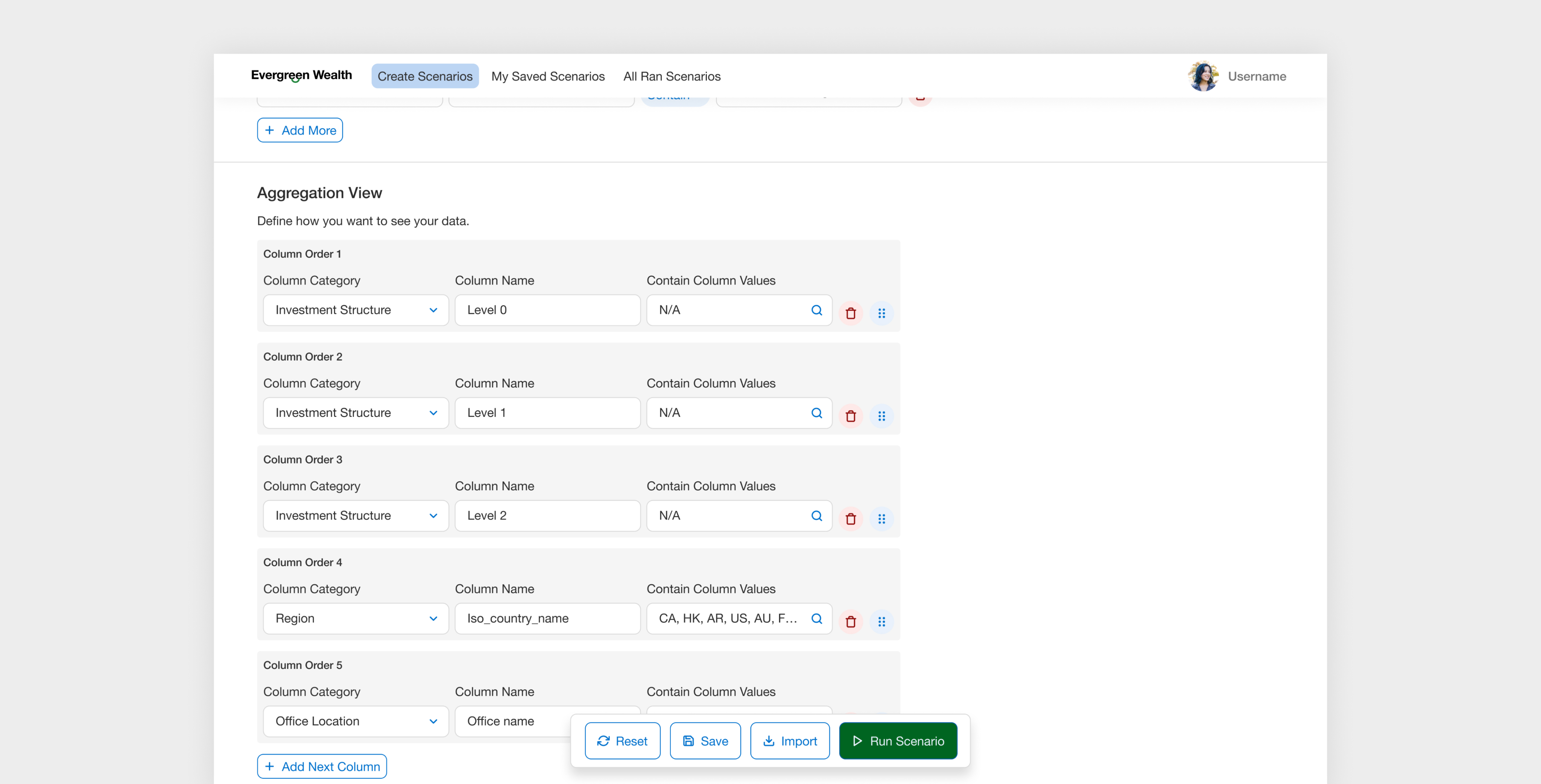

This solution provides users with a dedicated section where they can select how to organize their data in the final scenario. Users can define the specific category values and reorder the groupings in a way that makes sense for their analysis.

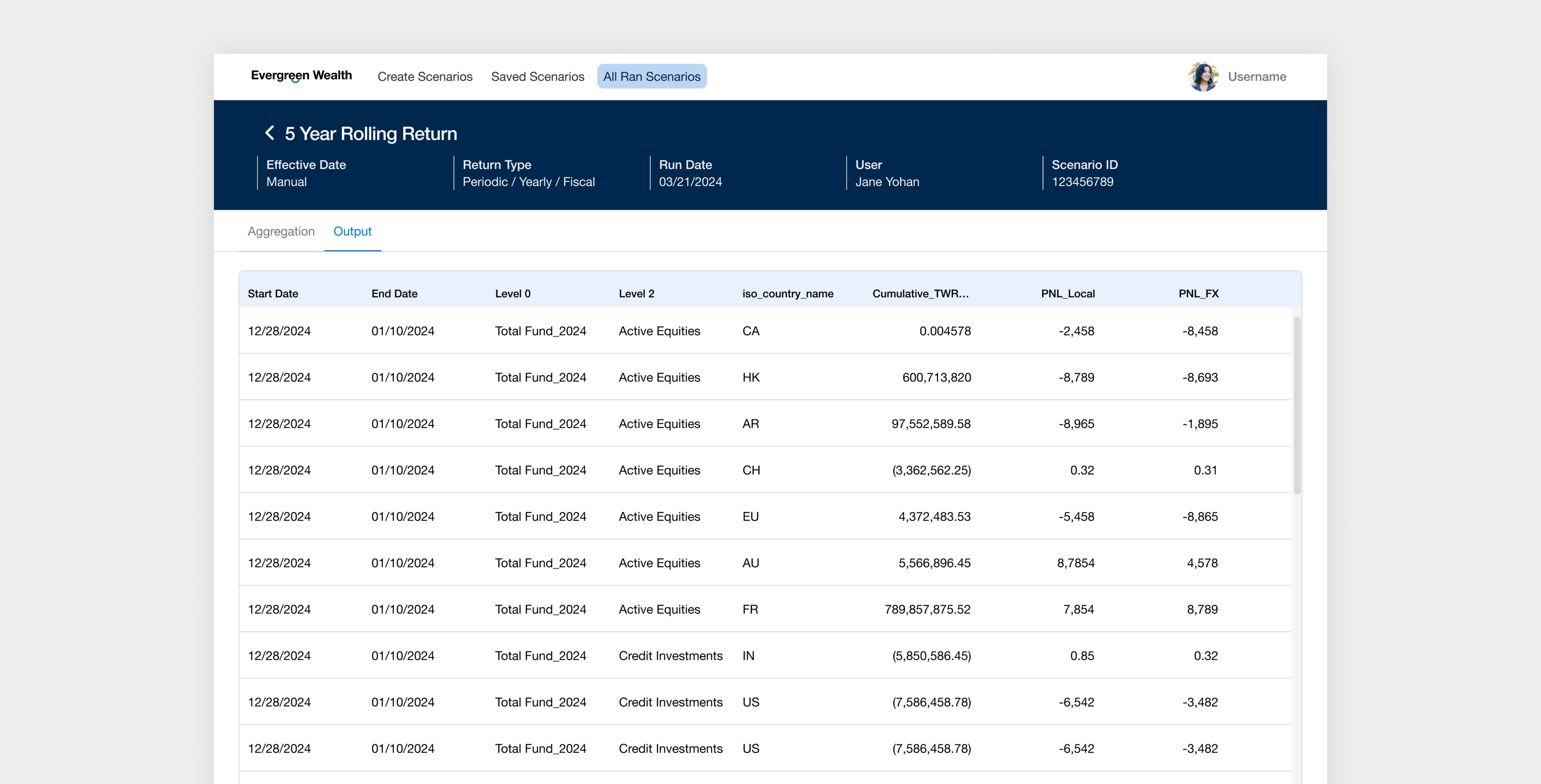

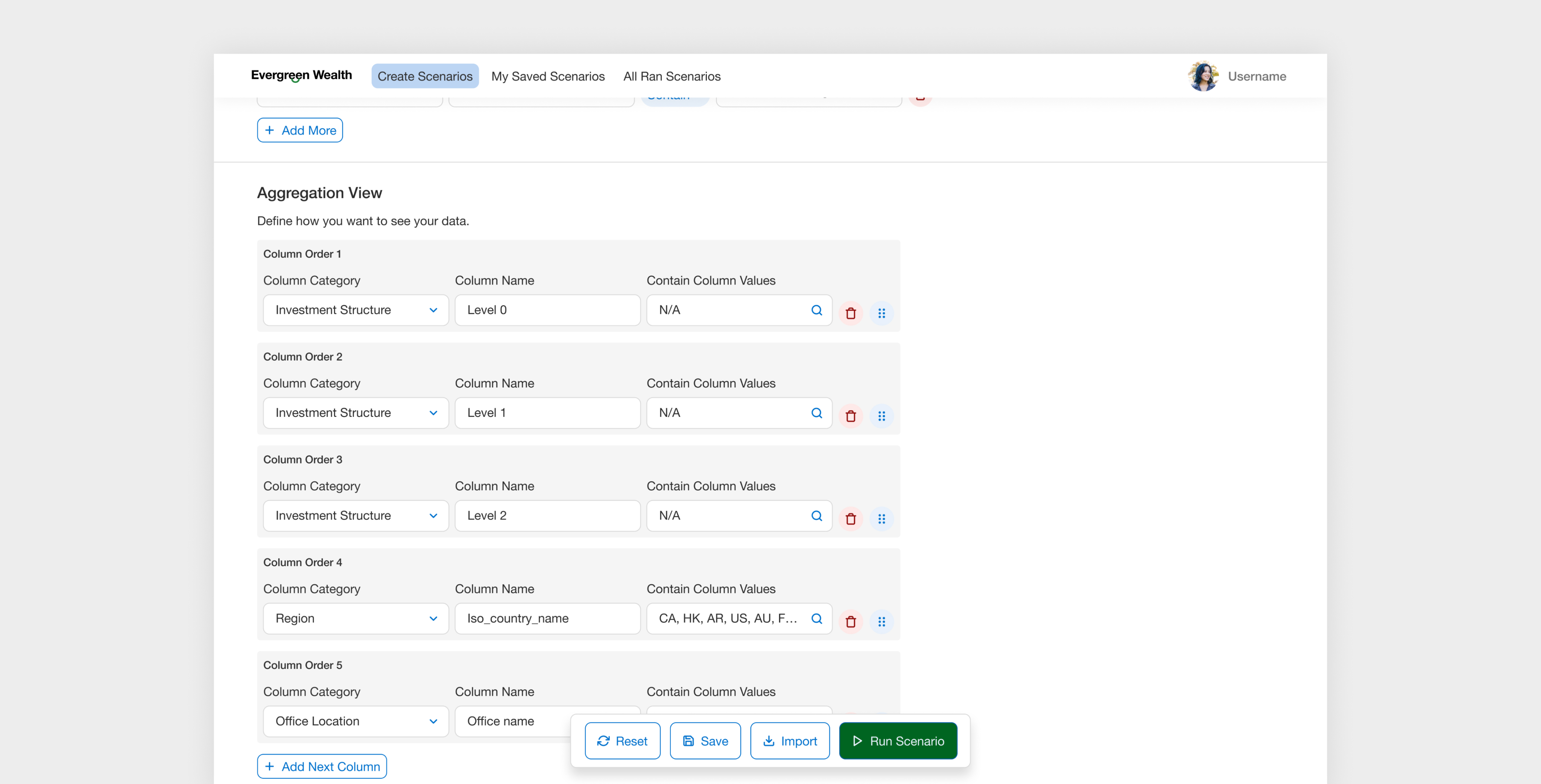

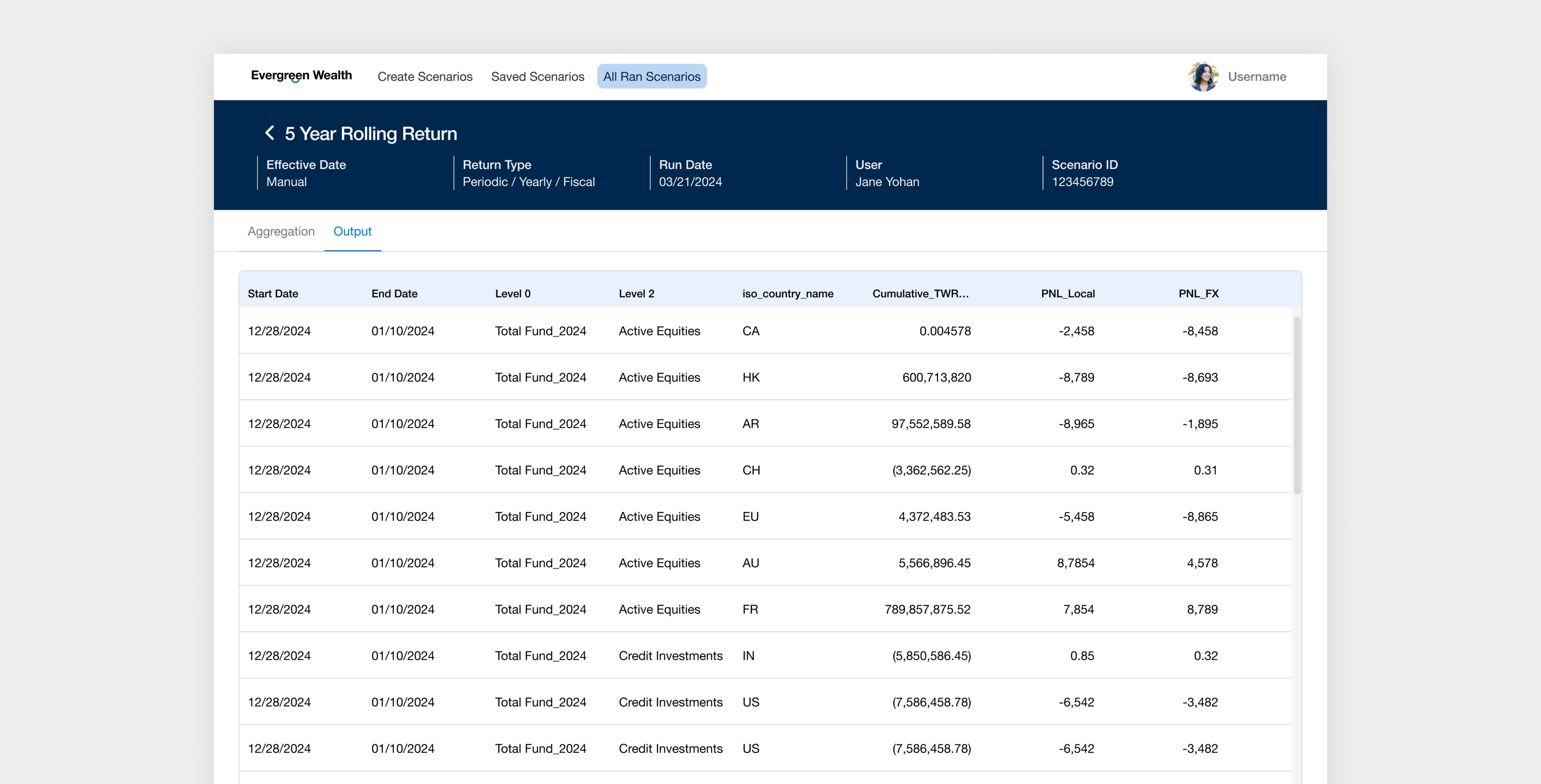

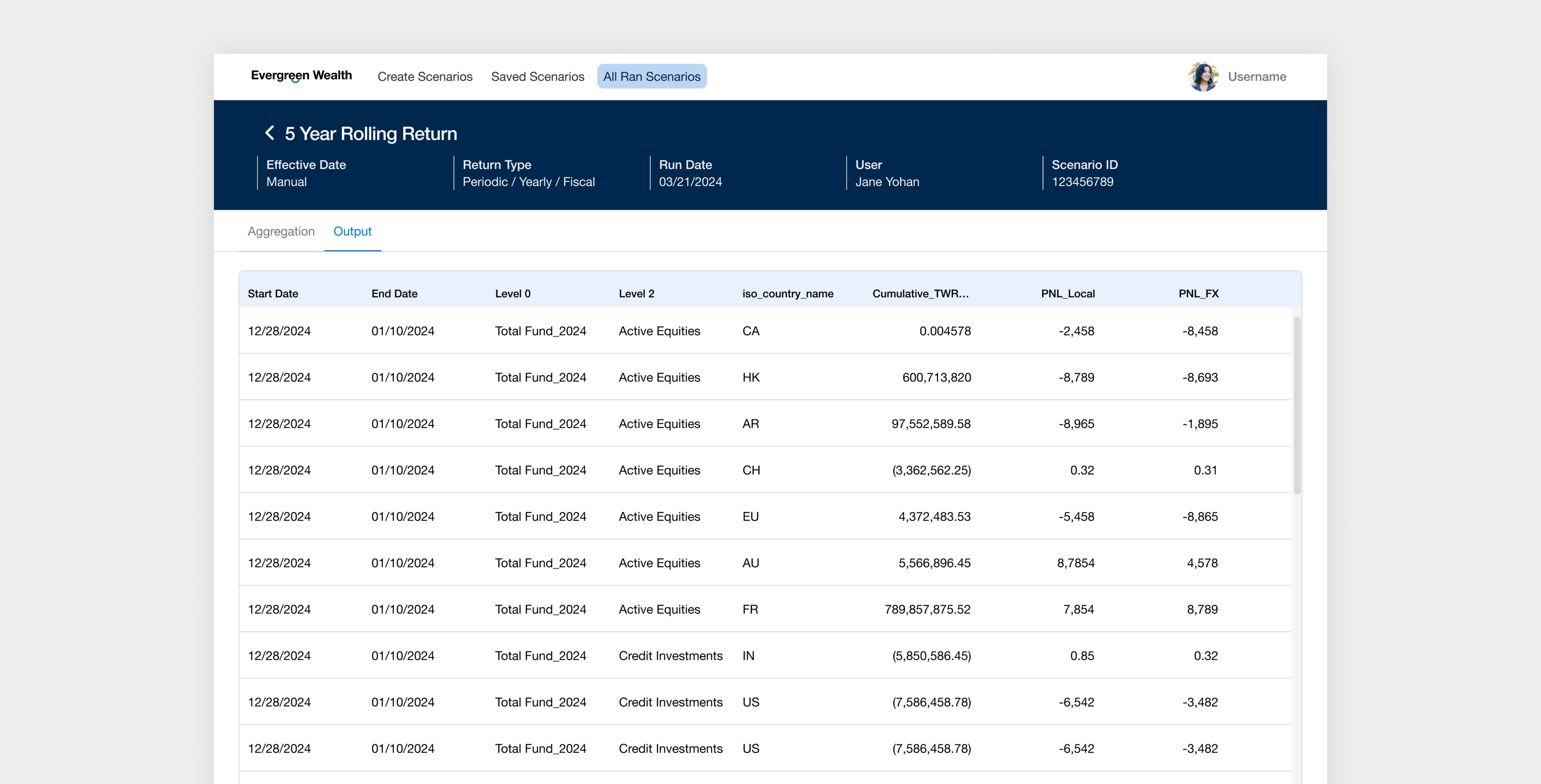

Preview the Final Report

A key functionality for users is the ability to preview data after completing the scenario setup. Once all conditions, filters, and selections are in place, users need an easy way to run the scenario and view a preview of the final report—helping them validate their inputs, catch errors early, and build confidence in the results before sharing or finalizing.

Thank You.

If you’d like to discuss a project or just grab a coffee and chat, feel free to reach out—always happy to connect! 😊

hjw.chelsea@gmail.com

2024 July - 2024 November / Lead Designer

Designing Scenario Builder for Investment Performance Managers

I led the end-to-end design of an enterprise platform for EverGreen Wealth (Whitelabelled company), streamlining complex financial workflows and cutting weekly operational hours by 50%.

*Client name has been white-labeled due to NDA requirements.

Project Context

Custom Reporting for Complex Scenarios is Slow and Fragmented

Performance managers analyze data across departments—such as Real Estate, Credit, and Private Equity—using various breakdowns by region, sector, currency, and benchmarks. However, due to limitations of the legacy tool and siloed workflows, they rely on manual Excel work to extract, clean, and reconcile data—leading to duplicated effort, delays, and increased risk of error.

Business Problem

1,200+ Hours Lost Weekly Due to Inefficiencies — Across a Team of 50 Performance Managers

EverGreen Wealth’s performance managers spend over 1,200 hours weekly on manual custom reporting. Each manager handles 3–5 report requests per week, with each taking 8+ hours due to complex data requirements and outdated, siloed tools.

Product Goal

Enable Performance Managers to Quickly Build Custom Reports

Design an enterprise product that enables performance managers to generate complex investment reports quickly and accurately—eliminating manual effort, reducing errors, and streamlining cross-departmental reporting workflows.

Discovery

During the discovery phase, I prioritized understanding the performance managers’ workflows and responsibilities. In the first two weeks of the project, I conducted 8 in-depth interview sessions with performance managers to learn how they currently build custom reports. This insight was critical to shaping a product that aligns with their needs and day-to-day tasks.

Understanding the Role of Performance Managers at GreenWealth

Performance managers at GreenWealth oversee and analyze the financial performance of investments and ensuring alignment with the organization’s financial goals. Their responsibilities focus on performance measurements, analysis, and reporting, which helps to inform strategic investment decisions.

Reviewing Legacy Products to Identify What Works and What Doesn’t

During 1:1 interviews with performance managers, I asked them to walk me through their legacy products and highlight what works and what doesn’t. While the tool is outdated, understanding the elements they still rely on helped identify valuable features worth retaining in the new experience.

Insights from Performance Manager Interviews

Given the complexity and nuance of their processes, these in-depth sessions were critical for uncovering actionable insights. Below are the key findings from the Discovery phase.

Switching Between Tools Created Workflow Friction

Performance managers juggled two legacy systems and Excel, each with different logic—slowing them down and increasing error risk.

Full Data Visibility was Valued

Despite a cluttered UI in the legacy product, they valued seeing all available data fields for greater control and confidence.

Heavy Excel Use for Final Output

Despite a cluttered UI in the legacy product, they valued seeing all available data fields for greater control and confidence.

Often Duplicating Previous Reports

They often duplicated old reports and tweaked filters like date, region etc to save time.

Define

After the discovery phase, I synthesized the insights and distilled them into key problems, which helped shape the design approach and direction.

Translating Research into Design Strategy

After conducting user research and multiple in-depth knowledge transfer (KT) sessions with the product manager and performance managers, I synthesized the information to define a clear and focused design strategy.

Flexibility

Performance managers value the ability to define custom logic on their own terms. They wanted a solution that offers flexibility to create and modify logic to suit their unique needs.

Simplicity

Simplify complex processes to make them easy to understand and navigate, allowing users to perform tasks without unnecessary complications.

Familiarity

Maintain the unique workflows and replicate patterns that the users were familiar with Excel to reduce the learning curve.

Defining the first MVP for this Product

Before diving into solutions, I led a collaborative session with the product manager, tech lead, and three business stakeholders (VP of Finance Performance, Senior Director Performance Management, Senior Performance Manager) define core features. The main challenge was aligning on the MVP, as the team often pushed for "nice-to-have" features. To address this, I facilitated a focused 1-hour workshop to prioritize and clearly define the core MVP.

Develop

To kick off the solution phase, I led a fast-paced workshop with the internal team to draft initial concepts. Given the tight six-week timeline, the process involved frequent white-boarding sessions with the core team to sketch ideas, define key use cases, and align on direction. I translated these concepts into Figma designs and maintained a tight iteration loop for rapid feedback and refinement.

Creating Core Userflow Together

I facilitated a white-boarding session to map out the core use cases and define the main user flow. By first sketching a basic skeleton of the "happy path," I gave the team a tangible starting point, which we then refined together through live feedback and iteration. This collaborative process helped align everyone on the foundational structure before moving into detailed design.

Designing the Best Layout for Performance Manager

To determine the most effective layout for scenario-building, I explored three low-fidelity options—each reflecting a different interaction model. My goal was to find the best way to support power users in building custom financial scenarios efficiently and confidently.

Evaluating Design Trade-Offs with Product and Engineering Stakeholders

I presented each low-fidelity option to stakeholders across product and engineering. We discussed trade-offs for each layout.

High Effort, Low Impact

The first option requires significant front-end engineering effort but offers limited user value, making it difficult to justify the level of custom development.

Excel-Like Experience

Across all options, stakeholders emphasized the importance of preserving familiar data behaviors—such as tabular layouts and multi-step formulas—commonly found in Excel.

Lack of Guidance and Unclear Layout

The team raised concerns about Option 1 feeling too open-ended for new users, especially without guidance or visual grouping.

Choosing the Right Design Path

Initially, I was biased toward the first design option, as I believed it clearly represented the scenario being built. However, after discussions with the team and quick feedback sessions with performance managers, it became clear that users preferred an interface more aligned with their legacy tool. The first option felt overly complex and unfamiliar to them. Additionally, it posed significant front-end limitations and scope challenges, which led us to explore the third option further.

Design Solution

Layout Aligned with Users’ Logical Workflow

The final design approach prioritized a flow that mirrors how users naturally think through scenarios—starting with defining key parameters (e.g., dates, return type), then selecting metrics, and finally organizing the data. This structured sequence supports clarity, efficiency, and familiarity.

Helping Users to Sort Through the Long List of Metrics Easily

The most important aspect for users was the ability to quickly select specific key metrics and perform metric aggregation. Users needed to view all available data, but also be able to quickly filter and select the relevant metrics for their reports.

Easily Manipulate the long lists & Level Selections

Users can navigate groupings in bulk, avoiding the need to manually sift through each grouping. This makes the process faster and more manageable.

Find Fields Instantly with Quick Search

If users know the type of field they’re looking for, the quick search feature helps them find it instantly—eliminating the need to scroll through long lists.

Give Flexibility to Easily Include or Exclude Specific Types Quickly

A key feature for users is the ability to define which investment strategies to include in their metric calculations. The challenge was to give users the flexibility to easily include or exclude specific investment types or categories in their calculations through an intuitive interface.

Define Custom Logic with Conditions

Users can define specific conditions to automatically filter data used in metric calculations. For example, when focusing on certain investment types, conditional logic surfaces only the relevant data—streamlining the workflow and reducing both manual effort and cognitive load.

Letting Users Choose How Data is Displayed

This solution provides users with a dedicated section where they can select how to organize their data in the final scenario. Users can define the specific category values and reorder the groupings in a way that makes sense for their analysis.

Preview the Final Report

A key functionality for users is the ability to preview data after completing the scenario setup. Once all conditions, filters, and selections are in place, users need an easy way to run the scenario and view a preview of the final report—helping them validate their inputs, catch errors early, and build confidence in the results before sharing or finalizing.

Thank You.

If you’d like to discuss a project or just grab a coffee and chat, feel free to reach out—always happy to connect! 😊

hjw.chelsea@gmail.com

2024 July - 2024 November / Lead Designer

Designing Scenario Builder for Investment Performance Managers

I led the end-to-end design of an enterprise platform for EverGreen Wealth (Whitelabelled company), streamlining complex financial workflows and cutting weekly operational hours by 50%.

*Client name has been white-labeled due to NDA requirements.

Project Context

Custom Reporting for Complex Scenarios is Slow and Fragmented

Performance managers analyze data across departments—such as Real Estate, Credit, and Private Equity—using various breakdowns by region, sector, currency, and benchmarks. However, due to limitations of the legacy tool and siloed workflows, they rely on manual Excel work to extract, clean, and reconcile data—leading to duplicated effort, delays, and increased risk of error.

Business Problem

1,200+ Hours Lost Weekly Due to Inefficiencies — Across a Team of 50 Performance Managers

EverGreen Wealth’s performance managers spend over 1,200 hours weekly on manual custom reporting. Each manager handles 3–5 report requests per week, with each taking 8+ hours due to complex data requirements and outdated, siloed tools.

Product Goal

Enable Performance Managers to Quickly Build Custom Reports

Design an enterprise product that enables performance managers to generate complex investment reports quickly and accurately—eliminating manual effort, reducing errors, and streamlining cross-departmental reporting workflows.

Discovery

During the discovery phase, I prioritized understanding the performance managers’ workflows and responsibilities. In the first two weeks of the project, I conducted 8 in-depth interview sessions with performance managers to learn how they currently build custom reports. This insight was critical to shaping a product that aligns with their needs and day-to-day tasks.

Understanding the Role of Performance Managers at GreenWealth

Performance managers at GreenWealth oversee and analyze the financial performance of investments and ensuring alignment with the organization’s financial goals. Their responsibilities focus on performance measurements, analysis, and reporting, which helps to inform strategic investment decisions.

Reviewing Legacy Products to Identify What Works and What Doesn’t

During 1:1 interviews with performance managers, I asked them to walk me through their legacy products and highlight what works and what doesn’t. While the tool is outdated, understanding the elements they still rely on helped identify valuable features worth retaining in the new experience.

Insights from Performance Manager Interviews

Given the complexity and nuance of their processes, these in-depth sessions were critical for uncovering actionable insights. Below are the key findings from the Discovery phase.

Switching Between Tools Created Workflow Friction

Performance managers juggled two legacy systems and Excel, each with different logic—slowing them down and increasing error risk.

Full Data Visibility was Valued

Despite a cluttered UI in the legacy product, they valued seeing all available data fields for greater control and confidence.

Heavy Excel Use for Final Output

Despite a cluttered UI in the legacy product, they valued seeing all available data fields for greater control and confidence.

Often Duplicating Previous Reports

They often duplicated old reports and tweaked filters like date, region etc to save time.

Define

After the discovery phase, I synthesized the insights and distilled them into key problems, which helped shape the design approach and direction.

Translating Research into Design Strategy

After conducting user research and multiple in-depth knowledge transfer (KT) sessions with the product manager and performance managers, I synthesized the information to define a clear and focused design strategy.

Flexibility

Performance managers value the ability to define custom logic on their own terms. They wanted a solution that offers flexibility to create and modify logic to suit their unique needs.

Simplicity

Simplify complex processes to make them easy to understand and navigate, allowing users to perform tasks without unnecessary complications.

Familiarity

Maintain the unique workflows and replicate patterns that the users were familiar with Excel to reduce the learning curve.

Defining the first MVP for this Product

Before diving into solutions, I led a collaborative session with the product manager, tech lead, and three business stakeholders (VP of Finance Performance, Senior Director Performance Management, Senior Performance Manager) define core features. The main challenge was aligning on the MVP, as the team often pushed for "nice-to-have" features. To address this, I facilitated a focused 1-hour workshop to prioritize and clearly define the core MVP.

Develop

To kick off the solution phase, I led a fast-paced workshop with the internal team to draft initial concepts. Given the tight six-week timeline, the process involved frequent white-boarding sessions with the core team to sketch ideas, define key use cases, and align on direction. I translated these concepts into Figma designs and maintained a tight iteration loop for rapid feedback and refinement.

Creating Core Userflow Together

I facilitated a white-boarding session to map out the core use cases and define the main user flow. By first sketching a basic skeleton of the "happy path," I gave the team a tangible starting point, which we then refined together through live feedback and iteration. This collaborative process helped align everyone on the foundational structure before moving into detailed design.

Designing the Best Layout for Performance Manager

To determine the most effective layout for scenario-building, I explored three low-fidelity options—each reflecting a different interaction model. My goal was to find the best way to support power users in building custom financial scenarios efficiently and confidently.

Evaluating Design Trade-Offs with Product and Engineering Stakeholders

I presented each low-fidelity option to stakeholders across product and engineering. We discussed trade-offs for each layout.

High Effort, Low Impact

The first option requires significant front-end engineering effort but offers limited user value, making it difficult to justify the level of custom development.

Excel-Like Experience

Across all options, stakeholders emphasized the importance of preserving familiar data behaviors—such as tabular layouts and multi-step formulas—commonly found in Excel.

Lack of Guidance and Unclear Layout

The team raised concerns about Option 1 feeling too open-ended for new users, especially without guidance or visual grouping.

Choosing the Right Design Path

Initially, I was biased toward the first design option, as I believed it clearly represented the scenario being built. However, after discussions with the team and quick feedback sessions with performance managers, it became clear that users preferred an interface more aligned with their legacy tool. The first option felt overly complex and unfamiliar to them. Additionally, it posed significant front-end limitations and scope challenges, which led us to explore the third option further.

Design Solution

Layout Aligned with Users’ Logical Workflow

The final design approach prioritized a flow that mirrors how users naturally think through scenarios—starting with defining key parameters (e.g., dates, return type), then selecting metrics, and finally organizing the data. This structured sequence supports clarity, efficiency, and familiarity.

Helping Users to Sort Through the Long List of Metrics Easily

The most important aspect for users was the ability to quickly select specific key metrics and perform metric aggregation. Users needed to view all available data, but also be able to quickly filter and select the relevant metrics for their reports.

Easily Manipulate the long lists - Allow for group selects & Level Selections

Users can navigate groupings in bulk, avoiding the need to manually sift through each grouping. This makes the process faster and more manageable.

Find Fields Instantly with Quick Search

If users know the type of field they’re looking for, the quick search feature helps them find it instantly—eliminating the need to scroll through long lists.

Give Flexibility to Easily Include or Exclude Specific Types Quickly

A key feature for users is the ability to define which investment strategies to include in their metric calculations. The challenge was to give users the flexibility to easily include or exclude specific investment types or categories in their calculations through an intuitive interface.

Define Custom Logic with Conditions

Users can define specific conditions to automatically filter data used in metric calculations. For example, when focusing on certain investment types, conditional logic surfaces only the relevant data—streamlining the workflow and reducing both manual effort and cognitive load.

Letting Users Choose How Data is Displayed

This solution provides users with a dedicated section where they can select how to organize their data in the final scenario. Users can define the specific category values and reorder the groupings in a way that makes sense for their analysis.

Preview the Final Report

A key functionality for users is the ability to preview data after completing the scenario setup. Once all conditions, filters, and selections are in place, users need an easy way to run the scenario and view a preview of the final report—helping them validate their inputs, catch errors early, and build confidence in the results before sharing or finalizing.

Thank You.

If you’d like to discuss a project or just grab a coffee and chat, feel free to reach out—always happy to connect! 😊

hjw.chelsea@gmail.com

2024 July - 2024 November / Lead Designer

Designing Scenario Builder for Investment Performance Managers

I led the end-to-end design of an enterprise platform for EverGreen Wealth (Whitelabelled company), streamlining complex financial workflows and cutting weekly operational hours by 50%.

*Client name has been white-labeled due to NDA requirements.

Project Context

Custom Reporting for Complex Scenarios is Slow and Fragmented

Performance managers analyze data across departments—such as Real Estate, Credit, and Private Equity—using various breakdowns by region, sector, currency, and benchmarks. However, due to limitations of the legacy tool and siloed workflows, they rely on manual Excel work to extract, clean, and reconcile data—leading to duplicated effort, delays, and increased risk of error.

Business Problem

1,200+ Hours Lost Weekly Due to Inefficiencies — Across a Team of 50 Performance Managers

EverGreen Wealth’s performance managers spend over 1,200 hours weekly on manual custom reporting. Each manager handles 3–5 report requests per week, with each taking 8+ hours due to complex data requirements and outdated, siloed tools.

Product Goal

Enable Performance Managers to Quickly Build Custom Reports

Design an enterprise product that enables performance managers to generate complex investment reports quickly and accurately—eliminating manual effort, reducing errors, and streamlining cross-departmental reporting workflows.

Discovery

During the discovery phase, I prioritized understanding the performance managers’ workflows and responsibilities. In the first two weeks of the project, I conducted 8 in-depth interview sessions with performance managers to learn how they currently build custom reports. This insight was critical to shaping a product that aligns with their needs and day-to-day tasks.

Understanding the Role of Performance Managers at GreenWealth

Performance managers at GreenWealth oversee and analyze the financial performance of investments and ensuring alignment with the organization’s financial goals. Their responsibilities focus on performance measurements, analysis, and reporting, which helps to inform strategic investment decisions.

Reviewing Legacy Products to Identify What Works and What Doesn’t

During 1:1 interviews with performance managers, I asked them to walk me through their legacy products and highlight what works and what doesn’t. While the tool is outdated, understanding the elements they still rely on helped identify valuable features worth retaining in the new experience.

Insights from Performance Manager Interviews

Given the complexity and nuance of their processes, these in-depth sessions were critical for uncovering actionable insights. Below are the key findings from the Discovery phase.

Switching Between Tools Created Workflow Friction

Performance managers juggled two legacy systems and Excel, each with different logic—slowing them down and increasing error risk.

Full Data Visibility was Valued

Despite a cluttered UI in the legacy product, they valued seeing all available data fields for greater control and confidence.

Heavy Excel Use for Final Output

Despite a cluttered UI in the legacy product, they valued seeing all available data fields for greater control and confidence.

Often Duplicating Previous Reports

They often duplicated old reports and tweaked filters like date, region etc to save time.

Define

After the discovery phase, I synthesized the insights and distilled them into key problems, which helped shape the design approach and direction.

Translating Research into Design Strategy

After conducting user research and multiple in-depth knowledge transfer (KT) sessions with the product manager and performance managers, I synthesized the information to define a clear and focused design strategy.

Flexibility

Performance managers value the ability to define custom logic on their own terms. They wanted a solution that offers flexibility to create and modify logic to suit their unique needs.

Simplicity

Simplify complex processes to make them easy to understand and navigate, allowing users to perform tasks without unnecessary complications.

Familiarity

Maintain the unique workflows and replicate patterns that the users were familiar with Excel to reduce the learning curve.

Defining the first MVP for this Product

Before diving into solutions, I led a collaborative session with the product manager, tech lead, and three business stakeholders (VP of Finance Performance, Senior Director Performance Management, Senior Performance Manager) define core features. The main challenge was aligning on the MVP, as the team often pushed for "nice-to-have" features. To address this, I facilitated a focused 1-hour workshop to prioritize and clearly define the core MVP.

Develop

To kick off the solution phase, I led a fast-paced workshop with the internal team to draft initial concepts. Given the tight six-week timeline, the process involved frequent white-boarding sessions with the core team to sketch ideas, define key use cases, and align on direction. I translated these concepts into Figma designs and maintained a tight iteration loop for rapid feedback and refinement.

Creating Core Userflow Together

I facilitated a white-boarding session to map out the core use cases and define the main user flow. By first sketching a basic skeleton of the "happy path," I gave the team a tangible starting point, which we then refined together through live feedback and iteration. This collaborative process helped align everyone on the foundational structure before moving into detailed design.

Designing the Best Layout for Performance Manager

To determine the most effective layout for scenario-building, I explored three low-fidelity options—each reflecting a different interaction model. My goal was to find the best way to support power users in building custom financial scenarios efficiently and confidently.

Evaluating Design Trade-Offs with Product and Engineering Stakeholders

I presented each low-fidelity option to stakeholders across product and engineering. We discussed trade-offs for each layout.

High Effort, Low Impact

The first option requires significant front-end engineering effort but offers limited user value, making it difficult to justify the level of custom development.

Excel-Like Experience

Across all options, stakeholders emphasized the importance of preserving familiar data behaviors—such as tabular layouts and multi-step formulas—commonly found in Excel.

Lack of Guidance and Unclear Layout

The team raised concerns about Option 1 feeling too open-ended for new users, especially without guidance or visual grouping.

Choosing the Right Design Path

Initially, I was biased toward the first design option, as I believed it clearly represented the scenario being built. However, after discussions with the team and quick feedback sessions with performance managers, it became clear that users preferred an interface more aligned with their legacy tool. The first option felt overly complex and unfamiliar to them. Additionally, it posed significant front-end limitations and scope challenges, which led us to explore the third option further.

Design Solution

Layout Aligned with Users’ Logical Workflow

The final design approach prioritized a flow that mirrors how users naturally think through scenarios—starting with defining key parameters (e.g., dates, return type), then selecting metrics, and finally organizing the data. This structured sequence supports clarity, efficiency, and familiarity.

Helping Users to Sort Through the Long List of Metrics Easily

The most important aspect for users was the ability to quickly select specific key metrics and perform metric aggregation. Users needed to view all available data, but also be able to quickly filter and select the relevant metrics for their reports.

Improving Usability for Long Lists Through Group and Level Selection

Users can navigate groupings in bulk, avoiding the need to manually sift through each grouping. This makes the process faster and more manageable.

Find Fields Instantly with Quick Search

If users know the type of field they’re looking for, the quick search feature helps them find it instantly—eliminating the need to scroll through long lists.

Give Flexibility to Easily Include or Exclude Specific Types Quickly

A key feature for users is the ability to define which investment strategies to include in their metric calculations. The challenge was to give users the flexibility to easily include or exclude specific investment types or categories in their calculations through an intuitive interface.

Define Custom Logic with Conditions

Users can define specific conditions to automatically filter data used in metric calculations. For example, when focusing on certain investment types, conditional logic surfaces only the relevant data—streamlining the workflow and reducing both manual effort and cognitive load.

Letting Users Choose How Data is Displayed

This solution provides users with a dedicated section where they can select how to organize their data in the final scenario. Users can define the specific category values and reorder the groupings in a way that makes sense for their analysis.

Preview the Final Report

A key functionality for users is the ability to preview data after completing the scenario setup. Once all conditions, filters, and selections are in place, users need an easy way to run the scenario and view a preview of the final report—helping them validate their inputs, catch errors early, and build confidence in the results before sharing or finalizing.

Thank You.

If you’d like to discuss a project or just grab a coffee and chat, feel free to reach out—always happy to connect! 😊

hjw.chelsea@gmail.com